ETF Just Happened

By Bas van Geffen, Senior Macro Strategist At Raboank

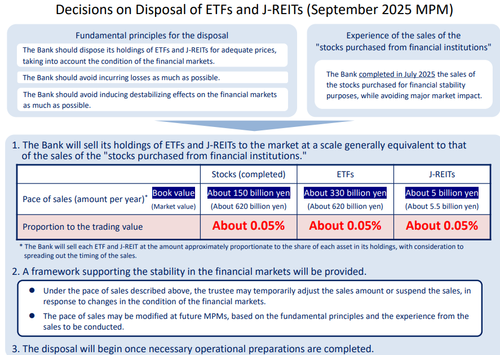

In a surprise decision, the Bank of Japan announced it would start to gradually sell its ETF holdings. The central bank plans to shrink its portfolio by ¥620 billion ($4.2 billion) per year. To emphasise how gradual of a pace that is, Governor Ueda recounted that “it would take more than 100 years” to fully unwind the central bank’s ETF holdings.

On top of that, two policymakers dissented from the decision to leave the policy rate unchanged today. They preferred to hike to 0.75% already, which puts a rate hike in October squarely on the table.

The shock announcement made for a bit of a rollercoaster ride for Japanese equities. The Nikkei 225 opened the trading day about one percent higher; tumbled 2.5% from those levels on the Bank’s announcement; and finally recovered some of those declines to end up 0.6% below yesterday’s close.

But there’s, perhaps, another interesting element to this decision: the central bank decided to reduce its ETF holdings, rather than speeding up its exit from the sovereign bond market – that is, more than the tapering of JGB purchases it had announced in June. Both programmes will need to be right-sized as part of policy normalisation, but perhaps the recent pressure on global long-term bond yields –and particularly JGBs– was a consideration as well. Either way, the Japanese curve is twist flattening on the hawkish decision.

The UK monetary policy decision made less waves. Yesterday, the Bank of England decided to keep its policy rate unchanged at 4.00%, with a familiar split vote. The usual two suspects voted in favour of another 25bp cut. That, along with the policy statement, affirms our view that there is still a bias toward easing in the monetary policy committee, even though the bar for further rate cuts is rising. Policymakers are looking to cut further, but only when they get clearer evidence that the disinflationary process is continuing.

Yet, UK inflation data suggest that the disinflationary momentum is waning, and various metrics of underlying inflation remain sticky, and we don’t believe that the October inflation report will provide a very different picture. Therefore, we now expect the next rate cut to be delayed into early 2026, and we have revised our forecast for the terminal rate somewhat higher.

As our UK strategist notes, the Bank remaining on hold through Q4 also puts the emphasis on Chancellor Reeves’ Autumn budget. The Chancellor has the difficult task of plugging a roughly £50 billion fiscal gap.

Today’s data once again underscored the need to shore up the UK’s finances. Public sector net borrowing was much higher than expected in August: last month, the government borrowed £5.5 billion more than the Office for Budget Responsibility had forecast in March. And estimated borrowing in earlier months were revised up as well. Yields on longer-dated gilts are opening significantly higher – with sterling down against both dollar and euro, reflecting concerns about the sustainability of the UK’s finances.

In short, tax hikes are pretty much unavoidable. That will be a tough message to sell, as Labour is already trailing Reform in the polls. But investors require something more tangible than just rhetoric: they demand to see credible and substantial fiscal adjustments.

Given the hesitance amongst gilt investors, it is noteworthy that the Bank of England will shrink its sovereign bond holdings by £70 billion over the next year. That includes £21 billion in active sales, on top of the maturing bonds – an increase from this year’s pace. In an attempt to limit disruptions in longer-dated Gilts, the central bank will skew its sales towards shorter maturities.

Tyler Durden

Fri, 09/19/2025 – 15:40ZeroHedge NewsRead More

R1

R1

T1

T1