Reality Checks

Submitted by Peter Tchir of Academy Securities

Reality Check – Jobs

We published Weak Jobs Data ahead of the NFP release, in case the NFP turned out to be surprisingly good (who knows, with this data). We could have saved some time by not digging through ISM Employment, JOLTS Openings and Quits, ADP, or the soon to be released revisions to Q2 2024 to Q1 2025 numbers, since the NFP report was weak across the board.

We always like to look for “inconsistencies” within this report. Things that are either inconsistent in the report itself, or relative to other data. This basically just reinforced and confirmed the view that the labor market is weak (and made us even more bitter that the June number, released as a “glorious” beat on July 3rd, was actually negative, which was in line with our views as a potential outcome at the time).

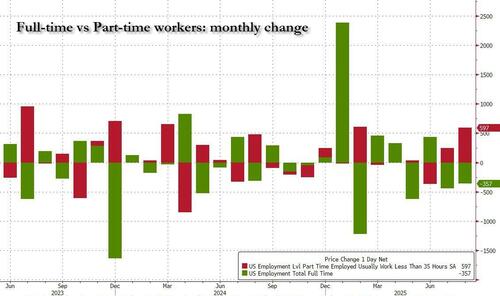

We couldn’t even find “glimmers of light” as earnings declined more than expected, hours worked dropped, and the unemployment rate went up (partly due to a small increase in the Participation Rate). Of greater concern was that the Underemployment Rate increased to 8.1%, the highest since the end of 2021! It had been above 10% prior to 2016, so it isn’t alarming, but it isn’t helpful either. The Household Survey did show a gain of 288k jobs, but its 3-month average is 40k, pretty much in line with the Establishment Survey’s 3-month average of 29k. For the past 2 months, the Household Survey has had full-time job losses of almost 800k and part-time job gains of about 850k. That is not good and the number of people who are working part-time is rising steadily.

For those of you who regularly read our criticisms of the birth/death model, it added 90k. Normally, we’d highlight that it is “odd” that a model of new businesses contributes this much relative to the total, but we will be kind and admit that we could be seeing new businesses starting, trying to take advantage of the myriad of policies being implemented. Change creates opportunity and there are many positive developments (for growth) on the tax side, shifting priorities, and reduced regulation in some industries.

With ongoing uncertainty around policy:

- The courts are still deciding on the legality of many existing tariffs (and the admin is working on how to keep them in place even if the courts rule against them, by using other rules to impose the tariffs, or even pointing to the trade “deals”).

- The admin still seems to change some tariff levels somewhat arbitrarily (at least compared to “traditional” standards), though nowhere near as much as around Liberation Day.

- There still is little in the way of formal, detailed documentation regarding the deals announced, and it seems fair to say that what the U.S. says about some deals, versus what the other country is saying, doesn’t always tie out (Japan’s “investment” in the U.S. as one pretty big example).

- What are other countries doing behind the scenes? No country was really in a position to lose a lot of business with the U.S. (other than maybe China, primarily due to their stranglehold on many rare earths and critical minerals – with magnets taking center stage). So of course, some “deals” were struck, but it is impossible to believe that many aren’t taking steps to insulate themselves from what they may see as “erratic” or “aggressive” behavior.

The job market needs to be addressed better, though it is possible that the combination of tariffs and other policies will bring a flood of jobs to the U.S. as they fully take effect. We remain most optimistic around ProSec™ (Production for Security) – and have seen some steps taken on that front (though some of the steps have raised issues about control, etc.)

Reality Check – Tariffs

Clearly, tariffs came up in our discussion of the job market. We believe tariff policy, both the uncertainty and the time it takes to have an effect, is hurting employment at the moment. Uncertainty does not encourage aggressive spending.

The disruption of tariffs comes first. Then, over time, once companies believe high tariffs are here to stay, and they have negotiated deals with suppliers, they can turn more attention to making products in the U.S. Some of that is already starting, but in general it takes time to build out. The build-out phase will also generate some jobs, but the big impact will come from a serious increase in domestic manufacturing. We remain concerned, that outside of ProSec™, the administration’s goals related to tariffs may not be achieved:

- The build-out time for many facilities is measured in years, not months, making the economy susceptible to the negative consequences of tariffs.

- In some cases, the cost disadvantage is so great, that even with large tariffs, domestic manufacturing may still have limited gains.

We continue to look to the monthly Tariff Revenue Charts for the cumulative impact. Only as the cumulative number grows should we expect to see the potential negatives – goods inflation/margin pressure – show up in the data. There are “whispers” in the data “hinting” that they are real and developing, but that could turn into a “crescendo” in the coming quarters as inventory has been rolled over to the point that it is completely tariffed, agreements with suppliers have been hammered out, and sales contracts get renegotiated.

Reality Check – AI Spend

The spending on AI (data centers, chips, electricity production) has been instrumental in keeping the economy going (and getting stocks to record levels).

So far, there are few, if any signs of the spending (investment) ebbing. By and large the talk from the chip companies, hyper-scalers, and large potential customers remains very positive and aggressive in regards to spending.

The President just met with the CEOs of major tech companies, so there should be ongoing support from the administration. Portions of the “Big Beautiful” Tax Act, such as accelerated depreciation, should add to the amount spent.

We have barely scratched the surface on the potential spending and growth as crypto in general and stablecoins make use of the tailwinds of recent laws and regulations. We are seeing Digital Asset Treasury companies being created daily and there is growing chatter of the potential for MSTR to be added to the S&P 500 (it was already added by Nasdaq).

Given the importance of this industry to the economy and markets, any cracks, even small ones, could have immediate, relatively large effects. Hopefully, we won’t find any cracks, but we are spending time on that front as it is truly mission critical that these industries continue to speed along!

Reality Check – Inflation

We concede, based on our views on tariffs, that there is some risk of goods inflation. But, if we are right on the economy, that will be relatively small. A weak job market doesn’t lend itself to consumers bidding up prices.

As we wrote recently, the housing inflation data is simply wrong. It doesn’t reflect what is currently occurring with rent, and it is “guaranteed” to catch up, since it is pretty much an exercise in math. It is difficult to believe that the Fed that missed rising rents in a timely manner during the “transitory” period, will make the same mistake, in reverse now, but that has been the path that they are on.

The goods inflation will pass through to the service economy over time (as service providers have to purchase equipment, products, supplies, etc.) but without job growth, it is difficult to see inflation running rampant.

Overall, I’d expect inflation to run somewhere close to (but likely below) 3% for the next year.

A touch high for the Fed to be comfortable cutting, but not so high that they shouldn’t respond to the already weak job market (after revisions, it has been weak for 3 months, and we think that Q1 was likely overstated for the reasons listed at the time – birth/death and invalid seasonality adjustments being the primary reasons).

Reality Check – Housing

Lower mortgage rates should help, but we continue to look at some “problem” areas that we have focused on before.

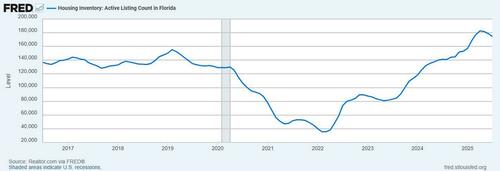

We hear a LOT about lack of supply, but we keep coming back to charts like this one.

The number of homes for sale in Florida has come down from recent highs, but it is still above where it was pre-Covid, and I believe it has improved due to seasonality (this chart is not seasonally adjusted).

We will be checking out other states, but we have a weird dynamic:

Affordability is low in most areas, especially for buyers who need a mortgage.

Supply of some types of residences is low in some areas (I’m told) yet we see several big states/regions with charts similar to the one above.

Not sure what is going on, but it seems like there is some risk that houses become affordable in a bad way (homeowners lose some of their equity – which tends to slow spending and the economy).

Reality Check – The Consumer

Never bet against the U.S. consumer continuing to spend. There have been periods that the U.S. consumer’s ability/willingness to consume has been tested, but not often nor for long since at least the GFC.

Being on the road this week on vacation, with a lot of spotty wi-fi during any downtime, we didn’t make much progress digging deeper into this risk. However, I’ve seen a lot more circulating on this topic. Nothing alarming, and some reports remain optimistic, but given our concern about the job market, taking a closer look at the consumer seems like a necessary project

Reality Check – The Fed, Treasury, and Interest Rates

While the market gapped closer to our target of 100 bps of cuts this year, even with some flattening on the week, we think the market is still underestimating the steps the Fed, in conjunction with Treasury, can take to reduce rates across the curve.

We’ve had numerous discussions on the subject since we published How We’d Drive All Yields Lower. We were playing “Devil’s Advocate” but worth a read, especially after this week’s data and some of Secretary Bessent’s recent talking points.

Given price action on Friday and our overall outlook, we like lower yields and flatter curves (rather than just a “theoretical like” as we think steepeners are crowded and could face some pain in the coming days).

Reality Check – Don’t Fight the Fed

The Fed is cutting.

If we are correct on even a few of our policy thoughts, we will see flatter yield curves.

But is that enough for stocks to keep going strong? That is literally the trillion dollar question.

Stocks seemed to think so initially on Friday (and even Thursday as they regained losses from a few of the prior days). Then they seemed to second guess that as they sold off, only to fight back to close to unchanged.

What will next week bring? I think the recent struggle to materially break higher will persist, with more risk of a 5% move to the downside before another 5% to the upside for major U.S. stock indices.

Guess we are encouraging “fighting the Fed” – at least a little on the equity side.

Bottom Line

Really like bonds here. Credit should be fine. Slightly cautious on equities. Exploring the crypto/stablecoin arena for the best opportunities.

Had a great vacation, but am looking forward to full steam ahead as September through November is already looking like it will be extremely busy on so many fronts (and today we barely touched on geopolitics, the military, and the American Brand – so plenty more to assess and keep you posted on as the Geopolitical Intelligence Group continues to expand in size and scope).

Tyler Durden

Sun, 09/07/2025 – 16:20ZeroHedge NewsRead More

R1

R1

T1

T1