WTI Hovers Near 5 Month Lows After India Confusion, Record US Production

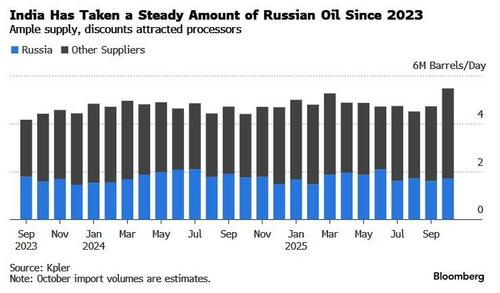

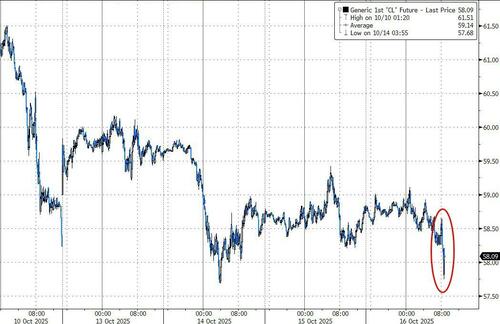

Oil prices are flat this morning (holding near five-month low) amid mixed signals on President Trump’s push to stop India’s purchases of Russian crude, his lengthy ongoing talks with President Putin, and a surprisingly large crude inventory build reported by API last night.

India’s oil refiners said they expect to reduce – not stop – the purchase of Russian crude, a move that could squeeze global supply, following remarks by Trump that the South Asian nation would halt all buying.

Bloomberg reports that Mangalore Refinery and Petrochemicals Ltd Managing Director Mundkur Shyamprasad Kamath told an analyst conference call Thursday that he was “confident” his company would continue buying Russian oil.

“We are not trying to slow down or anything,” he said when asked how he sees US push to stop Russian oil buying.

“For us it is business as usual, with respect to sourcing. We are sourcing those Russian barrels that is available today.”

India has flip-flopped between defying the US and crimping Russian imports in response to pressure from Washington to cut back.

The decisions India ultimately takes are vital for Moscow, which needs petrodollars to help fund its war in Ukraine.

Still, the market is awaiting clarification on the situation from the government in New Delhi, which didn’t officially confirm or deny Trump’s remarks.

Trump didn’t set out a timeline for India to wind down purchases of Russian oil, or give any indication of how Washington might enforce or scrutinize the shift, but said that the buying wouldn’t stop immediately.

The development took some air out of the earlier rally, with traders newly assured that the halt to India’s imports of Moscow’s crude won’t be immediate.

We will see shortly whether the official data confirms API’s notable build.

API

-

Crude +7.36mm

-

Cushing: -978k

-

Gasoline: +3.0mm

-

Distillate: -4.8mm

DOE

-

Crude (+300k exp, +2.3mm whisper)

-

Cushing: -703k

-

Gasoline:

-

Distillate:

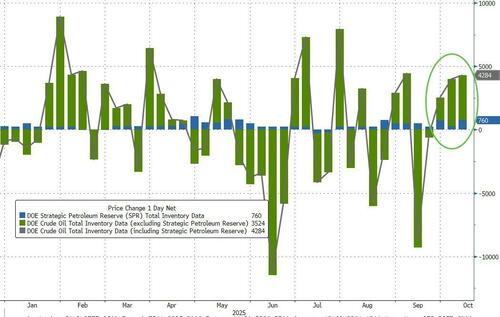

he official crude build of 3.52mm barrels was modest (and well below the huge 7.4mm barrel build reported by API). That is the 3rd weekly build in crude stock sin a row (and 3rd weekly draw in stocks at Cushing). Distillates inventories plunged by 4.53mm barrels – the biggest draw since January – perhaps affected by the El Segundo refinery fire

Source: Bloomberg

Including the 760k barrel addition to the SPR, last week saw one of the largest weekly builds in total US crude inventories of the year…

Source: Bloomberg

US Crude production rose once again, to a new reocrd high at 13.636mm b/d…

Source: Bloomberg

WTI is testing back near 5-month lows…

“Inventory builds have now eclipsed 2024 build pace by +220 (million barrels), with pressure pushing on the seaborne market. Nearly all regions are seemingly under selling pressure,” Brian Leisen, global oil strategist at RBC Capital Markets, wrote.

Tyler Durden

Thu, 10/16/2025 – 12:07ZeroHedge NewsRead More

R1

R1

T1

T1