WTI Holds Losses After Big Surprise Crude Build

Oil prices continue to decline on concerns that OPEC+ will once again bolster supply at a meeting on Sunday, compounding fears of higher volumes later in the year.

Russian Deputy Prime Minister Alexander Novak subsequently said OPEC+ will “look at the current situation as a whole” before making a decision.

Several delegates from the group said it has yet to decide on how to proceed.

Additionally, API reported a surprise (though small) build in crude inventories

API

-

Crude +622k (-3.4mm exp)

-

Cushing

-

Gasoline -4.57mm

-

Distillates +3.68mm

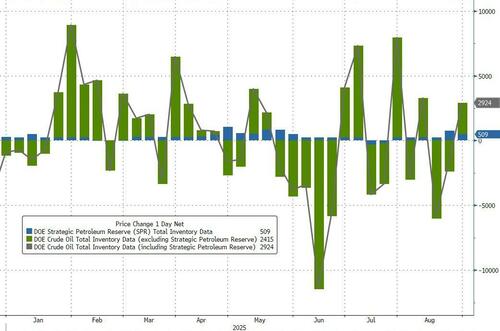

DOE

-

Crude +2.415mm (-3.4mm exp)

-

Cushing +1.59mm – biggest build since Mar 2025

-

Gasoline -3.795mm – biggest draw since Apr 2025

-

Distillates +1.68mm

The official DOE data shows a very mixed bag with a big surprise crude build, large jump in stocks at the Cushing Hub and a big draw in gasoline stocks….

Source: Bloomberg

With the addition of 509k barrels to the SPR, total commercial crude stocks rose for the first time in 3 weeks…

Source: Bloomberg

US Crude production remains near record highs despite the plunge in rig counts…

Source: Bloomberg

Algorithmic traders also may have contributed to oil’s slide on Thursday. Trend-following commodity trading advisers have been steadily selling crude since reaching “buying exhaustion” at the $65-a-barrel level, “creating just a few ripples and weighing on prices,” according to Daniel Ghali, a commodity strategist at TD Securities.

“We think a tidal wave is coming next,” Ghali said.

“We expect that algos are now set to imminently sell a massive 40% of their maximum size.”

WTI traded down to two week lows ahead of the official inventory and supply data…

Bloomberg reports that US oil has retreated more than 10% this year as OPEC+ has boosted production targets at a rapid clip to reclaim market share from rival drillers. At the same time, producers from outside the alliance have ramped up output, while concerns about demand have intensified as the Trump administration imposed a wave of trade tariffs.

The combination has spawned widespread predictions for a glut that will swell global stockpiles, pushing many investors to the sidelines until clarity on OPEC’s output plans is achieved this weekend, brokers say.

“We still see the current oversupply in oil markets intensifying,” Samantha Dart, an analyst at Goldman Sachs Group Inc., said in a note, forecasting Brent in the low $50s in late 2026.

Tyler Durden

Thu, 09/04/2025 – 12:08ZeroHedge NewsRead More

R1

R1

T1

T1