Crypto Carnage: Trump Tariff Tape-Bomb Triggers Largest Liquidation Event In History

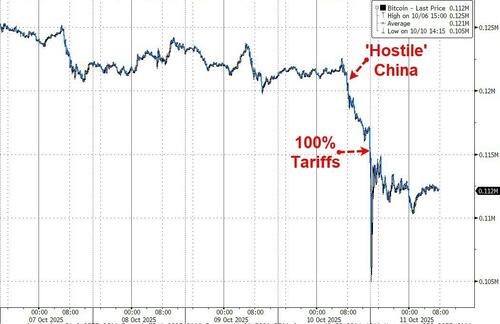

Crypto market traders were hit by record liquidations just days after Bitcoin touched an all-time high, after President Trump triggered a wave of cross-market volatility saying he would impose an additional tariff on China and export controls on software.

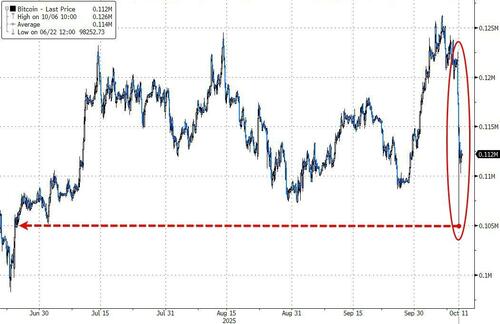

October has historically been a particularly strong month for Bitcoin’s price – a longstanding pattern that has led much of the crypto industry to expect the same results come every fall. The trend at first seemed poised to continue this year; the first week of this month, BTC surged some 10.5% to a new all-time high price north of $126,000.

Bitcoin plunged to $105,000 – its lowest since June – following Trump’s aft-hours tweet yesterday…

…before bouncing back above $112,000

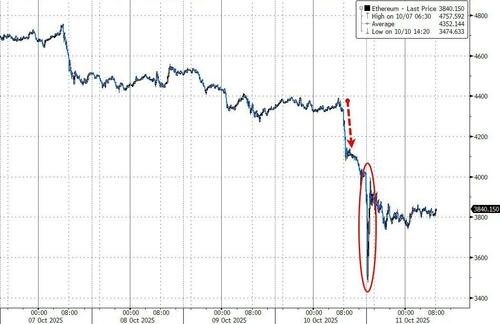

Ethereum was also clubbed like a baby seal…

But that was the least of it as dozens of so-called alt-coins saw almost total wipe-outs.

As CoinTelegraph reports, traders betting big on the bull run suffered to an extent never seen in crypto market history.

Data from CoinGlass indicates that 24-hour liquidations reached nearly $20 billion, with long positions comprising the vast majority.

Coinglass described this as “the largest liquidation event in crypto history.”

Over the past 24 hours, bets worth more than $19 billion have been wiped out, and more than 1.6 million traders liquidated, according to Coinglass data.

More than $7 billion of those positions were sold in less than one hour of trading on Friday.

“The actual total is likely much higher — Binance only reports one liquidation order per second,” CoinGlass said on X about the figures.

The $19.31 billion in liquidations is more than ten times the losses seen during the COVID-19 crash ($1.2 billion) and the FTX collapse ($1.6 billion).

Crypto.com CEO Kris Marszalek has called for a regulatory investigation into exchanges that suffered the largest losses following a record $20 billion in crypto liquidations over the past 24 hours.

In a Saturday post on X, Marszalek urged regulators to “conduct a thorough review of fairness of practices,” asking whether trading platforms had slowed down, mispriced assets, or failed to maintain proper anti-manipulation and compliance controls during the crash.

“Regulators should look into the exchanges that had most liquidations in the last 24 hours,” he wrote.

“Any of them slowing down to a halt, effectively not allowing people to trade? Were all trades priced correctly and in line with indexes?”

Data from CoinGlass shows that Hyperliquid led all exchanges in liquidations, recording $10.31 billion in wiped-out positions. It was followed by Bybit with $4.65 billion, and Binance with $2.41 billion. Other major platforms like OKX, HTX and Gate saw smaller totals, at $1.21 billion, $362.5 million and $264.5 million, respectively.

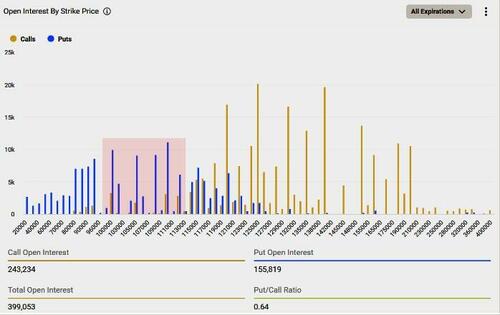

Exchange order-book liquidity showed a severe imbalance between bids and asks – resistance was stacked around $120,000, while little support was in place to prevent a fresh dive toward the $100,000 mark.

Perhaps the most impacted asset of the day was Trump’s own crypto token. WLFI, the native token of World Liberty Financial, the Trump family’s crypto platform, plummeted almost 50% immediately following the president’s China announcement, to just south of $0.10 a token. It has since partially recovered to $0.13…

David Jeong, chief executive officer at Tread.fi, an algorithmic crypto trading platform for institutional traders, said the market was experiencing a “black swan event.”

“It is likely that many institutions did not expect this level of volatility and with how leveraged perpetual futures are designed, many large traders, including institutions, would have gotten liquidated,” he said.

Perpetual futures are a type of contract with no expiration, and are used by crypto traders to trade leveraged positions around the clock.

The next major support level for Bitcoin is $100,000, according to Caroline Mauron, co-founder of Orbit Markets, below which “would signal the end of past three-year bull cycle.”

Vincent Liu, chief investment officer at Kronos Research, said the rout was “sparked by US-China tariff fears but fueled by institutional over-leverage.”

“This highlights crypto’s macro ties,” he said.

“Expect volatility, but watch for rebound signals in cleared markets.”

Bitcoin options market reflected Mauron’s views with highest number of ‘put’ or sell strikes at $110,000 and next highest at $100,000, according to data on Deribit platform.

“The focus now turns to counterparty exposure and whether this triggers broader market contagion,” said Brian Strugats, head trader at Multicoin Capital. He added that some estimates place total liquidations above $30 billion.

Ahead of all this carnage, US spot Bitcoin ETFs continued their strong “Uptober” performance with $2.71 billion in weekly inflows, marking another strong week for institutional demand.

“Capital keeps flowing into BTC as allocators double down on the digital gold conviction trade. Liquidity is building now as the market momentum takes shape,” Vincent Liu, chief investment officer at quantitative trading firm Kronos Research, told Cointelegraph.

Obviously, these flows came before the after-hours collapse that triggered the massive liquidations, but we are seeing a bid return in quiet Saturday trading.

“Trump’s tariff threat looks more like a negotiation tactic than a policy pivot, classic pressure play,” Liu said.

“Markets may flinch short term, but smart money knows the game: macro noise, conviction unchanged,” he added.

Finally, CoinTelegraph notes that stablecoin demand in China offers valuable insight into traders’ positioning.

When investors rush to exit the cryptocurrency market, stablecoins typically trade at a 0.5% or greater discount compared with the official US dollar/CNY rate.

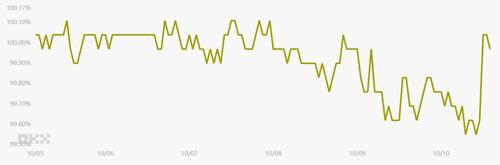

Tether (USDT/CNY) vs. US dollar/CNY. Source: OKX

Tether had been trading at a slight discount since Wednesday, suggesting traders were previously cashing out as Bitcoin struggled to maintain bullish momentum.

However, the metric returned to parity after BTC fell below $120,000, indicating that traders are no longer eager to exit the crypto market.

Tyler Durden

Sat, 10/11/2025 – 12:15ZeroHedge NewsRead More

R1

R1

T1

T1