Savings Rate Tumbles To 4 Year Lows As Fed’s Favorite Inflation Indicator Comes In Hot

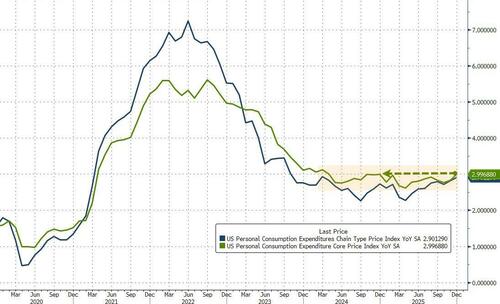

The Fed’s favorite inflation indicator – Core PCE (a measure of price changes in consumer goods and services that excludes volatile food and energy costs) – rose 0.4% in December (the latest data released today), slightly hotter than expected (+0.3% MoM). That lifted YoY inflation up 3.0% (above the prior month and hotter than expected) – the highest since April 2025…

Source: Bloomberg

The headline PCE rose 0.4% MoM (more than expected too) driving prices up 2.9% YoY (the highest since March 2024)

Source: Bloomberg

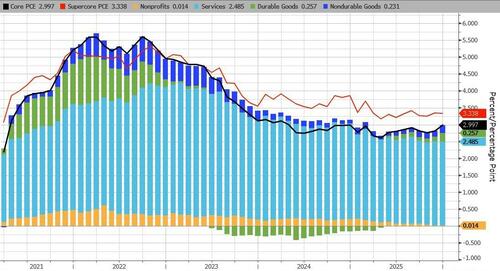

The much watched SuperCore PCE rose 0.3% MoM (the last MoM decline was April 2020). But the SuperCore PCE YoY printed +3.3% – very much unmoved in the last year…

Services prices continue to dominate the price gains but Goods costs also accelerated in December…

Many were fearful of the recent surge in oil prices impacting inflation, but as the chart below shows, the government’s measure of energy costs has recently (oddly) decoupled from actual energy costs…

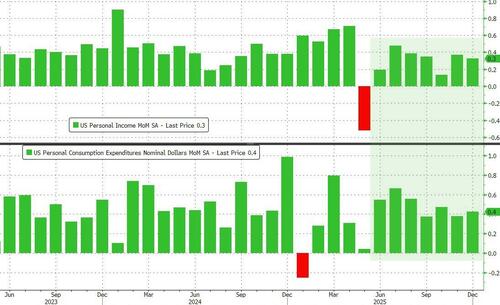

Higher prices were accompanied by higher incomes and higher spending…

But Spending continues to outpace incomes (even though the former is decelerating)…

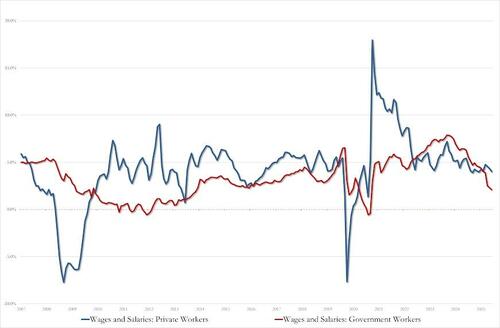

Wage growth is slowing, especially for government workers…

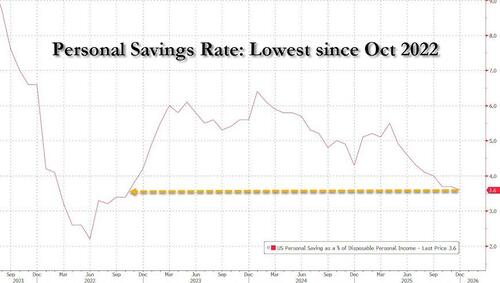

But, putting it altogether, the savings rate is tumbling to afford all this…

We look forward to President Trump explaining how affordability is ‘fixed’ next week at the SOTU.

Tyler Durden

Fri, 02/20/2026 – 08:47ZeroHedge NewsRead More

R1

R1

T1

T1