Race To The Financial Dung Heap

Submitted by QTR’s Fringe Finance

As I wrote just weeks ago, I believed (and still do) that any new market collapse could come at the hands of crypto and/or stablecoins, which have in many ways become an essentially unregulated $4 trillion slush-y money market fund reminiscent of 2008.

But watching the headlines coming out of commercial real estate, private credit and subprime auto over the last week or two — and I’m not certain we don’t have a new leader, or leaders, in the nationally televised Race To The Financial Dung Heap™.

Let’s try to make this case as clear and as simple as possible, with examples and charts for people with very short attention spans, like myself.

First, commercial real estate. When the pandemic hit, it didn’t just empty restaurants and stadiums—it hollowed out the very premise of office real estate.

Remote work turned once-bulletproof towers into stranded assets almost overnight, leaving landlords with vacant floors, plunging rents, and billions in debt that no longer penciled out. We still haven’t recovered.

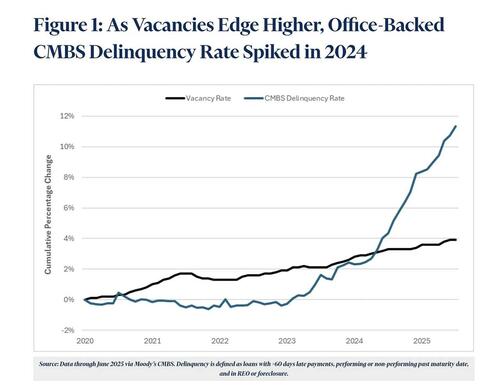

By mid-2025, the U.S. office vacancy rate had climbed to a record 20.7%, according to Moody’s Analytics.¹

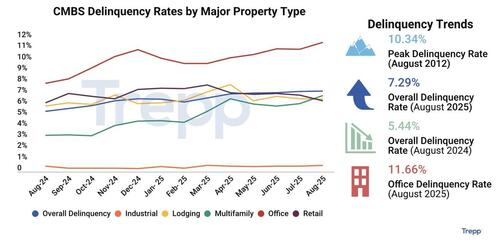

New York was in the middle of converting 4.1 million square feet of offices into housing, the most since 2008.⁴ CMBS delinquency rates had risen for six straight months through August, hitting 7.29% overall and 11.66% for office loans, both records.² ³

Reappraisals continue to be brutal, one headline after another. In New York, the 18-story office tower at 440 Ninth Avenue, near Hudson Yards, was sold in April 2025 for just over $100 million, a 62% plunge from the $269 million it fetched in 2018.

In San Jose, the Sobrato Office Tower changed hands in May 2025 for $63.7 million, down nearly 61% from its $163.1 million assessed value.

Houston saw Chevron unload the former Noble Energy headquarters in June 2025 for $18.2 million, a fire-sale compared with a previous valuation near $130 million.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

In San Francisco, a vacant downtown tower at 199 Fremont Street was sold in July 2025 for $111.3 million, well below the levels comparable buildings had commanded only a few years earlier. And in August 2025, Manhattan’s One Worldwide Plaza was reappraised at $345 million—just 20% of its 2018 valuation—leaving lenders facing potential losses of nearly half a billion dollars.

Banks are not immune. As of the second quarter of 2025, unrealized losses on securities were still near $400 billion.⁵ Regulators had already warned that non-bank CRE lending—the shadow financing that filled the void left by banks—could transmit and amplify shocks across the system.⁶

MSCI data showed distress had climbed to $116 billion by early 2025, the highest in a decade.⁷ Even the multifamily sector, long considered the safest corner, was showing strain.

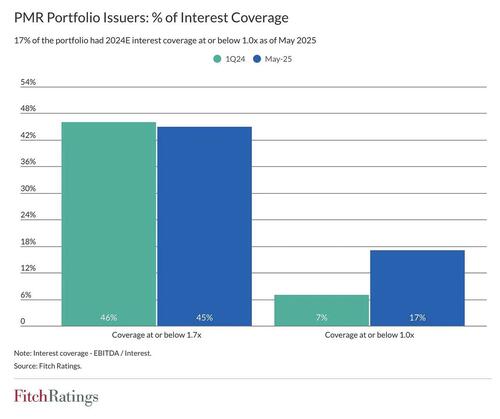

From there we move to private credit, the $1.7 trillion darling of institutional allocators, which has been running into its own wall. In 2024, the default rate for mid-sized U.S. companies financed by private credit had more than doubled to 8.1%, up from 3.6% in 2023, according to Fitch.⁸

Funds had kept many troubled borrowers alive with covenant waivers, extend-and-pretend refinancings, and payment-in-kind tweaks. But when loans had stayed in breach for multiple quarters, lenders often moved to take the keys.

One day last week I was sitting at a bar on Park Ave. and two younger gentleman from the banking world sat next to me. They looked late 20s/early 30s and started to talk shop, so I joined in, leaning over and asking candidly after their second martini: “What’s it really like out there for CRE and private credit?”

Their affect changed and the answer was visible. One guy just shook his head. The other said, verbatim, “Everyone is in breach of their covenants”.

“What happens when people go to hit the bid when everyone’s marks are all inflated,” I asked the guy closest to me. “We’re going to need a bailout,” he said.

And it’s not just drunk 28 year old junior bankers saying this. Look at this hot-shit PIMCO executive on CNBC a couple days ago, essentially admitting that both public and private credit markets are flashing warning signs: public bonds are seeing high-profile defaults where companies can’t restructure effectively, while in private credit many borrowers are already unable to service cash interest and are resorting to “payment in kind” just to stay afloat.

He says borrowers are being forced to choose between costly but flexible private loans or cheaper public debt that becomes unworkable in distress, highlighting growing fragility across the system. At the same time, asset managers are under fee pressure and leaning on efficiency tools like AI just to manage risk.

Taken together, it points to rising defaults, strained borrowers, and lenders tightening terms—the classic setup for a credit crunch.

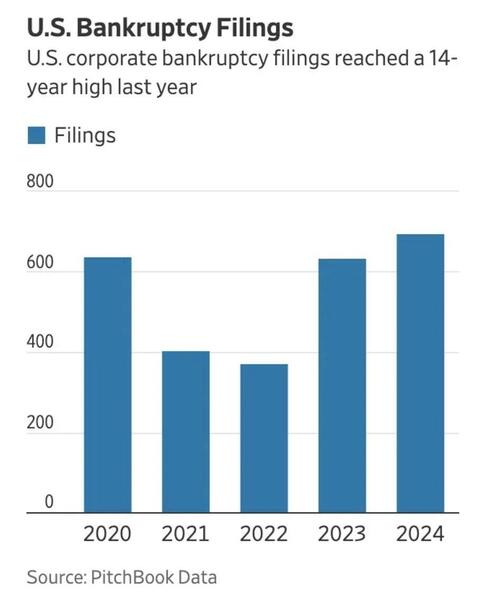

There have been clues along the way that this was happening. In 2024, corporate bankruptcies reached their highest level since 2010, and private-credit managers—from Blackstone to midsize players—expanded workout teams aggressively. Compensation packages for senior restructuring professionals ran as high as $1.5 million.¹⁰

Distressed-for-control transactions, in which lenders seize ownership through debt positions, had tripled compared with pre-2022 levels.¹⁰ Liquidity worries surfaced too: by September 2025, some funds were resorting to selling loan portfolios in the secondary market to support reported yields.¹¹

Even the Boston Fed had raised the question of whether private credit’s growth posed systemic risk, pointing out its jump from $46 billion in 2000 to about $1 trillion by 2023.¹² The late September bankruptcy of First Brands, with over $10 billion of debt, off-balance sheet liabilities and questions about whether receivables had been double-pledged, underscored the fragility.¹³

First Brands is, of course, an auto parts maker, which leads this horse directly towards other financial nuclear horse piss water.

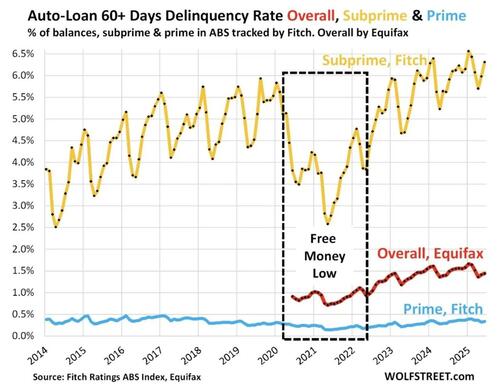

Delinquencies on auto loans 90 days past due reached 5% in the second quarter of 2025, up more than 12% from a year earlier.¹⁶ Net losses in subprime auto ABS were running at 9.44% as of January.¹⁴ Recovery rates were weak because wholesale used-car prices remained high, with the Manheim index still up 2.2% year over year in September.¹⁵

Chart from WolfStreet article, which is also a great read.

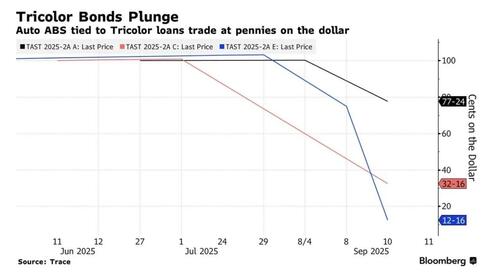

Also in September 2025, Tricolor Holdings, a major subprime auto lender focused on low-credit and undocumented borrowers, filed for bankruptcy and said it would liquidate. Federal prosecutors were investigating allegations that the company had pledged the same collateral multiple times to warehouse lenders.¹⁸ ¹⁹ Big banks including Fifth Third, JPMorgan, and Barclays were left staring at hundreds of millions in potential losses.

Earlier in August, another subprime lender, Automotive Credit Corp., had abruptly stopped making new loans.²⁰ The subprime auto ABS market, at roughly $80 billion, is far smaller than subprime housing ever was—but the echoes are unmistakable.

As usual, the easy money of the past 5 years only hid the risks; it didn’t erase them. By 2025, the AAA labels, perpetual funds, and clever underwriting had given way to a harsher reality: empty lobbies, mounting defaults, and repos in the driveway.

As it relates to how I invest personally, this setup makes me want to avoid any names in private credit (i.e. APO, BX, OWL, PRIV and the likes), in regional banking (KRE or any of its components), in the buy now pay later space which I highlighted 2 years ago and was way early on (SOFI, UPST, AFRM, Klarna, etc.) or subprime autos (CACC, CVNA, ALLY, etc.).

Ultimately my friends may get the bailout they talked about that night at the bar. But that would only come after a sharp ‘shit hits the fan’ type deleveraging that sees stock prices fall quickly, prompting the rescue.

-

Moody’s Analytics, “US office vacancy reaches record high,” July 8, 2025.

-

Trepp, “CMBS Delinquency Rate Rises for Sixth Straight Month to 7.29%,” Sept. 24, 2025.

-

Multifamily Dive, “CMBS delinquencies hit 7.29%, a post-pandemic record,” Sept. 16, 2025.

-

Financial Times, “New York leads office-to-housing conversions,” Sept. 29, 2025.

-

FDIC, “Quarterly Banking Profile Q2 2025,” Aug. 25, 2025.

-

Financial Stability Board, “Non-bank CRE financing risks,” June 19, 2025; Bloomberg, “Shadow CRE lending may amplify bank shocks,” June 21, 2025.

-

MSCI Real Assets, “US commercial real estate distress update,” Aug. 20, 2025.

-

Fitch Ratings, “Private credit default rate doubled in 2024,” Mar. 3, 2025; Fitch, “Private credit outlook,” May 30, 2025.

-

Preqin/Brookfield, “Private credit to $1.7 trillion,” 2025; Deloitte, “Private credit survey,” 2025.

-

Wall Street Journal Pro, Isaac Taylor, “Private-Credit Firms Expand Restructuring Teams Amid Bankruptcy Surge,” Mar. 12, 2025.

-

Bloomberg, “Private credit leans on secondaries to support liquidity optics,” Sept. 4, 2025.

-

Federal Reserve Bank of Boston, “Is private credit a systemic risk?,” May 21, 2025.

-

Financial Times, “First Brands bankruptcy raises red flags for private debt,” Sept. 29–30, 2025.

-

S&P Global Ratings, “US Subprime Auto ABS Tracker,” Mar. 10, 2025.

-

Cox Automotive / Manheim, “Used vehicle value index,” Sept. 17–22, 2025.

-

New York Fed / LendingTree, “Household Debt and Credit Report,” Sept. 23, 2025.

-

Experian / Auto Remarketing, “Auto finance state of the market,” Aug. 28, 2025.

-

Bloomberg, Carmen Arroyo, Isabella Farr, Scott Carpenter, “Subprime Auto Lender Collapse Delivers Blow to Risky Debt Market,” Sept. 11, 2025.

-

Financial Times, “Tricolor bankruptcy and alleged fraud probe,” Sept. 10, 2025.

-

Auto Finance News, “Automotive Credit Corp pauses new originations,” Aug. 7–8, 2025.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Sun, 10/05/2025 – 10:30ZeroHedge NewsRead More

R1

R1

T1

T1