If ‘Cash Is King’, Berkshire Hathaway Leads The World

The cash that companies hold is important for paying employees, funding operations, and as a measure of financial health.

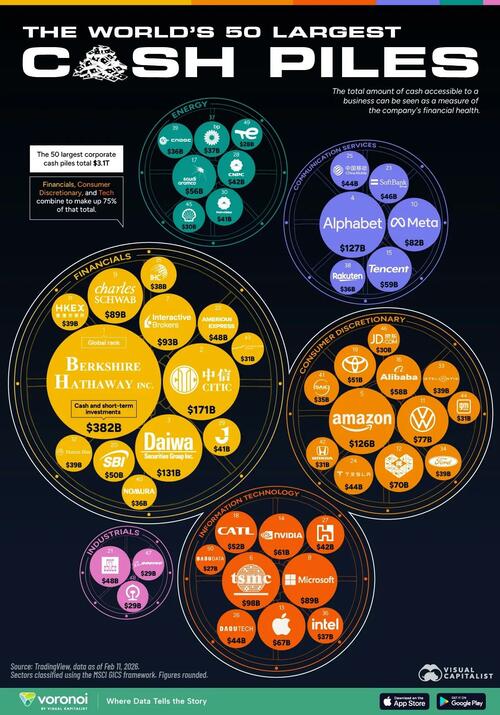

This chart, via Visual Capitalist’s Boyan Girginov, shows the 50 companies with the largest cash holdings, using data from TradingView to highlight who is sitting on the largest war chests.

This metric captures a company’s most liquid assets: cash plus short-term securities like T-bills that typically mature within a year.

Which Companies Hold the Most Cash?

Berkshire Hathaway leads the rankings with an impressive $382 billion.

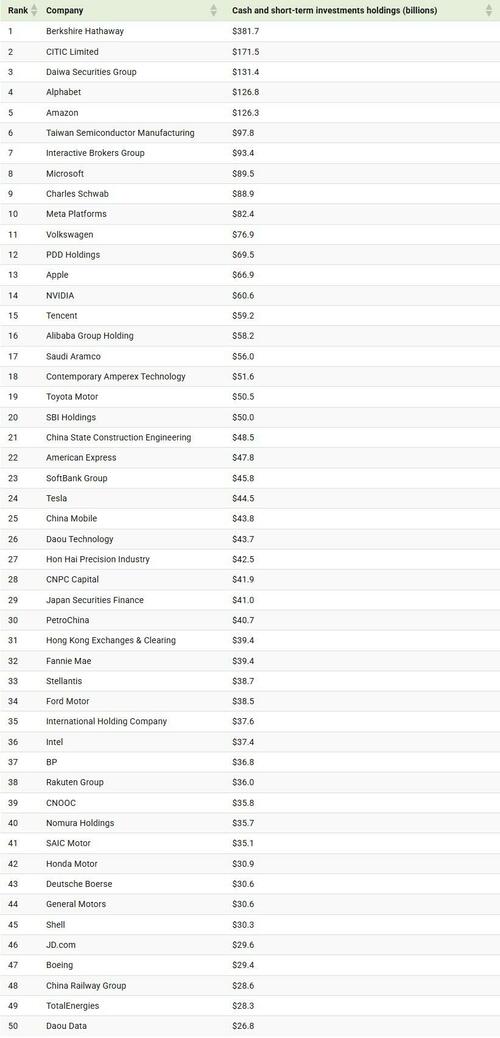

The data table below shows the top 50 companies worldwide with the largest cash and short-term securities holdings:

Source: TradingView | Cash and Short-Term Investments | as of Feb 11, 2026

Following Berkshire are CITIC—a Chinese state-backed financial conglomerate—and Daiwa Securities Group, one of Japan’s biggest financial brokerages.

Big Tech rounds out the top five, with Alphabet holding $127 billion and Amazon holding $126 billion.

Why Buffett Holds So Much Cash

Among the top 50 companies, the Financials sector collectively holds the largest cash reserves at $1.2 trillion—partially driven by strict capital rules requiring banks to maintain large liquid buffers.

Berkshire Hathaway is different: its cash position is strategic, not regulatory.

After 12 straight quarters as a net seller of stocks, Buffett and the team have parked much of the company’s liquidity in short-term U.S. Treasury bills, implying that equity valuations look expensive.

The Oracle’s cash and cash equivalents as a percentage of total assets is at an all-time high—roughly 31% of total assets.

Historically, this has coincided with periods when he waits for a major economic or market dislocation before deploying capital as prices begin to mean-revert—quietly accumulating dry powder in the meantime.

Why Big Tech Holds So Much Cash

The Magnificent Seven: Alphabet, Amazon, Meta, Microsoft, Apple, Nvidia and Tesla collectively hold $597 billion—enough to buy most S&P 500 companies.

Traditionally, Big Tech companies are massive cash machines: high gross margins and scalable cost structures mean incremental revenue converts into cash quickly.

Despite spending heavily to build AI factories, they’ve used little of their cash reserves to finance them—opting instead for debt.

They hold large cash stockpiles both to fund acquisitions and guard against potential economic turmoil, such as threats from tariffs or geopolitical conflicts.

To learn more about the world’s largest companies, check out this graphic on Voronoi.

Tyler Durden

Sat, 02/21/2026 – 11:05ZeroHedge NewsRead More

R1

R1

T1

T1