WTI Holds Gains Despite Biggest Crude+Product Build Since 2023

Oil climbed for a third session as investors weighed President Donald Trump’s latest tariff threats on Russian crude buyers, the fallout from Israel’s strike in Doha and the outlook for US interest rate cuts.

Trump told European Union officials he’s willing to slap new tariffs on India and China, the top importers of Russian crude, in an effort to get Moscow to negotiate with Ukraine – but only if EU nations do so as well.

Meanwhile, Israel’s attack targeting Hamas leaders in Qatar’s capital threatens to derail US-led efforts to end the Middle East conflict, reviving geopolitical risk premiums in crude prices. Israel has claimed full responsibility, while Trump distanced himself from the strike.

Despite an expected draw, API reported a crude inventory build overnight, but traders shrugged it off…

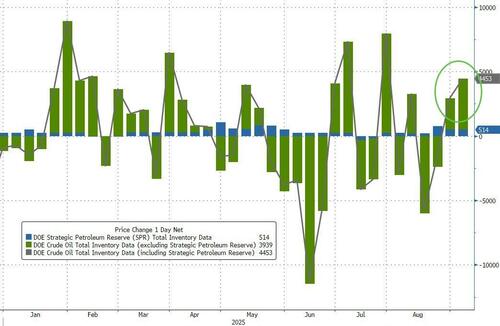

API

-

Crude +1.25mm (-1.9mm exp)

-

Cushing

-

Gasoline +399k

-

Distillates +1.5mm

DOE

-

Crude +3.939mm (-1.9mm exp)

-

Cushing -365k

-

Gasoline +1.458mm

-

Distillates +4.715mm – biggest build since Jan 2025

In an even bigger surprise than API, the official data printed a 3.94mm barrel build in crude stocks (versus a 1.9mm expected draw). Gasoline stocks rose for the first time in 8 weeks and Distillates saw the biggest build since January…

Source: Bloomberg

The build gets more notable as the Trump admin added another 514k barrels to the SPR…

Source: Bloomberg

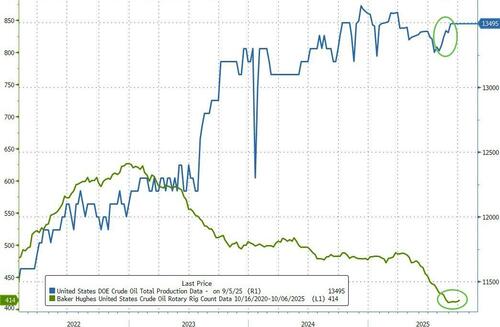

US crude production rose back near record highs as the trend lower in rig counts appears to have stalled for now…

Source: Bloomberg

WTI is holding gains for now despite the big builds…

Source: Bloomberg

Overall, according to Bloomberg, this is a very big build in total crude and product stockpiles, with builds across the board, leading to a 15.4 million barrel increase. It’s the largest since the middle of 2023.

Tyler Durden

Wed, 09/10/2025 – 10:39ZeroHedge NewsRead More

R1

R1

T1

T1