On The One Year Anniversary Of China’s Stealthy But Stunning Stock Market Rally

One year ago to the day, China’s top financial regulators and central bankers appeared together in an unprecedented press conference to unleash a raft of stimulus measures aimed at stabilizing the financial markets and support the country’s economic recovery.

The decision prompted billionaire hedge fund icon David Tepper to appear on CNBC and declare that he is buying “everything” in China: ‘ETFs…futures…everything.’ In retrospect, he was right again.

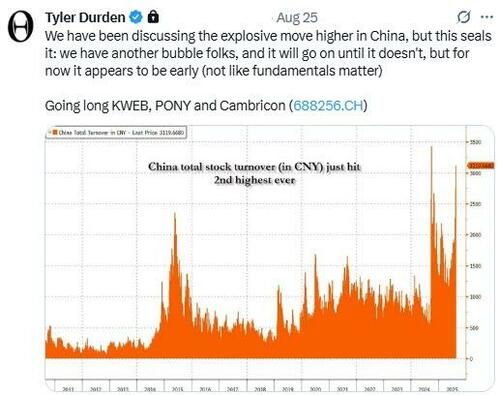

The market jolted higher on the following days, and over the following 12 months the move materialized into one of the strongest rallies amongst global assets. The past month, in particular has seen an epic meltup, just as we told our premium subscribers on August 25.

During this time, China A-shares total market cap surpassed 100TN yuan for the first time (+45% from 70TN yuan). SHCOMP surged from 2700 to 3900 level, while tech-focused benchmarks fared even better: STAR50 +115% and ChiNEXT +110%. During the same time, S&P returned a modest +16% and the Nasdaq rose +24%.

Meanwhile, in China over 3000 stocks in A-shares had gains of more than 50% in the past year, and nearly 1500 stocks more than doubled. Tech shares clearly took the lead here, with telco, electronics, computing names notching the highest gains by sector.

And, as Goldman executive director and trader, Fred Yin writes this morning, China’s momentum clearly has legs – just today, despite the strongest storm on earth so far this year ravaging Hong Kong throughout the day, the equity market remained open and posted solid gains. HSTECH +2.6% surged with internet shares posting solid gains as AI optimism continues to drive sentiment. Furthermore, Goldman’s HK Top Short basket +0.3% only on the day, suggesting short covering had little to do with the move.

Below we share some more observations from the Goldman trader:

Alibaba stock gained nearly 10%, the largest single day return since the +18.5% gain post earnings earlier in Sep which brings MTD gains for this mega-cap name to an incredible +50%. The HK line is now trading at 4-year highs.

On news front, a few things contributed to the move today:

- Company CEO vowed to increase AI infrastructure investment and released latest LLM QWEN3-MAX

- Alibaba Cloud’s Platform for AI will integrate Nvidia’s full suite of Physical AI software, a major collaboration in the domain

- Ark’s Cathie Wood reopened positions in Alibaba for the first time in 4 years

Side note: Alibaba has been getting support from Southbound flows too, the stock was net bought for 23 days in a row with US$8b+ of inflows on this stretch. The name is now 2nd largest holding by Southbound with nearly $42b worth of holding, behind only Tencent’s US$83.5b.

The good news doesn’t just stop there – elsewhere in China Internet space, Meituan +1.2% and JD +3.3% also climbed as the “anti-involution” drive finally comes to food delivery space after months-long price war: the SAMR released draft rules to regulate food delivery platforms with a focus on fees, promotions, and safety. The anti-monopoly watchdog calls for “fair competition” and seeks to halt “price wars”. Tencent +2% was not left behind either, stock climbing along with other gaming names as its title “Delta Force” has become one of the most downloaded apps on the Apple App Store.

Thematically, Goldman’s China Semis basket 4.6% higher after Micron gave positive outlook in its Q4 earnings and Huawei unveiled a 3-year plan to overtake Nvidia. Solar, Solid State Battery, Anti Involution also stood out with strong gains.

Where does this leave us, big picture? We still think the rally is only just beginning. In fact Kinger believes the setup for a “slow bull’ market seems better constructed now than ever before in A-shares.

Activity level in A-shares has been elevated since early August and remains high. This is the longest such stretch on record.

Source: BBG as of 24Sep25, past performance not indicative of future results

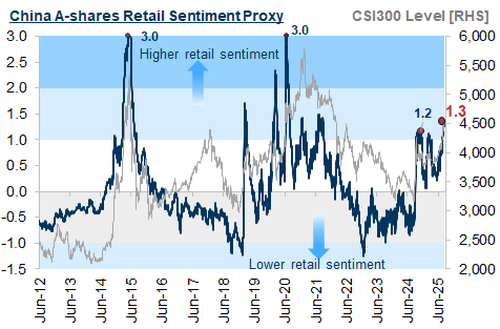

Retail sentiment is not stretched yet…

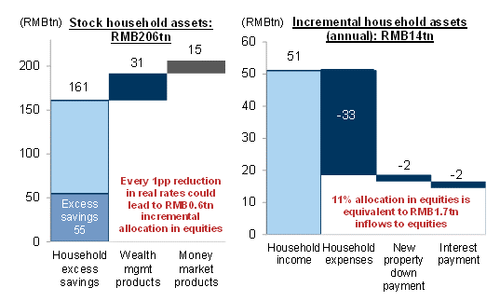

…with more dry powder. Chinese households hold just 11% of assets in equities versus 55% in property and 27% in cash/deposits, leaving substantial “cash on the sidelines,” including about 55TN yuan of excess savings from the roughly 80TN yuan deposit buildup since 2020, much of which is maturing and thus re-deployable.

Additional potential equity inflows could come from 31TN yuan in WMP and 15TN yuan in MM funds (with flows sensitive to real-rate declines) plus more than 14TN yuan of annual “new money” seeking deployment amid a weaker property market.

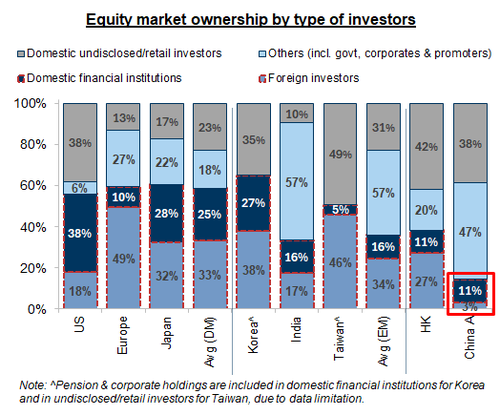

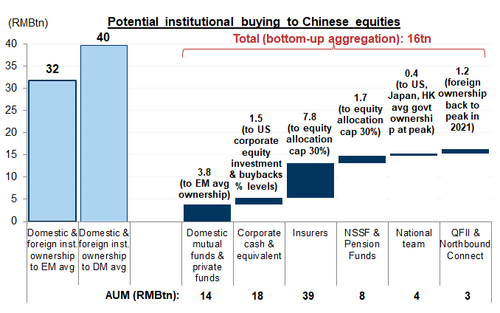

…while both domestic and foreign institutions still only represent a tiny part of overall market…

…with as much as 20-40t yuan of potential institutional buying over time

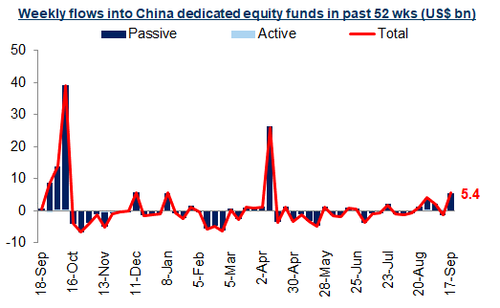

For example – last week’s inflow into China-dedicated equity funds was US$5.4b, the largest weekly inflow since Apr of this year

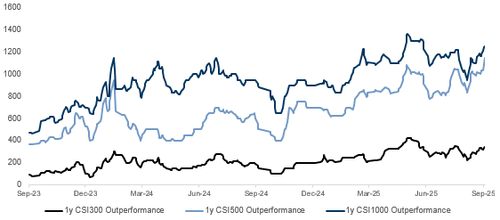

If you’ve made it far – what does the desk like here in terms of upside exposure? Funding levels (outperformance) has been slowing creeping higher again after dipping briefly late-summer so we still like taking advantage of the cheap forward.

However, with implied vol spiking higher and remains persistently elevated and skew inverted, we prefer structures that would cheapen the outright premium spent such as call spreads or up-and-out structures. For example, CSI1000 1y 95% Call w 130% E KO costs less than intrinsic value of the ITM call.

Alternatively, consider taking advantage of NKY/SPX correl in the mix, worst-of [GSC1000P 96%C / SPX 96.5%C / NKY 96.5%C] into Dec 2026 has no carry cost with premium equal to intrinsic value. Please reach out to the desk for more details.

Good luck – and to those of you in Hong Kong, stay safe and dry.

More in the full Goldman note available to pro subscribers.

Tyler Durden

Wed, 09/24/2025 – 21:02ZeroHedge NewsRead More

R1

R1

T1

T1