Watch Live: Fed Chair Powell Discusses The State Of The Economy

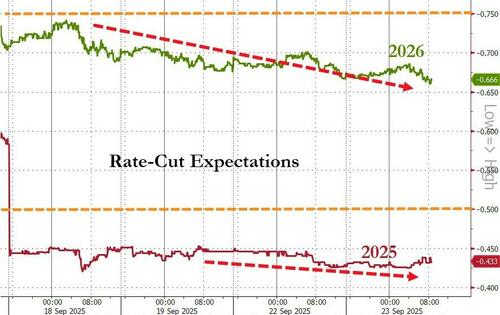

Since the last FOMC statement and Powell’s press conference, stocks are up, gold is up, the dollar is up, and bond yields are up with rate-cut expectations for 2026 drifting lower (with Oct 2025 odds of a cut at 92% and Dec at 81%)…

Source: Bloomberg

Is this what Powell wanted?

Since the FOMC statement, there has been a tsunami of FedSpeak

Sept. 23

Michelle Bowman, Fed Vice Chair for Supervision

Policymakers are in danger of falling behind the curve and need to act decisively to bring down interest rates as the labor market weakens.

“Should these conditions continue, I am concerned that we will need to adjust policy at a faster pace and to a larger degree going forward.”

Austan Goolsbee, The Fed Bank of Chicago president

He urged caution, given inflation remains persistently above the Fed’s target. said, “we need to be a little careful with getting overly up-front aggressive.”

Sept. 22

Stephen Miran, Fed Governor

“Leaving short-term interest rates roughly 2 percentage points too tight risks unnecessary layoffs and higher unemployment.”

He wants to cut rates by another 1.25 percentage points at the two remaining FOMC meetings this year.

Alberto Musalem, President of St. Louis Fed

“I supported the 25-basis-point reduction in the FOMC’s policy rate last week as a precautionary move intended to support the labor market at full employment and against further weakening.”

“However, I believe there is limited room for easing further without policy becoming overly accommodative.”

Raphael Bostic, President of Atlanta Fed

He’s hesitant to support another rate cut next month due to high inflation and doesn’t believe the labor market is in crisis right now.

Beth Hammack, President of Cleveland Fed

She remains focused on inflation and warned officials should be cautious about rate cuts to avoid overheating the economy.

Sept. 19

Stephen Miran, Fed Governor

Miran said he didn’t promise President Trump that he would vote a particular way on interest rates, adding “I will do independent analysis based on my interpretation of the data, based on my interpretation of the economy, and that’s what I will do and that’s all that I will do.”

Neel Kashkari, President of Minneapolis Fed

Kashkari supported the Fed’s decision to lower rates this week and penciled in two additional cuts this year.

He said “I believe the risk of a sharp increase in unemployment warrants the committee taking some action to support the labor market.”

So 3 doves, 3 hawks, and one fence-sitter.

But investors are looking for greater clarity with Fed Chair Powell set to deliver remarks on the economic outlook midday in Rhode Island.

Last week, Powell characterized the rate cut as “risk management” and underscored the need to balance cracks in the job market against the risks of rising inflation.

“Powell will, hopefully, clear up some of the confusion around having framed last week’s cut as a ‘risk management’ move,” said Michael Brown, senior research strategist at Pepperstone.

Focus now turns to Powell, and the release of data on gross domestic product and personal consumption expenditures – often called the Fed’s preferred inflation gauge – later in the week.

“Jobs are slowing and more importantly the neutral rate is much lower than the rate we have today,” Bruce Richards, chief investment officer at Marathon Asset Management, said in an interview on Bloomberg TV, adding that he expects 125 basis points of additional rate cuts.

“They have a lot more to go.”

Watch Powell speak live here (die to start at 1235ET)

Tyler Durden

Tue, 09/23/2025 – 12:25ZeroHedge NewsRead More

R1

R1

T1

T1