First Goldman, Then UBS: Street Races To Boost Tesla Delivery Estimates

Tesla’s third-quarter delivery report is expected to be released in early October. Goldman analysts have already raised both their delivery estimates and price targets, while UBS analysts just lifted their delivery forecast above consensus but maintained their “Sell” rating.

UBS: Tesla 3Q25 Delivery Forecast

-

New forecast: 475k units (+3% y/y, +24% q/q), raised from 431k.

-

Consensus: ~8% above Visible Alpha, but more in line with buyside (470–475k).

“We believe our new forecast is more in line with buy-side expectations in the 470-475k range,” UBS analyst Joseph Spak told clients Monday. S

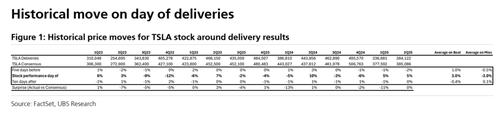

Spak continued, “Despite a print that may be inline with buyside expectations, we tend to find the stock does react to beat/misses vs. the headline number.”

Spak listed what changed their view ahead of the third-quarter delivery report expected on Oct. 2:

-

Strong deliveries in the US as Tesla pushes, and consumers take advantage of, the $7,500 IRA EV tax credit before its expiry at the end of September 2025. We believe 3Q25 could be the highest quarterly US deliveries since mid-2023 and potentially the highest ever. We believe demand is very likely being pulled forward so we’d expect a q/q drop in 4Q25, even if the new “lower cost” Model Y is introduced.

-

We expect Europe is improved q/q. Through the first 2 months of the quarter deliveries in Europe’s top 8 markets are up ~22% q/q.

-

China also looks solid q/q with retail (wholesale less exports) up ~45% q/q.

-

We note strong delivery growth is expected in Turkey and South Korea.

Other key points made by the analyst:

-

We expect deliveries to exceed production, perhaps by ~7% so “inventory” will be brought down. Recall in 2Q25, production exceeded deliveries by ~26k or 6%.

-

TSLA will also report GWh of energy storage deployed. While we don’t have a great way to “check” storage deployments (especially considering accounting treatment for recognition) UBS forecasts 10.4GWh (+8% q/q), essentially inline with Visible Alpha consensus at 10.9GWh and vs. 2Q25’s 9.6GWh. We remind investors energy storage deployments are lumpy.

-

For 4Q25 we now forecast 428k deliveries which would be down -14% y/y and is -10% q/q vs. our 3Q25 forecast. This is despite the introduction of the Model Y L in in China and the likely introduction of the “lower cost” Model Y in the US. For 2025, we now forecast 1.62mm deliveries, -9% y/y vs. 1.51mm prior and inline with consensus. For 2026 we now forecast 1.6mm units (1.62mm prior) and are -14% below consensus. We will update our financial model post deliveries which we expect to be on Oct. 2.

“TSLA stock driven more by AI narrative, not the auto business,” Spak noted.

Related:

The full note and chart pack are available in the usual spot for ZeroHedge Pro Subs.

Tyler Durden

Wed, 09/24/2025 – 07:45ZeroHedge NewsRead More

R1

R1

T1

T1