US Reports Biggest Ever Budget Surplus For Month Of September Thanks To Record Tariffs

Those looking for data on the US budget deficit contained in the Monthly Treasury Statement had to wait a few weeks because of the government shutdown, but better late than never, and today at 2pm, the Treasury unveiled the US income statement for the just concluded fiscal year 2025. It was ugly, but not as ugly as it could have been and the month of September was outright impressive.

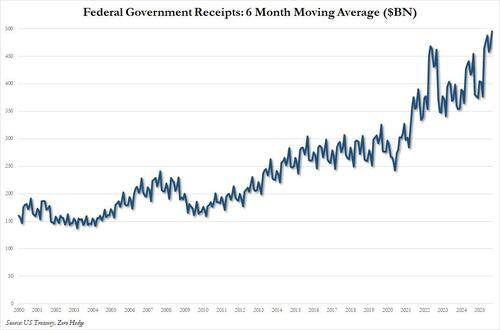

Starting at the top with the month of September, the numbers were surprisingly sold: total tax revenue of $543 billion were the highest since April (which is tax-collections month), a 3.2% improvement from a year ago, and pushed the 6-month moving average to a record high $496 billion.

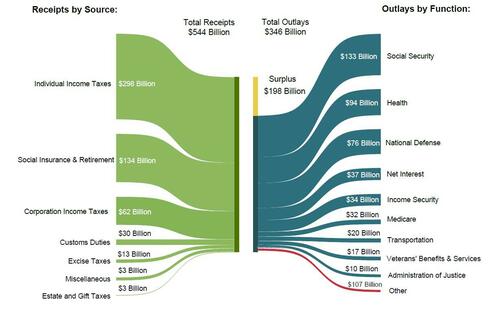

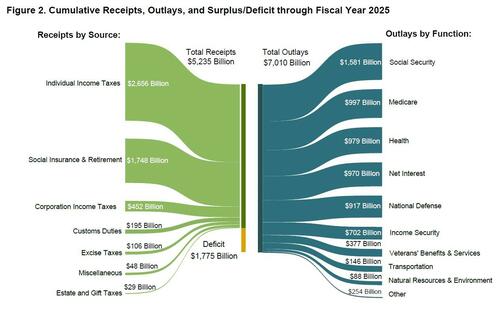

As usual, the vast majority of govt receipts was in the form of individual income taxes ($298BN out of $544BN), with Social Security contributing about a 3rd of the total receipts and Corporate Income Taxes accounting for 11% or $62 billion of the total.

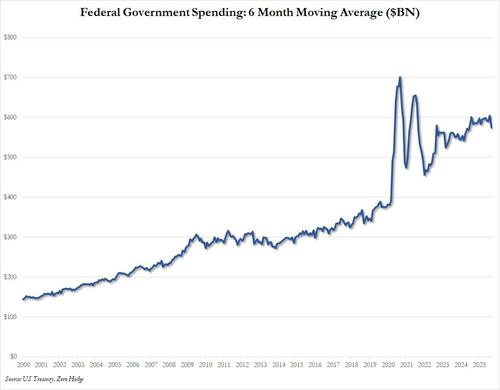

On the outlays side, here too there were notable improvements, with the US government spending only $346 billion, a sharp from from the $689 billion in August, and down a whopping 25% from the $463 billion last September. Even more remarkable is that the six month moving average of govt spending suddenly slumped from $604 billion – the highest since covid – to $573 billion, the lowest since June 2024. Yes, the improvement may be small, but every little bit helps and whatever Trump is doing to shrink govt spending is starting to show.

As shown in the chart above, the biggest spending categories for Sept were Social Security, Health and National Defense, accounting for $133BN, $94BN and $76BN respectively. What is odd is that net interest was only $37BN which is likely due to some calendar effect and we expect this surprisingly low spending total to catch up in October. But for now we can enjoy the trend even if it is fake.

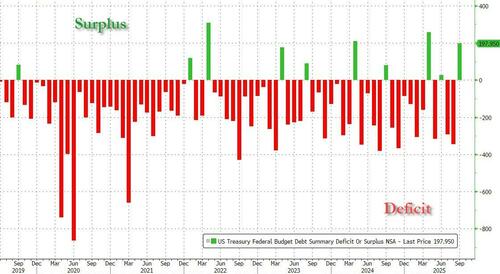

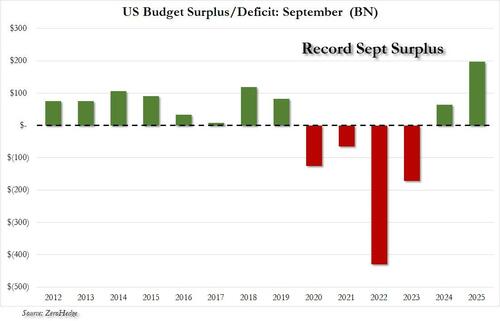

On a monthly basis, the September surplus was one of the best months in recent history for US government budget…

… and the just concluded month was a record for the month of September, which has traditionally been a strong, surplusy month except in the period following covid.

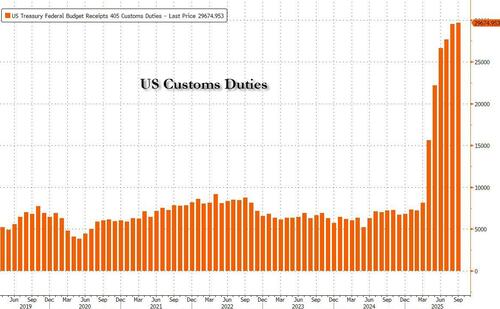

A big reason for the stellar September surplus is that tariff collections continued apace, and in September the US government collected a record $29.7 billion in tariffs, which translated in a record $195 billion for the fiscal year. And since Trump’s tariff regime was only active for 6 of the past 12 month, expect tariffs to deliver about $350 billion in annual revenue every year, unless they are canceled.

Turning to the full fiscal year which concluded on Sept 30, the picture here was less pleasant, with the US spending just over $7 trillion (broken down below) offset by $5.2 trillion in receipts…

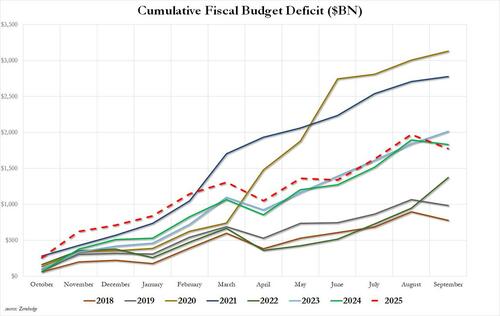

… resulting in a full-year deficit of $1.775 trillion which while still high, managed to stage an impressive reversal in recent months. As shown below, until a few months ago, 2025 was set to surpass both 2023 and 2024 in terms of the total deficit. And yet, in September, the belt-tightening meant that the cumulative full year deficit shrank enough to improve on both 2023 and 2024!

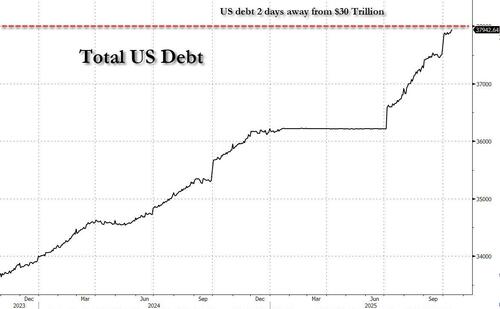

That’s the good news. The bad news is that the impressive September numbers were largely a calendar effect with much of the outlays delayed until next month, which means October’s numbers will be that much uglier. And worse, the exponential increase in total US debt which will surpass $38 trillion in 2 days and $40 trillion in under a year…

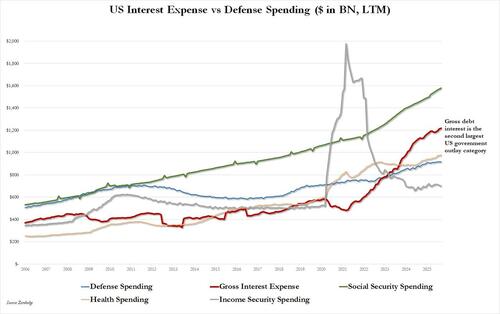

… means that the US interest expense continues to be the most dangerous, and rapidly rising, spending category of all: to wit, at $1.22 trillion in the past 12 months, gross interest expense is less than $400 billion away from catching up to Social Security Spending.

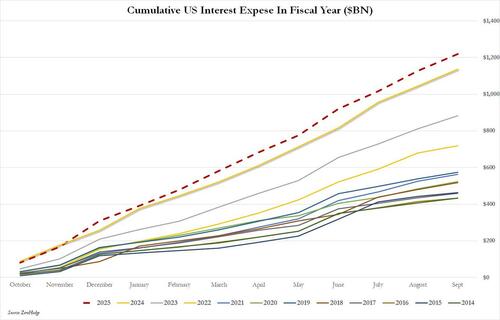

And with annual gross interest unlikely to decline ever again, because while rates may drop, the total amount of debt on which they accrue will only keep rising, it is safe to say that every month and every year we will have a record LTM interest print…

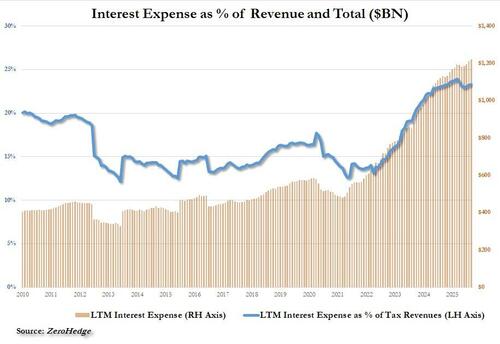

… which is a problem, because tariffs or not, DOGE or not, the US spends 23 cents of every dollar in revenue collected to pay down just the interest on debt…

… and that number will keep rising indefinitely, which is also why gold is now pricing in the coming yield curve control as anything else means game over.

Tyler Durden

Thu, 10/16/2025 – 18:00ZeroHedge NewsRead More

R1

R1

T1

T1