Greece Still Has The Highest Debt-To-GDP In Europe; Bulgaria The Lowest

As European countries pour billions into defense spending, their debt piles are expanding—raising questions of national fiscal stability.

In France, a rising debt ratio led Fitch to downgrade its credit rating in September. The country has faced ongoing political turmoil as the country’s debt supply recently hit a record $4 trillion.

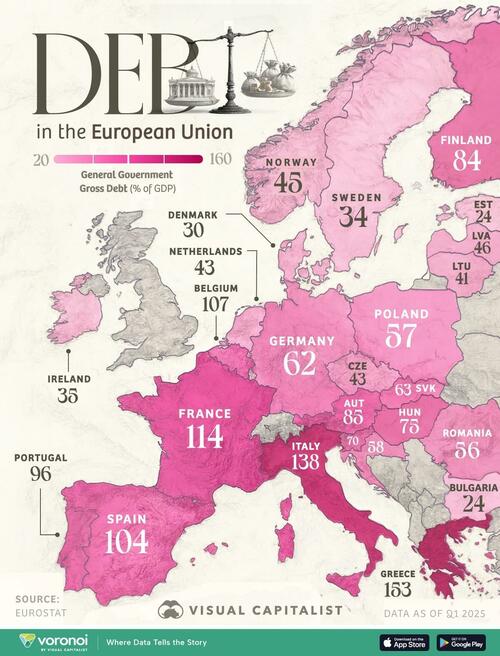

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows European Union debt-to-GDP by country, based on data from Eurostat.

The State of European Union Debt-to-GDP in 2025

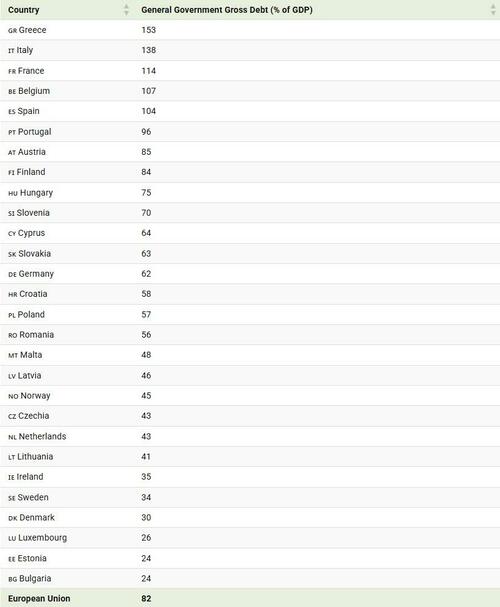

Below, we show general government gross debt as a percentage of GDP as of Q1 2025 in the EU:

While Greece’s economy is thriving in 2025—supported by tourism, real estate, and shipping sectors—its debt situation continues to rank as the worst in the EU.

However, its debt-to-GDP ratio has steadily fallen in recent years, from 180% in 2022 to 153% today. Given its recent economic momentum, the country launched an innovation and infrastructure fund with BlackRock designed to attract $1.2 billion in foreign investment.

Italy holds the second-highest debt-to-GDP ratio in the EU, at 138%. However, the country has made notable progress in narrowing its deficit, cutting it from 7.2% of GDP in 2023 to 3.4% in 2024 on the back of strong tax revenues. Like Greece, its debt levels have been gradually trending downward.

By contrast, debt is rising in France, where it stands at 114% of GDP. In efforts to combat its deteriorating fiscal situation, the French government has raised the retirement age, and proposed cutting two national holidays—stoking public outrage.

Meanwhile, Germany’s debt ratio of 62% falls significantly below the EU average of 82%. At the same time, the country has eased its fiscal rules with massive defense spending, causing debt levels to rise.

To learn more about this topic, check out this graphic on debt to GDP by country worldwide.

Tyler Durden

Wed, 10/08/2025 – 06:55ZeroHedge NewsRead More

R1

R1

T1

T1