Probably More ‘Cockroaches’: Finger-Pointing Begins In Private Credit As Managers Fear More ‘Late-Cycle Accidents’

JPMorgan CEO Jamie Dimon has sparked controversy in banking and finance circles amid a number of high profile (and sudden) bankruptcies, saying during his earnings call yesterday that:

“My antenna goes up when things like that happen. I probably shouldn’t say this but when you see one cockroach there are probably more.”

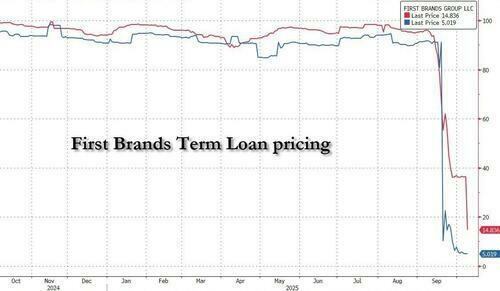

The cockroaches (which we have covered extensively here, here, here, here, and here) include the spectacular implosion of subprime auto lender Tricolor, and last month’s mega bankruptcy of First Brands, an auto parts supplier with $5.8 billion in outstanding leveraged loan debt…

Surprise!

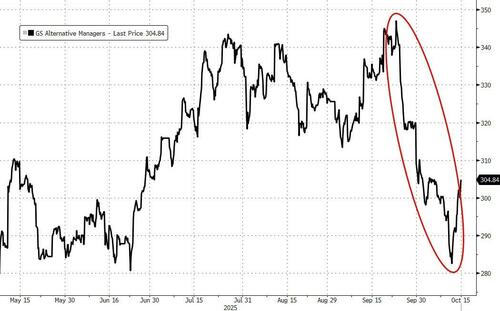

Alternative Asset Managers have come under pressure (bouncing back with the market this week)…

…particularly those in the Private Credit space like Blue Owl…

And given Blue Owl’s underperformance, it is no surprise that co-chief executive officer, Marc Lipschultz, came out swinging against Dimon’s comments on Tuesday, standing in fierce defense of private credit.

Banks might want to look at their own books for any “cockroaches.”

Tying private credit to the fallout from the bankruptcies of Tricolor and First Brands is an “odd kind of fear-mongering,” he said at the CAIS Alternative Investment Summit in Beverly Hills, California.

“We’re not seeing rising defaults, we’re not seeing companies struggling.”

Some, including Lipschultz, argue the blow-ups aren’t indicative of problems within the $1.7 trillion private debt market, but seem to signal issues within the syndicated markets.

“I guess he’s saying there might be a lot more cockroaches at JPMorgan, I’m not sure I know what he’s saying,” Lipschultz said.

“It’s not a private credit issue. It’s a liquid credit market.”

Specifically, JPMorgan took a hit from Tricolor, booking a $170 million charge-off in the third quarter, with Dimon describing the situation as “not our finest moment.”

The bank said it has no exposure to First Brands.

We are in the fingerpointing phase of the credit bubble bursting: JPM’s Jamie Dimon slams private credit “cockroaches” for Tricolor/First Brands bankruptcy, in response Blue Owl correctly notes the debt was liquid credit and the “cockroaches” are inside JPM’s own balance sheet

— zerohedge (@zerohedge) October 15, 2025

As we tweeted earlier, Lipschultz also made a very strong point that this was not illiquid private credits (which are practically untradable), these failures were syndicated loans (and JPM among other banks were primary originators of those):

“These couple of bankruptcies, both of which are in the syndicated market, would seem to be the evidence of the problem away from the private credit market,” Lipschultz said.

“I understand people have their own business to run and some people are axed against the product class.”

Marc Lipschultz, co-chief executive officer of Blue Owl Capital

As Bloomberg reports, executives at other alternative asset managers have also tried to quell the presumption that borrowers at large are posing trouble for the credit markets.

“We’ve been a little surprised by the First Brands, Tricolor selloff and buzz because when we look at our credit portfolios, we actually see pretty healthy portfolios relative to almost any metric that you can look at,” Kipp deVeer, co-president of Ares Management Corp., said during a separate panel at CAIS on Tuesday.

However, other top US financiers have warned of an erosion in lending standards with The FT reporting that Apollo Global Management chief executive Marc Rowan said the unraveling of the two businesses followed years in which lenders had sought out riskier borrowers.

“It does not surprise me that we are seeing late-cycle accidents,” Rowan said on Tuesday.

“I think it’s a desire to win in a competitive market that sometimes leads to shortcuts.”

Both Rowan and Blackstone president Jonathan Gray pointed the finger at banks for having amassed exposure to First Brands and Tricolor, but said the collapses were not signs of a systemic issue.

“What’s interesting is both of those were bank-led processes,” Gray told the same FT conference, rejecting “100 per cent” the “idea that this was a canary in the coal mine” or a systemic problem.

Banks and private capital firms have been at odds in recent years as businesses have increasingly turned to private credit for their borrowing needs. Traditional lenders have labelled the shift regulatory arbitrage and complained that non-bank financial institutions are too lightly regulated.

“In some of these more levered credits, there’s been a willingness to cut corners,” Rowan told the Financial Times Private Capital Summit in London.

Meanwhile, the IMF on Tuesday called for regulators to focus on bank exposure to the sector, noting that “banks are increasingly lending to private credit funds because these loans often deliver higher returns on equity than traditional commercial and industrial lending”.

So, just how many more cockroaches are there?

As we concluded last week, this is just the start, and once the public euphoria with the AI bubble – which is soaking up all attention like the world’s biggest mushroom – finally fades, watch out below as Second, Third, Fourth and so on instance of First Brands, shows just how hollow the current market all time high truly is.

Tyler Durden

Wed, 10/15/2025 – 11:05ZeroHedge NewsRead More

R1

R1

T1

T1