Struggling AI Startups Kept Afloat Despite Never Becoming Profitable

Authored by Autumn Spredemann via The Epoch Times (emphasis ours),

For years, artificial intelligence (AI) startups have been pitched as the vehicles of the next productivity boom.

But as product delivery lags behind the hype, some AI companies are slipping into a quieter, more troubling category: startups that are functional but no longer viable.

Economists and financial institutions describe these firms as “zombie” companies—businesses that can’t cover their debt, operating costs, or generate sufficient returns, yet continue to survive through repeated injections of fresh capital, debt restructuring, or investor reluctance to accept losses.

Venture capital, financial, and AI insiders say that signs of these zombie companies are increasingly visible in the AI startup community.

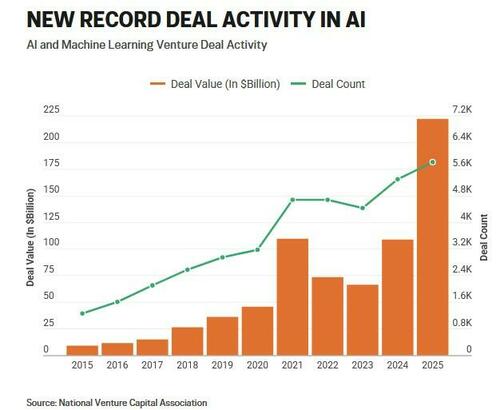

AI and machine learning venture capital deals accounted for more than 65 percent of all U.S. venture capital project funding in 2025, totaling $222 billion, according to the National Venture Capital Association. This represents an increase from 47 percent in 2024 and 10 percent in 2015.

That’s a lot of money flooding into an investment market with a high rate of failure. Approximately 90 percent of startups fail, according to analysis by data analytics company Demand Sage.

While a universally accepted count of U.S.-based AI firms operating as zombies is unavailable, a recent Fortune report put the number of venture capital zombies at 574. An analysis by management consulting firm Kearney reported that the number of zombie companies worldwide has grown by around 9 percent annually since 2010, with a total of 2,370 as of 2024.

Concern is no longer limited to investor losses but also broader economic effects, such as misdirected capital and talent being tied up in underperforming companies. Some believe this could slow AI productivity and future innovation.

“Typically, unproductive entities would fail quickly due to the inability to secure further funding and service debt. But with the AI boom, nearly half of the venture capital funding is going into all things AI, and it’s extended their lifespan beyond what normally would be expected,” Joseph Favorito, founder of Landmark Wealth Management, told The Epoch Times.

Favorito believes that prolonged support for debt-financed or insolvent AI firms can slow innovation and create broader economic ripples.

“At any given point in time, there is a limit to how much capital will be allocated towards innovation. If capital is allocated to an insolvent entity, those dollars could have been put to better use elsewhere in a place that would promote innovation and productivity,” he said.

“But this always happens on some level. That is the nature of capitalism. … The challenge is that every entity starts off in debt. It is up to those that are allocating their capital to determine if they are throwing good money after bad, or there is a valuable longer-term reward,” Favorito said.

Pay the Piper

“When the subsidy era ends, the companies that survive will be the ones that saw it coming,” Abdur Rehman Arshad, CEO of Capidel Consulting, told The Epoch Times.

Arshad said that cheap venture capital, along with potentially state-backed AI startup grants, hides the “real unit economics” and gives businesses a three- to six-year stretch of artificially low costs.

He also anticipates costs related to AI to climb threefold to tenfold. “Many will face an $800 billion revenue shortfall by 2030, turning them into ‘zombie’ outfits,” Arshad said.

However, he stressed that factors such as venture capital, grants, and cloud credits—a type of virtual currency offered by cloud service providers—can also make the difference between a “bankrupt founder and the next unicorn.”

Companies that qualify as AI “unicorns” are those valued at more than $1 billion. As of December 2025, there are 308 AI unicorns, including OpenAI, which owns ChatGPT.

In Arshad’s assessment, seed money is essential for AI startups, but it requires discretion.

“Startups often burn 30 [to] 40 percent of cash on infrastructure before they even find product market fit, and that burn rate can cripple a fledgling team. Federal AI funding is projected to hit $32 billion a year by 2026, stretching runways without diluting equity but also keeping unproductive ventures afloat,” he said.

Brayan Londono, founder of Resume Tailor AI and former venture capital analyst, suspects that many of the AI “efficiency gain” claims are mixed in with speculative growth. The result is a need to scale and push for more “fertile stories” to continue funding nonviable businesses.

“It has been my experience that credits from the cloud, government, or enterprise contracts, while delaying infrastructure costs, have hidden the weaknesses in fundamentals,” Londono told The Epoch Times.

“I have observed how a lot of money is trapped in low-trajectory AI start-ups, and the moment it unwinds would result in a sudden devaluation, as those distortions will also have been exposed, partly through having risk mispriced for so long,” he said.

Hollow Shell

There are a couple of ways AI companies can end up treading water and become zombies.

The Harvard Business Review noted AI companies are high-cost, but many lack a clear revenue plan, calling the path to profit “murky.”

“The problem is that generative AI today has a high variable cost and low variable revenue,” Andy Wu, the Arjun and Minoo Melwani Family Associate Professor of Business Administration, said in an article.

Estimates of pre-seed AI startup costs in 2026 range from $50,000—for those who want to use “bootstrap” methods—and $2 million.

Read the rest here…

Tyler Durden

Tue, 02/10/2026 – 06:30ZeroHedge NewsRead More

R1

R1

T1

T1