US Futures Rise As European, Asian All Time Highs Spill Over

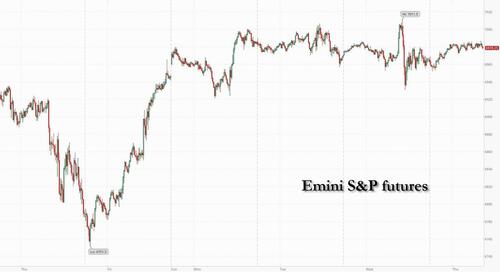

Futures are higher but there continues to be tangible angst below the surface as traders are aggressively shorting potential AI losers, while US stocks continue to fall behind the rest of the world. “It’s a paradox in that markets are holding, breaking records, yet investors remain cautious,” says Vontobel’s head of equities Jean-Louis Nakamura. As of 8:00am ET, S&P and Nasdaq futures are up 0.3%, with premarket strength in Mag7, Semis and Cyclicals while Energy and Materials underperform. It’s unclear right now which stocks will be hurt by AI, but it’s clear that traders are nervous. “The slightest miss on earnings is brutally penalized and substantial beats are required to boost share prices,” said Nakamura. Bond yield stabilize, flat to down 1bp across the curve with USD also flat. Commodities are mostly lower with Energy and Metals weaker (WTI, Precious down less than 1%) and Ags higher. Today’s macro data focus is on jobless claims and existing home sales. With the stabilization in the bond market and net positive WTD macro data, we may investors push the market higher into tmrw’s CPI where only a materially hawkish print is likely to shift the market narrative.

In premarket trading, Mag 7 stocks are mostly higher (Alphabet +0.5%, Amazon +0.3%, Apple -0.2%, Nvidia +1.2%, Meta Platforms +0.4%, Microsoft +0.4%, Tesla +0.5%),

- Coal stocks are up after the Trump administration ordered the Pentagon to purchase electricity from coal plants and announced funding for upgrades to coal facilities.

- Baxter International (BAX) falls 14% after the medtech company posted fourth quarter results.

- Cisco Systems Inc. (CSCO) drops 7% after the company gave a weaker-than-expected forecast for profitability in the current quarter, spurring concerns that mounting memory-chip prices are taking a toll on the company.

- Cognex (CGNX) is up 23% after the electronics components company forecast revenue for the first quarter that beat the average analyst estimate.

- Equinix (EQIX) rises 9% after the data center operator’s 2026 revenue guidance beat the average analyst estimate. Analysts are positive about the increased bookings and highlight a boost to the company’s forecast from accelerated AI demand.

- Fastly (FSLY) soars 40% after the cloud-platform provider posted fourth-quarter results that beat expectations and management gave a robust full-year forecast.

- ICON (ICLR) sinks 33% after the company said the audit committee launched an internal investigation into its accounting practices.

- Paycom Software (PAYC) falls 9% after the company’s outlook was seen as disappointing and pointing to tepid growth trends.

- Trip.com ADRs (TCOM) fall 5% after China Central Television reported that the city of Beijing had summoned the internet firm along with 11 others over issues related to train ticket sales.

- Viking Therapeutics (VKTX) rises 13% after the biotech said it plans to advance its oral obesity drug to Phase 3 in the third quarter of this year.

- Zoetis (ZTS) climbs 4% after the animal health company gave a forecast for adjusted earnings per share for 2026 that topped Wall Street’s expectations

With US stocks lagging gains in Asia and Latin America this year, the moves underscore how sensitive the market has become to companies’ exposure to the infrastructure behind the AI boom. Memory-chip shortages and pricing are coming up frequently as topics in company earnings reports and conference calls.

“This is a year of the bullish stock market, but a very volatile stock market — and the volatility will be induced by the AI trade, which is evolving,” said Beata Manthey, head of European Equity Strategy at Citigroup Inc. “Right now we are concentrating on losers. But we also need to discover who the new winners are going to be.”

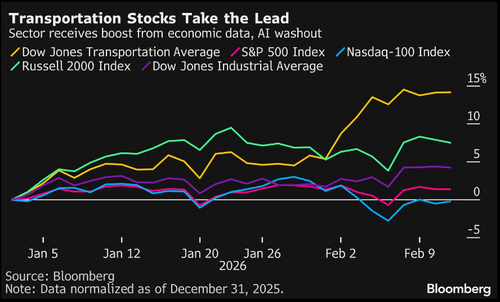

The AI winners and losers trade is playing out across the world, helping Asian markets — with a heavy concentration of AI hardware firms — extend their lead over the US. That’s left the S&P 500 ranking 69th among the 92 stock indexes tracked by Bloomberg, according to Markets Live. Among sectors, jitters over software have given the ‘old economy’ stocks in the Dow Jones Transportation Average a new lease of life.

And in single stocks, the huge memory-chip needs of AI are rippling out. Japanese chipmaker Kioxia surged after its guidance beat estimates, while Cisco shares are lower in premarket trading after saying that mounting memory chip prices are hurting its margins. Elsewhere in the AI space, Anthropic is said to be nearing the completion of a deal to raise more than $20 billion in a funding round with a plethora of big investors. And Softbank announced a near-$20 billion investment gain on OpenAI.

Since Jan. 9, there has been a larger swing for the average S&P 500 stock compared to 99% of the time over the past three decades. The 10.8% move, averaged on an absolute basis in that time, has created a windfall for investors with long dispersion positions, according to data from Nomura. US stocks appear less vulnerable than in recent weeks after hedge funds reduced positioning in January, according to JPMorgan strategists.

Traders are also keeping a close eye on key US economic data. Jobs numbers on Wednesday came in surprisingly strong, and attention now turns to Friday’s inflation report for clues on future policy moves by the Federal Reserve.

In politics, Trump’s tariff policies suffered their strongest political blow yet with the Republican-led US House passing legislation aimed at ending the president’s levies on Canadian imports. The US and Japan are closing in on the first three projects to be funded by Tokyo’s $550 billion investment vehicle, as part of their bilateral trade deal.

Out of the 346 S&P 500 companies that have reported so far in the earnings season, 77% have managed to beat analyst forecasts, while 19% have missed. CBRE, Exelon and Iron Mountain are among companies due to report results before the market open. CBRE earnings come in the face of a real estate services ‘AI scare trade’ which hit the sector on Wednesday. Earnings from Applied Materials, Coinbase and Airbnb follow later.

Europe’s Stoxx 600 rises 0.5% to 624.50, hitting a new record high on Thursday amid a flurry of positive earnings, including from EssilorLuxottica SA and Siemens AG. Financial services outperform, as Nuveen’s deal to buy Schroders Plc sends the UK asset manager soaring. Here are some of the biggest movers on Thursday:

- Schroders shares jump as much as 31%, the most since 2008, after the firm agreed to be bought by US asset manager Nuveen for £9.9 billion ($13.5 billion), a 34% premium to Wednesday’s closing price.

- EssilorLuxottica shares jump as much as 10%, the most since October, after the eyewear maker reported better-than-expected sales for the fourth quarter, riding a boom in demand for AI-powered glasses.

- Siemens gains as much as 6.2%, hitting a record high, after delivering order beats in both Digital Industries and Smart Infrastructure in the first quarter, and boosting its EPS guidance for the full year.

- Autostore shares surge as much as 17%, the most since mid-August, after the Norwegian warehouse automation firm delivered a strong revenue beat in the fourth quarter.

- Hermès gains as much as 3.1% as the French maker of the Birkin bag reported fourth-quarter sales and full-year profits that beat estimates.

- Michelin shares rise as much as 6.2% to the highest since May, after the French tiremaker’s plan to buy back as much as €2 billion worth of shares positively surprised analysts, who also noted improvement in earnings momentum.

- Adyen shares slump as much as 20% after the payments firm gave a revenue growth target that missed estimates, citing “continued macroeconomic uncertainty” weighing on market volume growth.

- Magnum shares fall as much as 16% in Amsterdam after full-year results that Jefferies analysts said will fuel concern over the impact of weight-loss drugs on demand.

- Verisure shares drop as much as 11% to a new record low, after the security services firm missed fourth-quarter adjusted Ebitda estimates, despite strong growth in new installations.

- RELX shares give up early gains as analysts at Morgan Stanley said one set of robust numbers will not settle the broader debate on how artificial intelligence may impact the software and information services sector.

- Sanofi shares drop as much as 5.1%, the most since Dec. 15, after the French drugmaker changed its chief executive following big bets on research spending which didn’t produce quick results, in a move that Jefferies analysts said “will be debated.”

- Mercedes shares fall as much as 5.7% after the German carmaker said margins would remain under pressure in 2026 due to US tariffs and China competition.

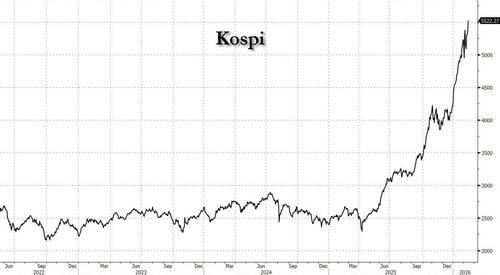

Earlier in the session, Asian stocks climbed, poised for a fifth day of gains, on continued investor optimism over benefits for the region’s technology hardware suppliers from the artificial intelligence boom. The MSCI Asia Pacific Index rose as much as 0.9%, on track for its best week since September 2024. South Korea’s Kospi jumped 3.1% to extend its lead as the world’s best-performing market this year, driven by gains in memory makers Samsung Electronics and SK Hynix.

The region’s stocks are outperforming global peers this year on extended enthusiasm for AI infrastructure firms, even as doubts over high spending and potential obsolescence of older business models rattle other markets. The MSCI Asia gauge has jumped about 13% so far this year versus the 1.4% advance in the S&P 500 Index, marking its best start to the year relative to the US gauge this century. The US gauge ranks 69th among the 92 stock indexes around the world tracked by Bloomberg. South Korea is the world’s best-performing market with a 30% surge.

Elsewhere, Japanese stocks extended gains on hopes that Prime Minister Sanae Takaichi’s decisive election win may boost spending. Hong Kong shares fell, bucking the broader regional gain, while mainland China equities traded flat ahead of Lunar New Year holidays. There’s no trading in Taiwan through next week.

In FX, USD/JPY is down marginally on the session but well off the APAC lows as questions surface over whether the post-election yen rally is running out of steam. The Bloomberg Dollar Index falls 0.1% with losses most pronounced against the franc and kiwi. The pound was unfussed by soft Q4 GDP metrics.

In rates, treasuries hold small gains, outperforming European bonds ahead of weekly jobless claims data and 30-year new-issue auction.The US 10-yr yield is unchanged at 4.17%. Bunds and gilts are similarly contained. US yields richer by 1bp to 2bp curve with curve spreads little changed; new 10-year yield near 4.165% is 1.5bp lower on the day, slightly outperforming bunds and gilts in the sector. $25 billion 30-year new-issue auction at 1pm New York time concludes this week’s Treasury supply; Wednesday’s 10-year tailed by 1.4bp. WI 30-year yield near 4.795% is ~3bp richer than January’s, which stopped through by 0.8bp.

In commodities, spot gold and silver are giving back some of yesterday’s gains, down 0.4% and 1.2% respectively. WTI futures are down 0.1% after failing to hold onto the mild APAC bid. Bitcoin is up 0.5%.Bitcoin briefly slid under $67,000, while Japan’s super-long bonds extended their post-vote rally as Prime Minister Sanae Takaichi’s historic election win soothed investor concerns about fiscal policy.

Today’s US economic calendar slate includes weekly jobless claims (8:30am) and January existing home sales (10am). Fed speaker slate includes Logan (7pm) and Miran (7:05pm)

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.2%

- Russell 2000 mini +0.5%

- Stoxx Europe 600 +0.3%

- DAX +1.4%, CAC 40 +0.6%

- 10-year Treasury yield little changed at 4.17%

- VIX -0.2 points at 17.46

- Bloomberg Dollar Index -0.1% at 1180.38

- euro little changed at $1.1881

- WTI crude -0.4% at $64.4/barrel

Top Overnight News

- In a closed-door meeting with Senate Republicans Wednesday, Treasury Secretary Scott Bessent agreed with lawmakers who suggested the Senate Banking Committee could investigate Federal Reserve Chair Jerome Powell, instead of the Justice Department. Semafor

- China has confirmed that discussions were under way about US President Donald Trump’s planned visit in April, when sources said the two sides were expected to extend their current trade truce by up to one year. SCMP

- One year after Chinese startup DeepSeek rattled the global tech industry with the release of a low-cost artificial intelligence model, its domestic rivals are better prepared, vying with it to launch new models, some designed with more consumer appeal. DeepSeek, Alibaba, ByteDance are set to release new AI models. RTRS

- Futures signaled that gains in Asian equities may extend to the US. Treasuries were flat after strong jobs data sparked a jump in yields. The dollar, gold and oil edged lower. BBG

- The “buy Japan” trade gained momentum after PM Sanae Takaichi’s decisive election victory increased investor confidence. The country’s long-dated bonds jumped, while the Topix extended its rally. BBG

- The UK economy grew less than forecast in the fourth quarter, piling pressure on Keir Starmer. GDP rose 0.1%, falling short of the 0.2% consensus. The pound was little changed. BBG

- The House of Representatives has voted to overturn Trump’s tariffs on Canada in a major rebuke of the US president’s signature economic policy. FT

- The Fed’s Jeff Schmid said rates should remain at a “somewhat restrictive” level, while Stephen Miran said January’s strong jobs report doesn’t warrant delaying further cuts. BBG

- Global oil inventories surged by 477 million barrels in 2025, the fastest build since 2020, as supply outpaced slowing demand, the IEA said, forecasting a record surplus in 2026. BBG

- “Old Economy” stocks are back in the lead. The Dow Jones Transportation Average has outpaced the S&P 500 in the past six weeks, as investors pivot from megacap tech to rails, truckers and airlines. BBG

Trade/Tariffs

- Chinese buyers are reportedly buying around 1mln tonnes per month of Australian barley due to a local feed supply shortage, traders report. Chinese buyers are reportedly booked near 2.5mln tonnes of US sorghum over the past three months to replenish domestic feed grain shortfall, traders report.

- Indian Trade Minister said textiles will receive no duties if raw material is from the US.

- China’s Commerce Ministry announced a tariff of up to 11.7% (prev. 42.7%) on EU dairy products; effective from the 13th of February.

- China’s Commerce Ministry, on Canada canola anti-dumping tariffs, said investigation period extended to March 9th.

- China’s Commerce Minister said China and the US are to maintain close communication at all levels through trade and economic consultation mechanisms.

- China’s chief trade negotiator Li Chenggang met with Mexico’s deputy economy minister in Beijing.

- China’s top trade negotiator met with Westinghouse Electric Company CEO on Tuesday.

- Taiwan and the US are reportedly to sign a reciprocal trade agreement on February 13th.

- US President Trump posted “Canada has taken advantage of the United States on Trade for many years. They are among the worst in the World to deal with, especially as it relates to our Northern Border”.

- US President Trump posted “Any Republican, in the House or the Senate, that votes against TARIFFS will seriously suffer the consequences come Election time, and that includes Primaries!”.

- US House majority backs resolution to eliminate Trump’s tariffs on Canada.

- US President Trump and Chinese President Xi are poised to extend trade truce by up to a year during April meeting in Beijing, according to SCMP citing people familiar with discussions.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with a slightly positive bias amongst the major indices as the region reflected on earnings releases and the better-than-expected US jobs data, while Japan’s benchmark hit a fresh record high on return from holiday, before fading the gains. ASX 200 was led higher by strength in utilities and financials after shares in Origin Energy and ANZ Group rallied post-earnings, but with upside in the broader market capped by hawkish rhetoric from RBA Governor Bullock. Nikkei 225 swung between gains and losses, in which the index initially climbed to above the 58,000 level for the first time, but then briefly wiped out all of its gains as currency strength persisted. Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark dragged lower by underperformance in the likes of Budweiser and NetEase following their earnings releases, with the latter also weighed by tech/AI-related headwinds, which dragged other large tech names lower such as Tencent, Baidu and Meituan, while AI startup Zhipu shares surged around 36% after the release of its new model. Conversely, the mainland treaded water following another firm liquidity operation by the PBoC and after China’s State Council held a session on boosting AI use, with Premier Li urging to promote the use of AI in various sectors, while there are also expectations for the US and China to extend the trade truce by up to a year during the expected Trump-Xi meeting in April.

Top Asian News

- Japan is said to have requested US Fed/NY Fed JPY rate check back in January.

- Japan’s top currency diplomat Mimura won’t comment on FX levels and said closely watching markets with a high sense of urgency, also said they are not lowering our guard and are in contact with US authorities.

- Japanese Finance Minister Katayama discussed with PM Takaichi about how to proceed with tax credits for benefits and sales tax cut on food, while she did not discuss forex with the PM, according to Jiji.

- Softbank (9984 JT) CFO Goto said nothing has been decided about an additional funding round for OpenAI.

European bourses (STOXX 600 +0.5%) are entirely in the green, with the DAX 40 (+1.2%) leading gains and CAC 40 (+0.9%) following closely behind. On the other hand, the Dutch AEX (-0.5%) lags, weighed by Adyen and Magnum earnings. Sectors hold a mostly positive bias with Financials (+1.3%) and Telecommunications (+1.0%) leading the pack. Schroders (+28.5%) leads in financials after Nuveen agreed to purchase the company for GBP 9.9bln. Deutsche Boerse (+2.0%) is also higher, after acquiring a further 20% stake in ISS STOXX, which is expected to be accretive to cash EPS in the first full year. Movers include Siemens (+5.7%), Hermes (+1.3%) and Mercedes-Benz (-2.0%). Siemens missed top-line expectations but raised its FY EPS guidance helping shares higher. Hermes posted earnings that beat estimates and highlighted that 2026 prices increases would be lower than it was in 2025. For Mercedes Benz, the Co. guided its Adj. ROS below market consensus.

Top European News

- EU Court Advisor said they should stop the release of c. EUR 10bln in funds for Hungary.

- UK Chancellor Reeves is to limit the deregulatory drive as she seeks closer UK relations with the EU, according to FT.

Central Banks

- Fed’s Hammack (2026 voter) said unemployment rate looks like it’s stabilising, adds we have the labour market broadly in balance but noted inflation is still too high. Consumer spending holding in driven by upper incomes. Important for Fed to get inflation back to 2%. Current Fed Funds Rate is right around neutral. Local contacts say growth is picking up. Good for the Fed to stay on hold right now and doesn’t need to fine-tune rate policy.

- Fed Governor Miran said Wednesday’s NFP report does not mean the Fed can’t lower rates. Think if you increase supply then you get a decline in inflation. If you blame supply chain failures for higher inflation, stands to reason pushing supply out lowers inflation. Deregulation opens up an output gap. I’d be very Happy to stay, but not up to me. What happens later this year will depend on choices the President and the Senate make.

- ECB’s Makhlouf said that the ECB is in a good place, adding that inflation is currently on target.

- ECB’s Cipollone said preserving monetary sovereignty has been a key objective of our single currency.

- ECB’s Villeroy said expected France’s economic growth in Q1 to be between 0.2-0.3%, and in line with the 1% annual growth expected in 2026.

- BoE’s Breeden said it is reasonable to expect rate cuts across the next couple of meetings if the economy evolves as expected.

- RBA Assistant Governor Hunter said need to assess extent to which recent rise in inflation is temporary, adds labour market has stabilised recently, but remains a bit tight; expects labour markets to remain tight and inflation above target for some time.

- RBA Governor Bullock said economy performing reasonably well, labour market a positive development, adds the Bank will monitor data and act if inflation becomes entrenched, warning that further rate hikes may be needed. She further added that the board decided inflation at around 3-point something was unacceptable.

- CBRT raises its end-2026 inflation forecast to 15-21% (prev. 13-19%).

FX

- G10s are mostly firmer against the USD. Kiwi leads, followed by the GBP, whilst the Aussie lags a touch; the latter seemingly paring back recent strength.

- DXY is incrementally lower today. As a reminder, the index was choppy in the prior session following a strong NFP report and as markets continue to digest reports that President Trump is looking exit the North American trade pact. Currently, the index resides towards the lower end of a 96.77-97.07 range, and further pressure could see a test of the prior day’s low at 96.49. Focus today will be on the US Jobless Claims, and then an appearance from the POTUS.

- GBP is slightly firmer this morning, largely attributed to the slight USD weakness. Earlier, a mixed GDP report spurred two-way action in Cable; in brief, December’s M/M figure printed in-line with expectations, whilst the Y/Y component and Q4 prelims metrics came in softer than expected. GBP/USD fell from 1.3617 to 1.3607 before paring, and then strengthening as the morning progressed. ING opines that, given recent seasonality-related factors, it expects the economy to “bounce back” a bit in Q1. On monetary policy, the bank believes that if recent growth and labour market weakness persist alongside falling wage growth, then a March cut is “highly likely”. As it stands, Cable currently sits at the upper end of a 1.3604-1.3654 range.

- JPY is currently moving at the whim of the USD, with USD/JPY towards the midpoint of a 152.26-153.54 range. Further pressure in the pair could see a test of the lows seen in late January, when Jiji reported that Japan asked the US to conduct USD/JPY rate checks. In terms of the environment for JPY, markets are continuing to increase bets of faster BoJ normalisation. Mizuho’s Koshimizu, speaking to Reuters, highlighted that improved growth prospects, clearer policy strategy and inflation continuing to remain above the BoJ’s target, may allow the Bank to deliver three rate hikes this year – suggesting that a hike could come as early as March or April. Markets currently price in a 60% chance of a hike in March, 92% chance in June and fully priced in for July.

Fixed Income

- A contained start for most benchmarks.

- Gilts are the relative outperformers after soft GDP data. The benchmark opened higher by 18 ticks before climbing another nine to a 91.30 peak and notching a fresh WTD high. Weighing on the UK’s 10yr yield to a 4.47% trough. For the BoE, the data works in favour of the doves who wanted to cut last week and somewhat skews the narrative towards a March cut vs current pricing for April. However, pricing didn’t really move as we await next week’s CPI and employment/wage metrics; furthermore, while the series was weak, the economy was still resilient during a tumultuous Q4, a finding that tempers the otherwise dovish impulse.

- JGBs returned from Wednesday’s holiday lower, reacting to the US NFP print and bearish UST action. Pressure that proved fleeting as the benchmark lifted to a 132.02 peak with gains of just over 10 ticks at best. However, that upside faded across the APAC session to a 131.52 trough. Drivers for this include a Reuters interview with Mizuho’s Kozhimizu, who expects as many as three hikes by the BoJ in 2026, and a move as soon as March or April is entirely possible. As it stands, just 3.5bps of tightening is implied in March, 14bps in April and 23.6bps in June, with a move not fully priced until July, where 30bps is implied.

- Bunds firmer, but contained, in narrow 128.62-76 parameters. Specifics for the bloc light, no move to a handful of ECB remarks, which stuck to the script.

- A similar story for USTs, rangebound in APAC hours towards the mid-point of the post-NFP drop. Holding at 112-11+ in thin parameters that are well within Wednesday’s 112-00 to 112-20 bound. Today, the US docket is comparatively light, with supply and weekly jobs the highlights. Barring a surprise on those, it may be a bit of a filler day into Friday’s CPI.

- Italy sells EUR 6.25bln vs exp. EUR 5-6.25bln 2.40% 2029, 3.15% 2033, 3.25% 2032 BTP.

- Australia sold AUD 150mln in 2035 indexed bonds, b/c 3.97, avg. yield 2.4127%.

Commodities

- WTI and Brent are mildly lower this morning and currently trade within a USD 64.18-65.10/bbl and USD 68.86-69.85/bbl range, respectively. Really not much driving things for the complex this morning; action seemingly a paring back of some of the geopolitically-driven strength in the prior session, where reports suggested that the Pentagon was preparing a second aircraft carrier to deploy to the Middle East. It is worth noting a bout of pressure was seen in early European trade, though this lacked a clear driver. Elsewhere, the IEA OMR cut its 2026 global oil demand and supply growth forecast.

- Spot gold has been lacklustre thus far throughout the European morning, with the yellow metal trading around the USD 5,075/oz mark at the time of writing, still within yesterday’s USD 5,019.71-5,119.35/oz range, with fresh catalysts on the lighter side. Alongside news flow, the Dollar remains relatively muted following yesterday’s NFP-driven volatility, which proved to be short-lived. Both the Dollar and XAU have been moving sideways since awaiting the US CPI tomorrow.

- Copper prices were indecisive during the APAC session, reflecting mixed sentiment in China, with the Hang Seng and Shanghai Composite diverging overnight. However, early positive sentiment from Europe keeps prices underpinned, and offsets some of the weakness from the APAC session, providing support to the red metal. 3M LME Copper is currently trading around USD 13.3k/t in a narrow 13,2k-13.339k/t range.

- Vitol CEO said Russia and Iran’s oil buyers are reaching for Western supply.

- IEA cuts 2026 global oil demand growth forecast to 850k BPD (prev. 930k BPD); cuts 2026 global oil supply growth forecast to 2.4mln BPD (prev. 2.5mln BPD). Lowers 2026 forecast for non-OPEC+ supply growth to 1.2mln BPD (prev. 1.3mln BPD). Escalating geopolitical tensions, snowstorms and extreme temperatures in North America, and Kazakh supply disruptions sparked the reversal to a bullish market.

- Goldman Sachs sees a boost to mine supply growth slowing considerably in 2027/28 which would the ex-China market into deficit.

- Saudi crude oil supply to China is set to rise to at least 53mln barrels in March, according to sources.

- US Energy Secretary Wright states Venezuela oil quarantine is essentially over, calling it a historic pivot, but noted political prisoners remain an issue.

- US President Trump directs Department of Energy to issue funds to coal plants in states including West Virginia and Ohio.

- Venezuela’s interim President Rodriguez said hopes relationship with US progresses without obstacles; talked with US Energy Secretary about deals on oil, gas, power, and mining; look forward to move forward as fast as possible.

Geopolitics: Ukraine

- Ukraine’s Air Force warns of a likely launch of Russian intermediate-range ballistic missile.

- An oil refinery has reportedly caught fire in Russia’s Komi due to a drone attack, RIA reported.

- Russia warns it will retaliate if Europe tries to create military capabilities against it, according to Al Arabiya.

- Witnesses reported explosions in Ukraine’s capital of Kyiv.

Geopolitics: Middle East

- Turkish top diplomat said US and Iran are showing flexibility on a nuclear deal, according to FT.

Geopolitics: Other

- South Korean MPs say North Korea is accelerating its program to develop and manufacture drones based on experience from the Russia-Ukraine battlefield, citing the spy agency.

- North Korea is said to be developing a submarine that can carry 10 submarine-launched ballistic missile, according to an MP citing South Korea’s spy agency. North Korea-Russia collaboration excludes modern tech and nuclear programs. North Korea seeks to improve relations despite dissatisfaction with China.

- Sounds of explosions at the US base in the countryside of Al-Hasakah, Syria, due to the explosion of mines, Al Arabiya reported citing sources; details light.

- US Energy Secretary Wright said US wants no conflict and no military action for the Americas. US is working seven days a week to issue new licenses.

US Event Calendar

DB’s Jim Reid concludes the overnight wrap

I’ve been energised by a leadership offsite for the last couple of days, so if members of my team are reading this, hopefully I won’t get it wrong and end up with team meetings today that resemble something from “The Office”. While I was in learning mode, markets put in a mixed performance yesterday, as investors weighed up a very strong US jobs report, growing geopolitical risks and a fresh decline in software stocks. On the upside, that jobs report included the biggest jump for nonfarm payrolls in over a year, which led to growing confidence that the US economy had kept up its momentum into 2026. But the print also solidified existing concerns about inflation, which got further support thanks to another jump in oil prices amidst mounting speculation about a potential US strike on Iran. Finally, today sees a symbolically important EU leaders summit on strengthening the single market. Mario Draghi is attending and his competitiveness paper will no doubt be heavily referred to. While firm commitments are unlikely, it’s an incredibly important meeting on the future roadmap for Europe so all eyes will be on what progress is made.

That jobs report was the big story yesterday, with the release proving much stronger than expected. The headline was that nonfarm payrolls grew by +130k in January (vs. +65k expected), marking their biggest monthly jump since December 2024. Indeed, it was a big contrast from fears earlier this week about a low number, as Kevin Hassett had warned on Monday that markets should expect “slightly lower jobs numbers”, albeit without specifics about when this might be. Then on top of the upside payrolls surprise, the unemployment rate unexpectedly fell back to 4.3% (vs. 4.4% expected), so the print very much leant in a more hawkish direction. Admittedly, there were some negative revisions to previous months, with the 2025 total payrolls gain revised down from +584k to +181k. But we already knew the downward revisions were coming, so markets were much more focused on the strong print for January rather than the backward-looking content.

With the jobs report coming in strongly, markets moved to price out the chance of rapid Fed rate cuts this year. For instance, the chance of a rate cut in one of Chair Powell’s final two meetings (March and April) plunged from 47% to 23%. And looking at the full year, the amount of cuts priced by the December meeting fell -7.1bps on the day to 53bps. In turn, that more hawkish profile led to a clear bear flattening in the Treasury curve, with the 2yr yield (+5.8bps) up to 3.51%, whilst the 10yr yield (+3.0bps) moved up to 4.17%.

Whilst Treasuries saw a clear selloff, equities saw a more mixed performance, with the S&P 500 (-0.005%) ultimately closing less than a basis point lower on the day. Initially, the index opened strongly, boosted by the very strong jobs report. However, there was then a fresh decline in software stocks, with that component of the S&P 500 down -2.58% on the day, including strong declines for IBM (-6.50%), ServiceNow (-5.54%), Workday (-5.66%) and Salesforce (-4.37%). Financial services (-1.35%) were under pressure on two fronts. First, AI-disruption fears weighed on asset managers, with names like Charles Schwab (-3.83%), Invesco (-3.11%), and T Rowe Price (-2.95%) underperforming. Second, the bitcoin selloff also led crypto-adjacent stocks to weaken, with Coinbase (-5.73%), Block (-6.09%), and Robinhood (-8.91%) among the worst performers in the index. So those losses offset advances for some of the more defensive sectors like energy (+2.59%) and consumer staples (+1.20%), leaving the overall index fairly flat.

In the background, oil prices continued to climb yesterday as fears mounted about an escalation over Iran. In terms of the latest, President Trump met Israeli PM Netanyahu at the White House yesterday, where President Trump said he “insisted that negotiations with Iran continue to see whether or not a Deal can be consummated.” The President later posted to social media that “Last time Iran decided that they were better off not making a Deal, and they were hit with Midnight Hammer — That did not work well for them. Hopefully this time they will be more reasonable and responsible.” So by the close, Brent crude was up +0.87% to $69.40/bbl, and this morning it’s up another +0.25% to $69.57/bbl.

Earlier in Europe, most assets had seen a relatively stronger performance, with the STOXX 600 (+0.10%) just about closing at a fresh record. That was driven by a strong gain for UK equities, and the FTSE 100 (+1.14%) was also at a new record of its own. But it was a different story across much of the continent, with the DAX (-0.53%), the CAC 40 (-0.18%) and the FTSE MIB (-0.62%) all losing ground. Meanwhile for sovereign bonds, there was a more consistent rally, but UK gilts were once again leading the way, with 10yr gilt yields down -3.0bps on the day. Otherwise, those on 10yr bunds (-1.6bps), OATs (-2.6bps) and BTPs (-1.6bps) all fell back slightly too.

Overnight in Asia, markets are looking much more positive again after the weak close on Wall Street yesterday. The KOSPI (+2.64%) is leading the way, on course for another record high, and the Nikkei (+0.25%) is also on course for a record as Japanese markets returned from Wednesday’s holiday. However, equities in mainland China have been more steady, with the CSI 300 (+0.04%) only posting a modest advance, whilst the Shanghai Comp (-0.01%) has slipped back very slightly. Meanwhile in Hong Kong, the Hang Seng (-1.15%) has posted larger declines. But looking forward, US equity futures are pointing to a stronger start, with those on the S&P 500 up +0.31%.

Looking forward, today will also see EU leaders gather in Belgium for a summit on strengthening the single market. They’ll be joined by former ECB President Mario Draghi, who wrote a report on EU competitiveness, and we heard from several EU leaders yesterday as well. For instance, French President Macron said that if the EU wanted to “transform the productivity and competitiveness”, then “the only way is to have common issuance of debt”. Separately, German Chancellor Merz said that there should be “bold” steps from the EU to reverse its decline, saying the EU should “deregulate every sector”. Our economists also have a preview for the summit here.

Looking at the day ahead, data releases include the UK’s Q4 GDP reading, the US weekly initial jobless claims, and existing home sales for January. Central bank speakers include the ECB’s Cipollone, Radev, Stournaras, Lane and Nagel. Otherwise, EU leaders will be meeting today in Belgium.

Tyler Durden

Thu, 02/12/2026 – 08:29ZeroHedge NewsRead More

R1

R1

T1

T1