‘Across-The-Board’ Strong Jobs Report… But Take It “With A Grain Of Salt”

Via Academy Securities’ Peter Tchir,

There is almost nothing to nitpick about this report (though we do have some caveats).

Big beat on jobs 130k vs 65k expected. Private jobs crushed it, adding 172k (yes, public sector jobs shrank).

Downward revision for prior 2 reports was “only” -17k.

The benchmark revisions were -862k.

A big number but -825k was baked in, so kind of a rounding error at this stage on “old” data.

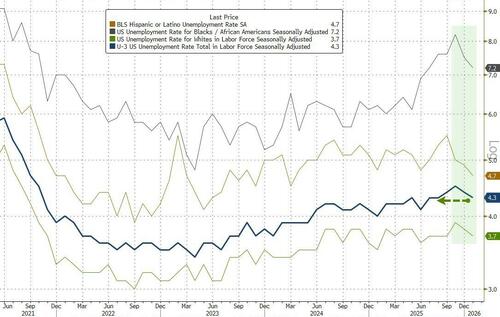

Unemployment rate dropped to 4.3%.

Not only did the household survey add 528k jobs, but we got this drop even while labor participation INCREASED to 62.5% – a very healthy shift in unemployment.

The birth/death model showed job losses of 69k.

Since I do think birth/death had an outsized influence on the revisions it is good to see a negative number here. It gives me more confidence in the print.

What is there to complain about?

-

NSA (not seasonally adjusted) had a drop of 2,649,000 jobs.

-

We have been complaining (for years) that the seasonal adjustments have a lot of issues and this year’s might be worse than usual in that respect

-

We still add a lot of jobs in winter and take them away in summer, because that is how the weather worked (slowing in the Northeast), but we no longer believe that is accurate as so much construction has moved to the South.

-

It adds back a lot of jobs that were added for the holidays. It is unclear how many jobs were really added for the holidays. It does not help that the government shutdown(s) has made the data even less reliable than usual.

-

-

In 2025 the largest downward revision was in February where they took away 167k from the prior 2 reports.

These two factors are why I will take this payroll data with a “grain of salt”.

The market has immediately priced in a more hawkish Fed with rate-cut expectations tumbling.

Tyler Durden

Wed, 02/11/2026 – 09:12ZeroHedge NewsRead More

R1

R1

T1

T1