Boeing 777X Commercial Debut Pushed To 2027, Billions In Charges Loom

Boeing’s 777X widebody jet is not expected to enter commercial service until early 2027, one full year later than planned, or about seven years behind schedule. One Jefferies analyst now expects Boeing to take a massive charge due to the delay, adding yet another headache for the struggling planemaker. The fresh setback comes one week after reports suggested the FAA was easing restrictions on 737 Max deliveries.

Bloomberg, citing sources familiar with Boeing and major airlines, reported that the 777X will not be delivered to Deutsche Lufthansa AG and Emirates in 2026, with the latest plans pushing entry into service to 2027.

Deutsche Lufthansa AG, the launch customer for the widebody aircraft, is already laying the groundwork for a fresh setback. The German airline isn’t including the 777X in its fleet plans until 2027, said one of the people, who asked not to be identified because the matter is confidential. Officials at Emirates, the 777X’s biggest customer, have also grown more cautious as it looks at entry into service possibly not before 2027. -BBG

The potential commercial delay for the 777X prompted Jefferies analyst Sheila Kahyaoglu to forecast that Boeing could take a charge as large as $4 billion due to the delays.

That includes the lost cash Boeing would have collected in 2026 from delivering 18 of the widebody jets, along with customer concessions and other related costs. Of the many challenges that the planemaker currently faces, “I’m sure it’s a big priority because it’s going to be a big cash drain for them,” Kahyaoglu said of the 777X certification delays.

Separately, RBC analyst Ken Herbert expects the 777X’s entry into service to begin sometime in the second half of 2027. He forecasts a $2.5 billion charge due to the delay.

Last month, Boeing CEO Kelly Ortberg revealed to investors at a Morgan Stanley conference that the 777X certification process was falling behind schedule.

Emirates (the largest customer), Qatar Airways, Lufthansa, Etihad Airways, Cathay Pacific, All Nippon Airways, and British Airways are among the customers awaiting delivery. This new jet is the successor to its out-of-production 747 jumbo.

Boeing shares are flat in premarket trading in New York. For the year, shares are up 23% (as of Thursday’s close) and have been locked in a half-decade lateral pattern since the twin Max jet crashes and the Covid pandemic.

Related:

-

Boeing Gains On Report Of FAA Move To Ease 737 MAX Deliveries

-

Boeing Gets Contract To Replace Bunker Busting Bombs The US Dropped On Iran

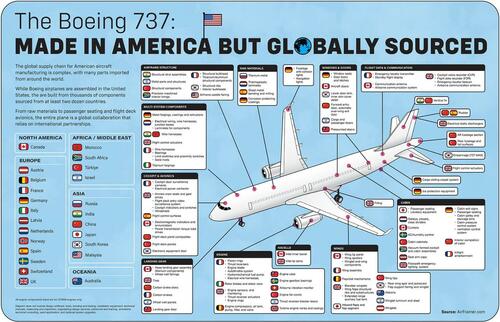

For the Trump administration, 737 Max’s global supply chain is a significant problem.

Time to re-shore. Read the report.

Tyler Durden

Fri, 10/03/2025 – 12:40ZeroHedge NewsRead More

R1

R1

T1

T1