Fool Me Once…

By Bas van Geffen, Rabobank Senior Macro Strategist

The US-China trade war is flaring up again, and the US government is still shutdown. But it’s also earnings season and we have AI deals, so stocks are going higher. How long will that last? And if the S&P 500 suddenly does become sensitive to the unravelling of international relations and global trade, who caves first?

According to Treasury Secretary Bessent, it won’t be the US government. They will not negotiate with China, just because the stock market is going down. That’s easy to say when markets are still going up, but will they stick to it? In any case, such statements do not exude confidence.

Bessent and US Trade Representative Greer noted that the Chinese restrictions on rare earths show that China cannot be trusted with the global supply chain: “It’s an exercise in economic coercion on every country across the world.” The Treasury Secretary concluded that if China cannot be a reliable partner, then the world must decouple.

Considering that the Chinese restrictions on rare earths will give that decoupling an extra nudge, why is the US so unhappy? At the same time, Bessent floated the possibility of a longer deferral of US tariffs on Chinese goods, in return for a delay to Beijing’s new restrictions on rare earths. If China’s supply of rare earths and magnets has been so unreliable despite an earlier agreement between the two countries, then why is Bessent willing to try again?

In the eyes of the Trump administration, things are perhaps moving in the right direction. Even if they are, things are certainly moving too fast for the US and the global economy. But remember, the stock market will not affect the US’ position in the negotiations with China. Neither will potential supply chain disruptions, or economic damage.

Nonetheless, Bessent did offer China another offramp: he suggested that, perhaps, the vice minister of Commerce had “gone rogue.” The US Treasury Secretary added that he “believes China is open to discussion,” and said he was “optimistic that this can be de-escalated” thanks to the strong relationship between President Trump and President Xi.

Trump, however, declared that the US and China are now in a sustained trade war. So, will Bessent’s suggestion of new trade truce get Trump’s approval? And are Chinese officials willing to entertain negotiations, while the US lambasts them at the same time? Will Beijing drop its own vice minister to restart the talks? China did not take the offramp provided by Trump last weekend either.

As the tensions between the US and China re-escalate, the Trump administration’s tactics are becoming less and less covert. The Dutch minister of Finance denied that there had been any US involvement in the unprecedented move to take control of Nexperia, but court documents indicate that the US had in fact warned the Netherlands months earlier that the company could be put on the entity list, subjecting it to US trade restrictions.

Add outright election interference to that. Yesterday, Bessent said that the US would arrange another $20 billion support for Argentina, as the country tries to overcome a liquidity crisis. But will that support be conditional on Milei winning the mid-term elections later this month, just like the $20 billion swap line might be? Trump has certainly suggested that: “I’m with this man because his philosophy is correct […] And if he wins, we’re staying with him. And if he doesn’t win, we’re gone.”

But we’ll undoubtedly have another AI-deal somewhere, soon.

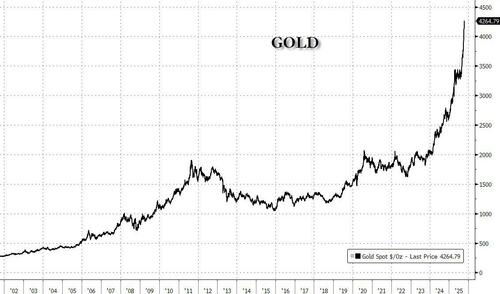

Equities may continually post gains, gold is too. The metal has surpassed $4,200 per troy ounce, in what has been coined the “debasement trade.” The IMF warned that global public debt will exceed 100% of GDP by the end of the decade, which would be the highest since the aftermath of World War II.

The IMF suggests that governments “spend smarter,” as debt servicing costs are rising: “Redirecting public spending toward infrastructure, education, health, and research and development, without increasing overall spending, can deliver significant long-term gains in output,” which would in turn improve debt sustainability.

Yet, many countries have now realised that there are a couple more items to add to that list, including defence, critical resources, and industry.

Tyler Durden

Thu, 10/16/2025 – 10:25ZeroHedge NewsRead More

R1

R1

T1

T1