September ‘Soft’ Survey Data Dips But Q3 Still ‘Best Quarter’ Of The Year For US Business

Following August’s big bonce in US Manufacturing survey data, the preliminary September data shows weakness for both Services and Manufacturing (despite strength in the hard data).

- Flash US Services PMI Business Activity Index: 53.9 (August: 54.5). 3-month low.

- Flash US Manufacturing PMI: 52.0 (August: 53.0). 2-month low.

However, both surveys are above 50 (expansion)…

Source: Bloomberg

“Further robust growth of output in September rounds off the best quarter so far this year for US businesses,” says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

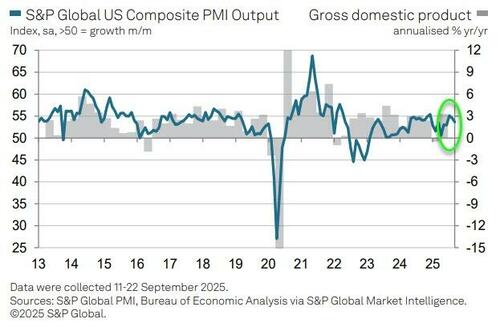

“PMI survey data are consistent with the economy expanding at a 2.2% annualized rate in the third quarter.”

It;’s not all goldilocks though:

“However, the monthly profile is one of growth having slowed from its recent peak back in July, and September saw companies also pull back on their hiring. Softening demand conditions are also becoming more widely reported, curbing pricing power. Although tariffs were again cited as a driver of higher input costs across both manufacturing and services, the number of companies able to hike selling prices to pass these costs on to customers has fallen, hinting at squeezed margins but boding well for inflation to moderate.

“The survey data are nevertheless still indicative of consumer inflation remaining above the central bank’s 2% target in the coming months. However, in manufacturing, there are also signs that disappointing sales growth has caused inventories to accumulate at an unprecedented rate, which could also further help soften inflation in the coming months.

“The inventory build-up of course also hints at some downside risks to future production. While growth expectations across both manufacturing and services also continue to be dogged by concerns over the political environment, and especially tariffs, September encouragingly saw business sentiment improve in part due to the anticipated beneficial impact of lower interest rates.”

Looking ahead, companies’ expectations about output in the year ahead improved to a four-month high in September yet remained below the survey’s long-run averages in both manufacturing and services. Service sector sentiment picked up to the highest level since May, while a three-month high was recorded in September.

Tyler Durden

Tue, 09/23/2025 – 10:01ZeroHedge NewsRead More

R1

R1

T1

T1