JPMorgan Kicks Off Earnings Season With Another Stellar Quarter As Dimon Flags “Heightened Uncertainty”

And they’re off. As is now customary, moments ago JPM reported Q3 earnings officially launching the third quarter earnings season with another batch of impressive results which beat across the board.

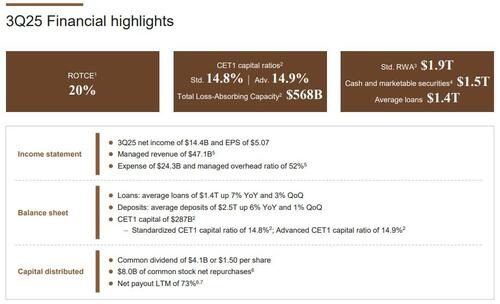

Starting at the top, JPM reported Q3 revenue which beat by almost $2 billion, thanks to another quarter of stellar FICC and equity sales and trading, with investment banking also coming strong and advisory rounding out the segments that beat. The bottom line was Net Income of $14.4 billion, a solid beat to consensus expectations, and a 14% increase YoY.

Here are the details:

- Adjusted revenue $47.12 billion, beating estimates of $45.48 billion

- Markets revenue of $8.9 billion, up 25% YoY

- FICC sales & trading revenue $5.61 billion, beating estimates of $5.33 billion

- Equities sales & trading revenue $3.33 billion, beating estimates of $3.04 billion

- Investment banking revenue $2.69 billion, beating estimates of $2.67 billion

- Markets revenue of $8.9 billion, up 25% YoY

- Net interest income $24.07 billion, just below estimates of $24.16 billion

- Non-interest expenses $24.28 billion, below estimates of $24.31 billion, but up 8% YoY, predominantly driven by higher compensation, including higher revenue-related compensation and growth in front office employees, as well as higher brokerage expense and distribution fees, higher auto lease depreciation and higher marketing expense, partially offset by lower legal expense

- Compensation expenses $13.57 billion, below estimates of $13.87 billion

- EPS $5.07, up 16% YoY and beating estimates of $4.82

Of note here was JPM’s slightly higher than expected provision for credit losses which came at $3.4 billion, compared to a consensus estimate of $3.08 billion, and higher than the $3.1 billion from a year ago. The higher provision was due to charge offs of $2.59 billion coupled with JPMorgan adding $810 million to its loan-loss reserve in Q3, double the reserve it took out in Q2. The bank attributed the figure to $608mm in Consumer and $205mm in Wholesale, and said that the impact from chargeoffs was related to borrower-related collateral irregularities and some other factors. It’s now boosted that reserve by almost $1.4 billion this year, seemingly prepping for more defaults to come. Bloomberg has previously reported that JPMorgan, Fifth Third Bancorp and Barclays were among banks bracing for potentially hundreds of millions of dollars in combined losses from loans tied to subprime auto lender Tricolor Holdings.

Adding to that point, Jamie Dimon pointed to a “heightened degree of uncertainty from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.” Still, the CEO said that while there have been some signs of a softening, particularly in job growth, the US economy generally remained resilient, and the bank benefited from higher client activity.

While comp expense did drop a bit, it still remained the elephant in the spending room because despite all the talk about cost savings and job losses from the AI revolution, they’ve yet to show up in the bank’s headcount figures. A year ago, JPMorgan employed just over 316,000 people; 12 months on, the number has ticked up a little to 318,153.

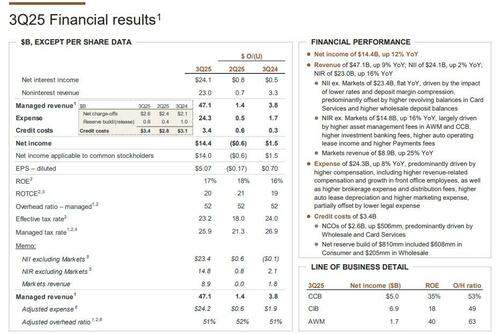

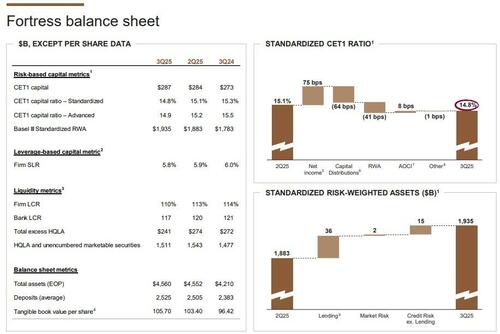

Turning to JPM’s “Fortress” Balance sheet, we find some disappointing elements of weakness:

- Net yield on interest-earning assets 2.45%, missing estimates of 2.48%

- Standardized CET1 ratio 14.8%, missing estimates of 15.1%

- Managed overhead ratio 52%, missing estimates of 53.2%

- Return on equity 17%, beating estimates of 15.7%

- Return on tangible common equity 20%, beating estimates of 18.8%

- Assets under management $4.60 trillion, beating estimates of $4.52 trillion

- Tangible book value per share $105.70, beating estimates of $104.57

- Book value per share $124.96, beating estimates of $124.33

- Cash and due from banks $21.82 billion, below estimates of $23.69 billion

- Loans $1.44 trillion, beating the estimate $1.42 trillion

- Total deposits $2.55 trillion, beating the estimate $2.58 trillion

The visual summary:

What stands out here is that while rates and margins are coming down, revolving card balances have increased as consumers get ever deeper in debt, helping the bank maintain its net interest income. Average loans in the cards business hit $234 billion in the last quarter, up from $217 billion a year ago.

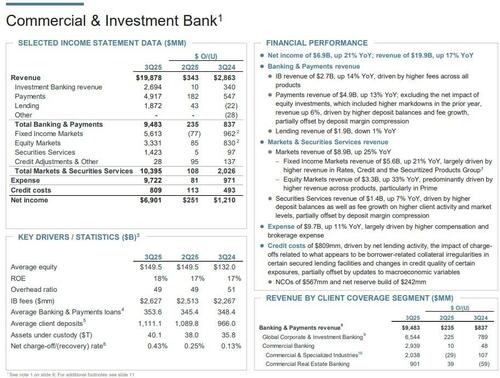

Turning to the all-important Commercial and Investment Bank, JPM reported stellar markets revenue which at $8.9B, was up 25% YoY:

- Fixed Income Markets revenue of $5.61B, beating estimates of $5.33B and up 21% YoY, largely driven by higher revenue in Rates, Credit and the Securitized Products Group

- Equity Markets revenue of $3.3B, beating estimates of $3.04B and up 33% YoY, predominantly driven by higher revenue across products, particularly in Prime

- IB revenue of $2.7B, up 14% YoY, driven by higher fees across all products:

- Advisory revenue $926 million, beating estimates of $901.3 million

- Equity underwriting rev. $527 million, beating estimates of $457.1 million

- Debt underwriting rev. $1.17 billion, beating estimates of $1.16 billion

- Securities Services revenue of $1.4B, up 7% YoY, driven by higher deposit balances as well as fee growth on higher client activity and market levels, partially offset by deposit margin compression

As Bloomberg notes, it’s easy to see why JPM has posted such strong numbers in investment banking: fees from that unit are up 16% YoY. It was the busiest quarter for IPOs since 2021. There has also been a noticeable pickup in new M&A announcements, and that will feed into the fee line for at least another couple of quarters.

On the other side of the ledger, expenses were up 11% to $9.7B, driven by higher compensation and brokerage expense. Compensation expense was up 6% through the first nine months of the year compared to the same period last year. Tech expense is outpacing the growth in comp, up 11% this year, and on track to exceed $10 billion for the full year. In other words, it is shaping up as a good year for bonuses.

Separately, the company reported that credit costs in the group were $809mm, driven by net lending activity, the impact of chargeoffs related to what appears to be borrower-related collateral irregularities in certain secured lending facilities and changes in credit quality of certain exposures, partially offset by updates to macroeconomic variables. We assume this is related to the Tricolor Bankruptcy.

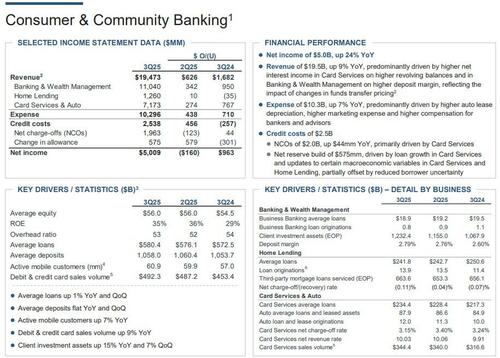

In the consumer and community banking business, while home lending revenues were down 3% on the same quarter a year ago, this was more than offset by a 12% rise in card services and auto, and a 9% uptick in banking and wealth management. Separately, when it comes to return on equity, Bloomberg notes that consumer and community banking is “an absolute monster.” This time last year JPMorgan was making a healthy 29% ROE from CCB, but a year on, this has risen to 35%. To put that in some context, the bank’s flashier commercial and investment banking operations increased their return from 17% to 18% over the same period. Also of note, provisions for credit losses in the consumer and community banking division were $2.5 billion in the quarter, 9% smaller year-on-year. While the bank has continued to build provisions based on loan growth in its cards business, this has been offset on by “reduced borrower uncertainty.”

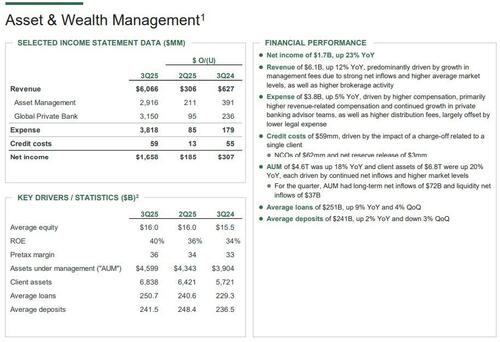

Turning to the bank’s asset and wealth management division, the booming stock market continues to be a major boost here, with assets under management rising 18% to $4.6 trillion, while client assets rose 20% to $6.8 trillion as a result of both net inflows and rises in markets. And talking of ROEs, asset and wealth management also managed a respectable 40% return on equity in the last quarter. This was a rise of 6 percentage points year-on-year.

Looking ahead, JPM raised its guidance again, and now sees FY Net Interest Income of $95.8BN – due to $25BN forecast in Q4 – up from its previous forecast of $95.5BN and above the $95.5BN median estimate. The bank also sees NII ex-Markets of $92.2BN, also an improvement from $92.0BN.

In response, JPMorgan shares swung between gains and losses premarket. Now down around 0.5%. Still, they are faring better than S&P 500 contracts, with futures down over 1%.

The full investor presentation is here (pdf link).

Tyler Durden

Tue, 10/14/2025 – 07:54ZeroHedge NewsRead More

R1

R1

T1

T1