Market Maelstrom Returns As China Escalates Trade War With Sanctions, Tit-For-Tat Port Fees

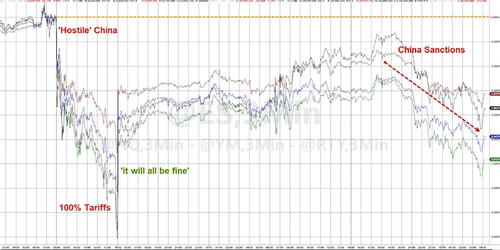

Global equity futures slipped on Tuesday after China vowed to “fight to the end” in its trade war with the U.S., following President Trump’s threat last week to impose 100% tariffs on Chinese goods. Despite Washington’s attempts to soften its tone over the weekend, tensions are intensifying into the new week: both countries are imposing new docking fees on each other’s vessels, signaling deepening Sino-US relations ahead of Trump-Xi talks. Adding to the flaring tensions, Beijing sanctioned five U.S. subsidiaries of South Korean shipbuilder Hanwha Ocean, while U.S. Treasury Secretary Scott Bessent accused China of deliberately undermining the global economy.

Trump’s move last Friday to threaten Beijing with an additional 100% tariff on Chinese goods, in response to China’s sweeping new export controls on rare earths and ahead of a planned Trump-Xi meeting later this month, signals that both sides are trying to gain as much leverage as possible before the Asia-Pacific Economic Cooperation forum in South Korea.

The Chinese Commerce Ministry condemned the Trump administration’s tactics, calling them incompatible with dialogue. “If you wish to fight, we shall fight to the end; if you wish to negotiate, our door remains open,” a ministry spokesperson said.

“The United States cannot simultaneously seek dialogue while threatening to impose new restrictive measures. This is not the proper way to engage with China,” the ministry said.

On Sunday, Trump walked back his rhetoric in a Truth Social post that said “it will all be fine”, adding that the U.S. wants to “help” China. This relief sent global equities soaring on Monday, yet the outlook darkened on Tuesday after the ministry sanctioned South Korean shipbuilder Hanwha.

China’s Commerce Ministry wrote in a statement that Hanwha Ocean’s five U.S. subsidiaries, Hanwha Shipping LLC, Hanwha Philly Shipyard Inc., Hanwha Ocean USA International LLC, Hanwha Shipping Holdings LLC, and HS USA Holdings Corp, are sanctioned over “assisting and supporting the U.S. government’s probes and measures against Chinese maritime, logistics and shipbuilding sectors. China is strongly dissatisfied and resolutely opposes it.”

Earlier Tuesday, Beijing confirmed it had begun imposing additional port fees on vessels linked to the U.S., while clarifying that Chinese-built ships would be exempt from the new charges. This tit-for-tat followed the U.S. decision to impose on Chinese vessels at U.S. ports.

Also, U.S. Treasury Secretary Scott Bessent told the Financial Times that Beijing is trying to damage the global economy with its export controls on rare earths and critical minerals, sending some global supply chains into snarled conditions.

“This is a sign of how weak their economy is, and they want to pull everybody else down with them,” Bessent said on Monday, adding, “Maybe there is some Leninist business model where hurting your customers is a good idea, but they are the largest supplier to the world. If they want to slow down the global economy, they will be hurt the most.”

Bessent added, “They are in the middle of a recession/depression, and they are trying to export their way out of it. The problem is they’re exacerbating their standing in the world.”

There’s been a flurry of developments on the U.S.-China front. UBS analyst Joe Dickinson broke down the past 24 hours, removing the noise to explain market impacts:

EStoxx fell 20bp to start, following U.S. futures lower. Commentary from both the U.S. and China on Trade was conciliatory overnight. China’s commerce ministry indicated working-level talks were held Monday, Treasury Secretary Bessent confirmed that Trump and Xi are still expected to meet at the APEC Summit at the end of the month.

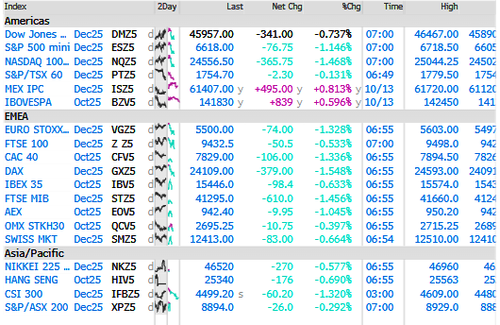

But price action in Asia is cautious and weaker again. Nikkei cash dropped 2.8% while futures were down 1.7%. China reopens lower in the afternoon session, with CSI300 down 80bp after China’s Ministry of Commerce announced curbs on five U.S. units of Hanwha Ocean in response to U.S. probes against Chinese maritime, logistics, and shipbuilding industries, as well as reports that China has started charging port fees for U.S. ships. Note that Samsung slid 4% post earnings.

S&P 500 futures are down a little more than 1% while Nasdaq 100 contracts fell 1.5%.

Sea of red across global equity futures.

Bitcoin’s rebound losing momentum.

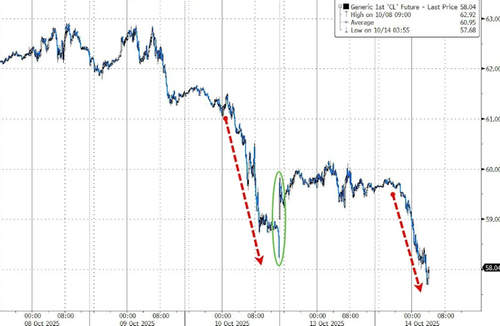

WTI futures tumbling.

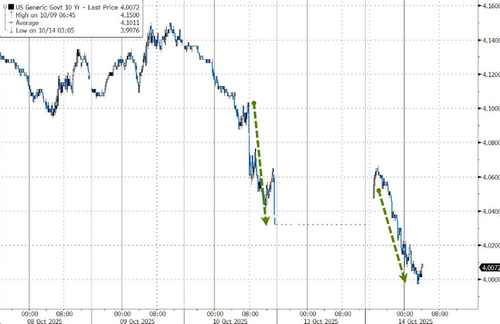

Treasuries bid. US10Y tags 4%.

Now we wait to see whether the Trump administration doubles-down on their tit-for-tat-ing or steadies the ship again?

Tyler Durden

Tue, 10/14/2025 – 07:26ZeroHedge NewsRead More

R1

R1

T1

T1