FICO Spikes On Plan To Go Direct To Lenders, Upends Experian, Equifax, TransUnion

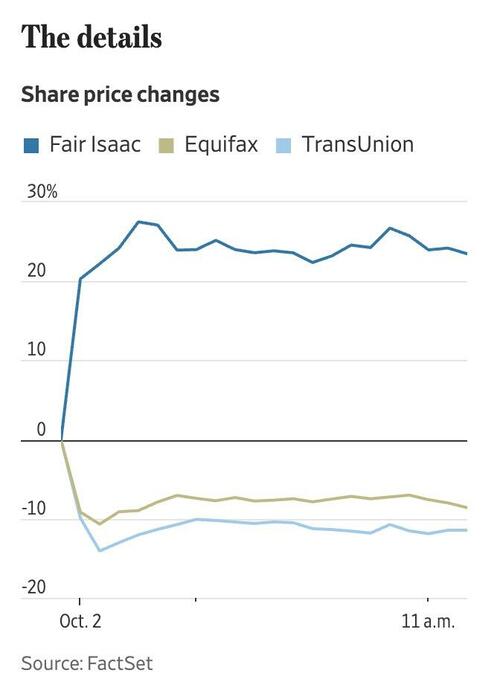

Fair Isaac shares surged today after announcing a plan that bypasses the big three credit bureaus – Experian, Equifax, and TransUnion – in providing its credit scores directly to mortgage lenders.

Until now, mortgage resellers had to purchase FICO scores through the bureaus, who added markups of about $10 per score, according to the Wall Street Journal. FICO will now sell directly, offering lenders either a flat $10 fee or $4.95 per score plus a $33 closing fee. The company said the new closing charge replaces reissue fees but didn’t disclose the prior cost.

WSJ writes that the change threatens a long-standing revenue stream for the bureaus. “We believe this change adds substantial uncertainty to a sector that has already been undergoing heightened volatility amid a series of potential regulatory changes,” wrote UBS analyst Kevin McVeigh.

The move follows pressure from regulators to reduce costs in an unaffordable housing market. Earlier this year, the FHFA authorized lenders to use VantageScore—developed by the three bureaus—for government-backed loans, challenging FICO’s dominance.

FHFA Director Bill Pulte called FICO’s plan a “first step” and urged bureaus to “take similar creative and constructive actions” while pressing VantageScore to ensure “they are competitive, in every way, including but not limited to costs.”

Industry reactions were cautiously positive. TD Cowen analysts called the change “politically positive.” Mortgage Bankers Association chief Bob Broeksmit said it was a “step in the right direction” but warned it “remains to be seen” whether it will meaningfully lower costs.

Tyler Durden

Thu, 10/02/2025 – 21:00ZeroHedge NewsRead More

R1

R1

T1

T1