Could AI’s Growing Thirst For Water Usher In Localized Resource Wars

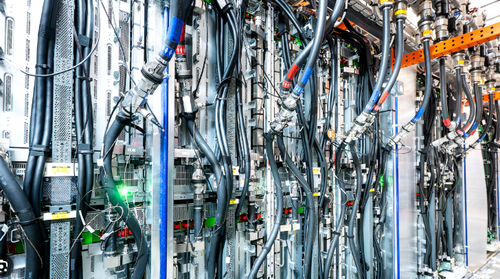

In the era of artificial intelligence, water availability is poised to become a top concern for developers, just as low-cost, reliable electricity and grid connection delays have become significant issues. These data centers consume massive quantities of water daily to cool next-generation AI servers that, with each new chatbot iteration, demand increasing amounts of power. This rising energy demand has rendered open-air cooling systems obsolete, pushing liquid cooling technologies to the forefront.

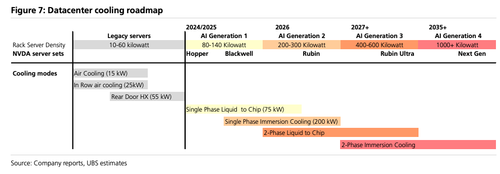

We first identified the stunning water consumption problem of data centers at the start of the year, as well as penned a note over the summer about a “chilling opportunity” in data center liquid cooling after UBS forecasted that thermal loads could exceed 200kW to 1,000 kW per rack by the end of the decade. This means air cooling is quickly becoming obsolete as new chatbots demand higher compute power, and therefore more advanced AI chips, driving higher demand for liquid cooling technologies.

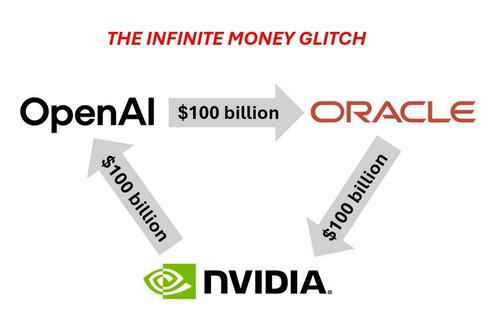

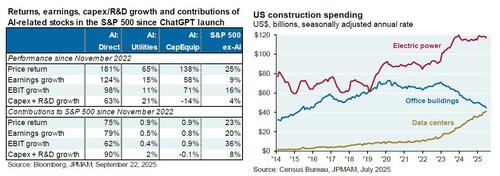

The pace of data center development is accelerating, as we previously pointed out in our discussion of the “circular economy” of AI, calling it, quite aptly, a stunning “circle jerk“…

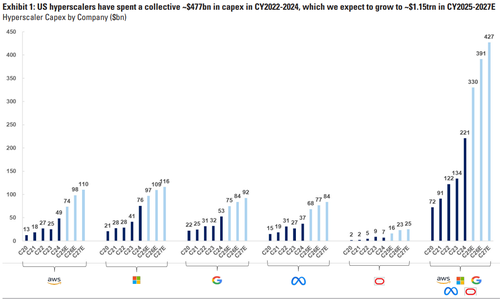

… that has ushered in an unprecedented era of Big Tech CapEx to build out AI infrastructure.

Notably, data centers are surpassing office construction spending and are coming under increased scrutiny for their impact on power grids and rising electricity costs.

Now that the backdrop has been explained, and data center buildouts are set to continue for years to come, ZeroHedge readers have already been well-informed about the urgent need for power grid upgrades. The other critical resource needed to keep these data centers running is the availability of fresh water for cooling.

Already, many data center developers tend to choose sites with low energy costs, even in drought-prone regions, intensifying stress on local water tables.

Stanford hydrologist Newsha Ajami told The New York Times that “water is an afterthought” for Big Tech firms building out data centers, which rely on local governments to solve shortages later.

As we mentioned earlier, every new iteration of a chatbot involves the need for more and more compute, that forces data centers to source the latest and greatest AI chips, in turn, means server racks demand higher and higher power consumption, with air cool technoligies no longer able to do the job, liquid cooling is in high demand and will be well into the 2030s.

This growing demand for water has already strained local water tables across various communities nationwide, like in Texas, Arizona, and Colorado. The NYT noted that data center expansion has been linked to localized droughts and new battles over water rights.

NYT interviewed Beverly Morris in Newton County, Ga, whose well ran dry after Meta broke ground on a $750 million data center. Morris’ home is located about 1,000 feet from the new data center.

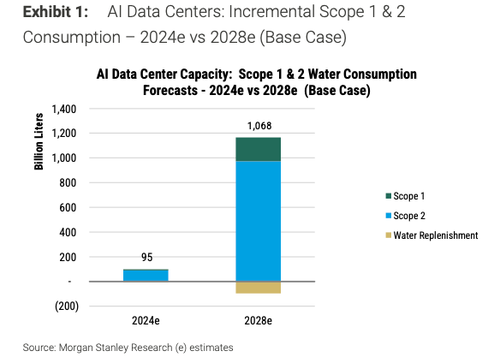

This leaves us with a Morgan Stanley report that forecasts AI data centers will consume around 1,068 billion liters of water annually by 2028, an 11 times increase from 2024 levels.

Stunning.

“Water is as critical to AI as power – and while solutions to manage water consumption are already emerging, this remains an underappreciated theme,” a team of MS analysts led by Ehsernta Fu wrote to clients early last month.

Where are the data centers?

The key takeaways of the report reveal that water consumption and its impact on local water tables will become a major point of debate. If people are already up in arms over soaring utility bills, just give it a few more years and water shortages will almost certainly be the next issue everyone is talking about:

AI’s Expanding Water Consumption Footprint. We expect AI data centers to drive annual water consumption for cooling and electricity generation to approximately 1,068 billion liters by 2028 (our base case) – an 11x increase from 2024 estimates (which equates to a more than eightfold increase in power demand). While the water consumption by data center cooling is well-recognized, its indirect consumption via electricity generation is significant but underappreciated. Beyond direct operations, AI’s’ scope 3′ water footprint includes semiconductor manufacturing, where facilities can consume up to five million gallons of ultrapure water daily, underscoring the industry’s reliance on water-intensive processes.

Water consumption is an evolving topic, whereas our estimates depend on assumptions around water consumption factors, water intensity, penetration of cooling technologies, and regional energy mix, etc., all of which may shift as operations adopt more efficient solutions in future. To account for this uncertainty, we present three scenarios factoring in different levels of assumptions. Under these scenarios, AI’s water consumption could range between 637bn liters to 1,485bn liters per annum by 2028e.

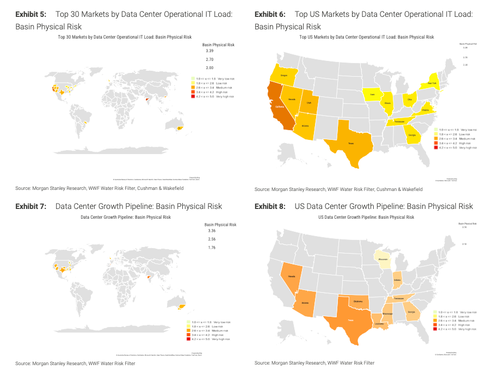

Water Stress is a Localized Risk. While AI’s total water use may appear modest on a global scale, its impact is highly localized. Over half of the world’s leading data center hubs are situated in regions already facing ‘medium basin physical risk’. These vulnerabilities are mirrored in secondary markets and growth pipelines. The recent example of Tucson, Arizona’s rejection of Amazon-backed Project Blue shows that governments at all levels are intervening to safeguard water resources.

Regulatory Landscape: From Restrictions to Incentives. The regulatory landscape is evolving from reactive restrictions to proactive incentives and standards. Jurisdictions such as California, Singapore, and the EU are introducing tax credits, disclosure mandates, and performance benchmarks to promote water-efficient technologies

Investment Framework for AI Water Consumption. For investors, this underappreciated theme presents three strategic avenues:

Investing in Enablers: This includes liquid cooling solutions for AI hardware, as well as water recycling and treatment technologies. We identify 17 stocks (of which 9 are OW-rated), including AVC, Vertiv, Johnson Controls and Toray Industries.

Renewable Energy Players: These offer indirect exposure to the reduction of off- site water consumption via electricity generation. We screened 54 stocks with ≥50% revenue/capex exposure (of which 21 are OW-rated).

Companies with Strong Water Stewardship: We identify key indicators by hyperscalers or semiconductor foundries to assist investors in gauging companies’ water stewardship.

Already, data center electricity consumption on outdated and fragile grids has sent power bills soaring, especially across the Mid-Atlantic area. What residents in these areas must also understand is that these resource-hungry AI server racks powering chatbots are now coming for the fresh water beneath their land.

Developers are already reporting that water availability is slowing down buildouts. At the top of the list is local power constraints.

This might usher in an era of localized resource wars.

ZeroHedge Pro Subs can access the full Morgan Stanley note – complete with over 40 detailed exhibits and charts – in the usual place.

Tyler Durden

Wed, 10/08/2025 – 11:10ZeroHedge NewsRead More

R1

R1

T1

T1