Six Thematic Takeaways, Buy-Rated Stocks From Goldman’s Global Sustainability Forum

Goldman Sachs hosted its 2025 Global Sustainability Forum in New York, outlining key takeaways on sustainable investing strategies in a rapidly evolving world where reliability and aging demographics dominate and act as tailwinds.

-

Reliability — prioritized investments, including infrastructure and efficiency solutions, towards keeping the power on, water running and water clean amid surging demand, aging infrastructure and more extreme temperatures/weather events.

-

Aging Populations in developed markets, which are opening opportunities for labor access as a competitive advantage.

“We continue to see multiple themes, strategies and stocks that we believe will supersede policy/macro uncertainty, and we expect that if Sustainable fund performance improves, AUM penetration will follow,” a team of Goldman analysts led by Brian Singer penned in a note on Monday morning.

Singer and his team outlined the presenting institutions at the Forum (Buy-rated stocks in bold):

- Amcor, Applied Materials, BNP Paribas, California Resources, Carlyle, CMS Energy, CPP Investments, Estée Lauder, Federal Reserve Bank of Dallas, IBM, Installed Building Products, Jacobs Solutions, Japan GX Acceleration Agency, J.P. Morgan, LRQA, Maersk, Morgan Stanley Investment Management, New York State Teachers’ Retirement System, NYC Bureau of Asset Management, NiSource, osapiens, Prologis, Prysmian, Putnam Investments, Repsol, SAP, Telefónica, Temasek, Vornado, Water Asset Management, Weyerhaeuser.

The event reinforced optimism around investable themes that transcend macroeconomic uncertainty, with continued optimism driven by:

-

Investable thematic opportunities that supersede uncertainty.

-

Maturation of Sustainable Investing via a greater embrace of nuance towards more performance and investability-linked approaches.

-

Potential for a more favorable (or less unfavorable) cyclical backdrop.

Four Forum takeaways on the direction of Sustainable Investing:

-

Sustainability as Investability: Asset manager and corporate focus is shifting from “what’s needed to achieve Sustainable Development Goals” towards “what’s on track and what’s likely,” elevating measurable risk factors, returns implications and preservation of asset value.

-

Real Economy Impact: Shift from “Reducing Financed Emissions” to “Financing Reduced Emissions.”

-

Optimism on Sustainability opportunities in private markets.

-

Corporates remain committed to Sustainable metrics despite recent quieting.

Six Forum thematic takeaways

-

Accelerating power demand growth, product availability driving All-of-the-Above energy sourcing, with long-term nuclear optimism.

-

Labor and reskilling is increasingly a potential constraint and differentiator.

-

AI a disruptor of labor markets and power markets as investors/corporates seek confidence in the extent of AI’s Sustainability benefits.

-

Adaptation focus increasing — both physical risk and investable opportunities.

-

Increased confidence in the Reliability (of power and water) theme, with Reliability prioritized over affordability and both reliability/affordability prioritized over decarbonization.

-

US renewables outlook bullish through 2028, more in debate afterwards. Exhibit 1: We see the confluence of multiple forces impacting Sustainable Investing and the broader economy in 2025, driving opportunity for stocks exposed to themes of Reliability, Efficiency, AI/Automation, Training/Reskilling, Womenomics and Affordability/Access as well as companies that are Quality Operators

Putting it all together…

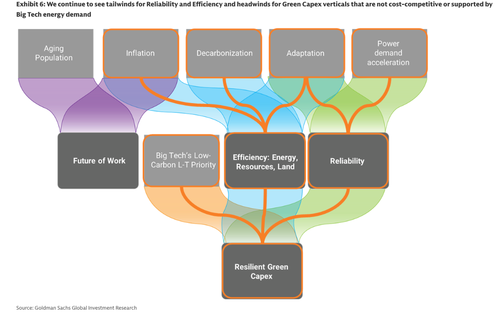

Tailwinds for Reliability and Efficiency and headwinds for Green Capex

What the analysts said they learned at the Forum:

In the US, companies generally expect strong renewables investment to continue through 2028. However, there were mixed views as to whether we would see a material step down post 2028 when IRA incentives sunset. Companies appeared more positive on utility-scale solar and battery storage than onshore/offshore wind.

Stocks mentioned in the report.

The full report, with additional charts and detail, is available to ZeroHedge Pro Subs.

Tyler Durden

Thu, 10/02/2025 – 19:20ZeroHedge NewsRead More

R1

R1

T1

T1