Futures Flat As Gold Selloff Extends

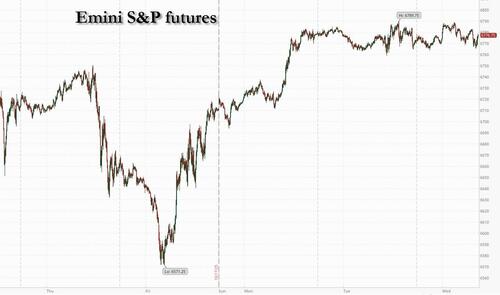

US equity futures are flat again, with tech and small caps lagging as traders parsed the latest earnings reports and corporate news amid worries over trade, the US government shutdown and geopolitical risks. Gold and silver extended declines after Tuesday’s slump. As of 8:00am, S&P futures were unchanged while Nasdaq futures dropped 0.2% after a rally on Wall Street lost steam. Pre-market, Mag7 names are mostly weaker ex-GOOG on its cloud deal. Netflix tumbled 6.8% in premarket trading after the streaming-video company reported third-quarter results that missed across the board despite stronger forecasts. Texas Instruments also plunged about 8% on an underwhelming outlook. Meme stocks are back, with Krispy Kreme among those joining Beyond Meat in the retail trader frenzy today. Mining stocks are weaker pre-market though gold and silver are bouncing off their overnight lows; both are underperforming platinum / palladium. The yield curve shifts lower and the USD continues its recent move higher. USD is +2.5% since making a 52-wk low on Sep 16. The balance of the commodity complex is bid with WTI +1.7% the standout on report that US and India are nearing an accord that could lead India to reduce imports of Russian crude. US / China situation still has aides talking behind closed doors as Trump / Xi remain likely to meet next week. There is no macro today .

In premarket trading, Netflix and Texas Instruments shares are both lower after disappointing results, with Tesla and IBM among the big names to watch later. The EV maker is expected to post a 25% drop in quarterly profits — but traders may not care. The shares have more than doubled in the past year on AI hopes.

- Mag 7 stocks are mostly lower. Alphabet (GOOGL) rises 1.8% as Anthropic is in discussions with Google about a deal that would provide the artificial intelligence company with additional computing power valued in the high tens of billions of dollars, according to people familiar with the matter (Tesla -0.2%, Nvidia +0.06%, Meta -0.1%, Microsoft +0.2%, Apple -0.6%, Amazon -1.3%).

- Alector (ALEC) tumbles 50% after the drug developer said a late-stage trial of its lead asset as an investigative treatment for dementia failed to meet a primary endpoint.

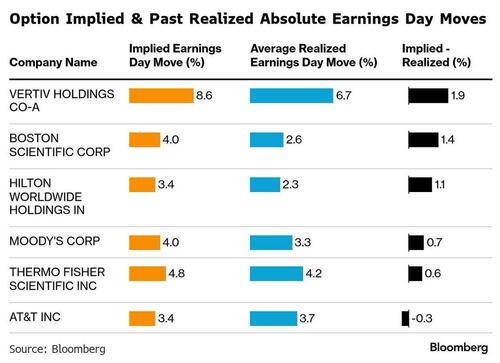

- AT&T Inc. (T) rises 1.4% after the company added more mobile-phone and home internet subscribers this summer than analysts expected.

- Avadel Pharmaceuticals (AVDL) gains 4% after Alkermes agreed to buy the company for up to $20 per share.

- Beyond Meat Inc. (BYND) soars 85%, boosting its four-day rally to almost 1,300%, in an echo of the meme-stock frenzies that periodically roil the market.

- DraftKings (DKNG) climbs 3% after the sports betting company said it acquired predictions platform Railbird for an undisclosed amount.

- Intuitive Surgical (ISRG) rallies 16% after the robotic-surgery company boosted its worldwide da Vinci procedure growth forecast for the full year.

- Manhattan Associates (MANH) falls 7% after the supply-chain software company posted a key metric — “remaining performance obligations” — for the third quarter that fell short of estimates.

- Mattel Inc. (MAT) is down 5% after the company reported third-quarter sales and earnings that missed analysts’ estimates as US retailers delayed orders due to uncertainty over President Donald Trump’s tariff policies.

- Netflix (NFLX) falls 7% after the streaming-video company reported third-quarter results it said were hurt by a tax dispute with Brazil.

- Texas Instruments (TXN) drops 7% after the chipmaker gave an outlook that is weaker than expected. The outlook indicates that some customers are slowing orders as they navigate mounting trade tensions.

- Vertiv Holdings (VRT) is up 6% after the company boosted its adjusted earnings per share guidance for the full year; the guidance beat the average analyst estimate.

- Warner Bros. Discovery Inc. (WBD) gains 2% after saying it’s considering a possible sale of the company after receiving unsolicited interest from multiple parties. Netflix Inc. and Comcast Corp. are weighing bids for parts of the media and entertainment company, according to people with knowledge of the matter.

In other company news, Anthropic PBC is said to be in talks with Alphabet’s Google about a deal that would provide the AI company with additional computing power valued in the high tens of billions of dollars. Apple’s iPhone Air got a subdued response from consumers in China.

Early US earnings point to the best corporate results in four years, with 85% of companies reporting beats. Despite recent de-risking amid concerns over trade and credit, stock exposure among global macro hedge funds and long-only strategies remains at the highest in over a year, according to Barclays Plc. Drawdowns have been short-lived as investors see them as opportunities to add risk to their portfolios.

Earnings will “play a decisive role in determining whether the rally can be sustained,” said Linh Tran, a market analyst at XS.com. “Profit expectations for major tech companies have been revised upward, while consumer and financial sectors may benefit from resilient demand and higher interest margins. If corporate results continue to outperform forecasts, this could help the S&P 500 extend its gains into Q4.”

Markets are also keeping one eye on trade news ahead of the resumption of US-China talks. Six months into Trump’s trade war, the resilience of Chinese exports is proving just how essential many of its products remain even after US levies of 55%.

Gold fell more than 2%, closing in on $4,000 an ounce and deepening its worst intraday drop in more than a dozen years in the previous session, amid concerns its rally had run too far, too fast. Silver also declined following Tuesday’s 7.1% fall. Gold’s drop on Tuesday drove the VanEck Gold Miners ETF down 9.4% in its biggest drop since 2020. Still, gold mining stocks are still on track for their biggest ever annual gain over the S&P 500.

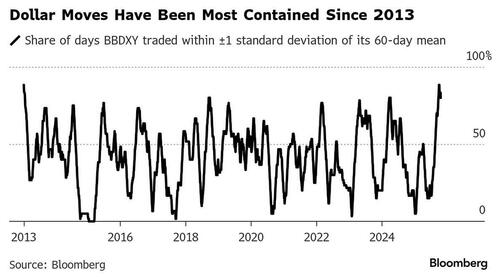

Bond traders are preparing for yields to drop further even as the 30-year sank to its lowest in six months on Tuesday. The cost of protection against a bigger decline in yields across the curve is rapidly rising, according to pricing of options wagers. Traders are piling into some risk-off assets as the US government shutdown becomes the second longest on record and amid renewed concerns over the credit market. Meanwhile, dollar trading has become unusually subdued, with the Bloomberg Dollar Spot Index remaining within one standard deviation of its average for about 80% of the time over the past 60 trading days, according to data compiled by Bloomberg.

In Europe, the Stoxx 600 index dipped, with consumer products and services leading declines after results from L’Oreal SA, Hermes International SCA and Adidas AG failed to meet lofty expectations. Energy stocks led gains as crude oil rose. UK stocks got a boost with the FTSE 100 rising 0.7% after UK CPI surprised to the downside as traders ramp up bets on an interest-rate cut by the Bank of England before year end. Among companies reporting in Europe on Wednesday, Barclays Plc gained after raising its earnings guidance and unveiling a £500 million buyback. Akzo Nobel NV slumped after the paintmaker lowered its earnings outlook, with customers more hesitant to spend amid rising global tariffs and softer economic conditions. Here are the biggest movers Wednesday:

- Precious metals miners in South Africa and Europe rose on Wednesday as gold and silver prices steadied, after suffering their steepest selloffs in years.

- Barclays shares rise as much as 4.1% after the UK lender increased its 2025 guidance and announced a £500 million share buyback, with investors looking beyond an increased provision for motor finance

- Heineken shares rise 2.3% as analysts say a soft quarterly print was no worse than expected. The company’s move of Ebit growth guidance to the lower end of the range had been foreseen, according to consensus views

- Handelsbanken gains as much as 2.1% after posting a slight beat to net interest income (NII) in its third-quarter report. Lower-than-expected costs also contributed to a solid showing from the Swedish lender

- European chipmakers slip on Wednesday after US peer Texas Instruments forecast 4Q sales below estimates, signaling a delay in the rebound of the automotive and industrial chip sector

- ITV shares plummet as much as 12% after the broadcaster’s largest shareholder Liberty Global cut its stake in half after offering shares at a discount

- L’Oreal shares fall as much as 8%, the steepest drop in a year, after the cosmetics company reported third-quarter like-for-like sales that fell short of elevated market expectations

- Hermes falls as much as 5% after sales at constant exchange rates for the third quarter showed double-digit growth in most regions, but key division leather goods slightly missed estimates, while valuation premium is stretched, according to analysts

- DNB Bank shares drop as much as 4.3%, the most since July, after the Norwegian lender posted a disappointing third-quarter report, according to analysts, who flagged misses on net interest income (NII) and fee

- Adidas shares dip as analysts say the sportswear maker’s increased full-year earnings forecast was only in-line with consensus and note a slight miss in third-quarter sales

- TeamViewer shares slump as much as 24% to a record low after the software maker reduced its annual recurring revenue guidance for this year and sales outlook for next year

Asian stocks fell, weighed down by technology shares as investors rushed to lock in gains amid doubts about the sector’s staying power. The MSCI Asia Pacific Index dropped as much as 0.6% before paring some losses, with TSMC, SoftBank Group and Alibaba among the biggest drags. Shares in Hong Kong and Vietnam declined, while South Korea’s Kospi rose. Chipmakers and other AI-related stocks in Asia, including SoftBank, declined after Texas Instruments presented a disappointing outlook, which added to concerns that the sectors’ shares may have been running too hot. Precious-metal stocks also tumbled after gold and silver posted their steepest selloffs in years. The slide in Hong Kong and mainland Chinese stocks came despite a bullish long-term call from Goldman Sachs Group Inc., which predicted key stock gauges may gain 30% by the end of 2027. The strategists argued the upside will be supported by pro-market policies, rising profits and strong capital flows. Here Are the Most Notable Movers

- Bangkok Bank shares advance after the lender’s third-quarter net income rose 11% on year, beating the average analyst estimate, partly driven by investments.

- LG Chem Ltd. shares surged by the most in five years after Palliser Capital UK disclosed a stake in the firm and urged changes, in a sign that overseas activists are starting to wade back into South Korea.

- IHI shares climb as much as 5.5% to ¥2,995 after Mizuho Securities raised its target price to ¥3,300 from ¥1,071, saying it expects growth in the civil aero engines business and expansion of defense-related operations.

- Laopu Gold shares fall as much as 8.1%, the most since Sept. 10, after the Chinese jewelry seller agreed to issue about 3.71 million new H shares at HK$732.49 apiece in a placement.

- Pop Mart shares rise as much as 7.9% after the toymaker’s third quarter sales growth of as much as 250% year-on-year came amid investor worries over the possible fading popularity of its collectible toys.

- Innovent Biologics shares rise as much as 9.9% in Hong Kong after the company said it will receive a $1.2 billion upfront payment, including an equity investment, as part of a strategic collaboration with Takeda Pharmaceutical to develop cancer therapies.

- Meituan shares drop 0.5% as JPMorgan cuts its target price, saying the company may face worst-than-expected pressure in its 3Q and 4Q results due to competition in China’s food delivery market and its expansion overseas.

- Taiheiyo Cement shares gain as much as 6% in early Tokyo trading, the most since April 10, following a report in Nikkei that Palliser Capital has taken a stake of over 3%.

In FX, the Bloomberg Dollar Spot Index rose 0.1%, taking gains into a fourth straight day; the index’s thin gains were led by the US currency’s advance versus the pound, which stumbled after data showing steady UK inflation raises speculation of an interest-rate cut in December. A 1% slide in gold prices also supported the greenback, suggesting that investors still see the currency as a viable haven. The pound fell 0.4% against the dollar and is the clear G-10 underperformer.

In rates, treasury yields sliding again, dropping more than 4bps with 10-year around 3.93%, near Tuesday’s low. They trail steep gains for gilts, where 2-year yields fell more than 10bp to 14-month low after UK headline, core and services CPIs fell short of estimates. UK yield curve is notably steeper as market prices in an increased 70% chance Bank of England cuts rates a quarter-point by December. The US session includes 20-year bond reopening: the $13 billion 20-year bond reopening, first coupon auction in more than a week, has WI yield near 4.510%, about 10bp richer than last month’s 20-year sale, which stopped through by 0.2bp

In commodities, WTI crude oil futures are up about 2%, which along with the 20-year auction creates resistance to lower Treasury yields. Oil is higher on report that US and India are nearing an accord that could lead India to reduce imports of Russian crude. Spot gold is down $50, having recovered from an earlier nosedive toward $4,000/oz. Silver dips 0.7% while Bitcoin is down 2.4%.

The US economic calendar calendar is blank, and Fed’s external communications blackout ahead of the Oct. 29 Fed policy decision began Saturday. Earnings after the close include Tesla and IBM.

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini -0.2%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 -0.2%

- DAX -0.3%, CAC 40 -0.6%

- 10-year Treasury yield -1 basis point at 3.96%

- VIX +0.1 points at 17.96

- Bloomberg Dollar Index little changed at 1212.96

- euro little changed at $1.1596

- WTI crude +1.7% at $58.19/barrel

Top Overnight News

- The US government shutdown is now the second-longest in history, and with Trump expected to head to Asia later this week, lawmakers and congressional aides see a real possibility of the closure extending into November. BBG

- US companies are beating earnings expectations at the highest rate in over four years, with 85% surpassing profit estimates in the third quarter so far. BBG

- Trump said he won’t meet with Democratic leaders unless the government is reopened.

- Trump’s administration plans to release over USD 3bln in aid to US farmers previously frozen due to government shutdown: WSJ.

- US has offered energy companies access to nuclear waste that they can convert into fuel for advanced reactors in an attempt to break Russia’s stranglehold over uranium supply chains: FT.

- Bessent is facing mounting pressure to justify Washington’s multibillion dollar rescue of Argentina as a political backlash builds over the administration’s efforts to support Milei. The Treasury secretary has taken the lead in managing Trump’s effort to provide financial support for Milei’s libertarian government, which the US sees as a crucial Latin American ally, through a package of measures designed to prop up its economy and its currency, the peso. FT

- China is demanding some US semiconductor firms submit sensitive information about their sales in the world’s largest chips market as part of its probe of American suppliers. BBG

- As Japan’s new premier Sanae Takaichi got to work on Wednesday, her government began finalising a purchase package, including U.S. pickups, soybeans and gas, to present to President Donald Trump in trade and security talks next week, two sources said. RTRS

- Japan’s new Prime Minister Sanae Takaichi is preparing an economic stimulus package that is likely to exceed last year’s $92 billion to help households tackle inflation, government sources familiar with the plan said on Wednesday. RTRS

- Indonesia unexpectedly leaves rates unchanged at 4.75% (the Street was anticipating a cut to 4.5%). BBG

- India and the United States are nearing a long-stalled trade agreement that would reduce U.S. tariffs on Indian imports to 15% to 16% from 50%, India’s Mint reported on Wednesday citing three people aware of the matter. The deal, which hinges on energy and agriculture, may see India gradually scale back its imports of Russian crude oil. RTRS

- The U.K.’s annual rate of inflation in September unexpectedly held at the pace of the previous month, raising the chance that Bank of England policymakers could cut interest rates later this year, despite price rises remaining at a level still well above the central bank’s target. CPI comes in cooler than anticipated at +3.8% Y/Y on the headline (vs. the Street +4%), +3.5% on core (vs. the Street +3.7%), and +4.7% on services (vs. the Street +4.8%). WSJ

Trade/Tariffs

- US President Trump reiterated that the November 1st tariffs on China will be about 155% and that higher tariffs on China won’t be sustainable for them, while Trump also said he spoke with India’s PM Modi on Tuesday and talked about trade.

- South Korean chief presidential policy aide said South Korea and the US stand apart on a couple of matters in tariff talks.

- South Korea Minister for Trade Yeo expressed concern in a call with China’s Li Chenggang regarding Beijing’s shipbuilding curbs, while he asked Li to swiftly lift sanctions on South Korea shipbuilder Hanwha Ocean and discussed China’s rare earths export restrictions.

- India and the US are closing in on a long-pending trade deal that could slash current tariffs from Indian exports to between 15-16% from 50%, according to Mint citing three people aware of the matter.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued following the mixed handover from the US, where participants digested a mixed bag of earnings releases, and precious metals slumped, with a historic drop seen in gold following the recent record-setting rally. ASX 200 retreated with heavy losses in the mining sector after gold prices fell by the most since 2013 and which was its largest one-day dollar value drop on record. Nikkei 225 briefly dipped beneath the 49,000 level with early pressure seen following mixed trade data, although the index gradually pared its early losses as participants also reflected on the new Takaichi-led government, with the PM instructing the cabinet to compile a package of steps to cushion the blow from the rising cost of living. Hang Seng and Shanghai Comp were subdued following a slew of recent trade-related rhetoric, including from US President Trump, who reiterated 155% tariffs on China from November 1st and that he will meet with Chinese President Xi in two weeks, but then also commented that maybe that meeting won’t happen.

Top Asian News

- Japanese PM Takaichi is preparing economic stimulus expected to exceed last year’s JPY 13.9tln, with the package to be built around three main pillars which are measures to counter inflation, investment in growth industries and national security, according to sources cited by Reuters.

- Japanese PM Takaichi is to meet with US President Trump on October 28th and will discuss national defence. It was later reported that Japanese Chief Cabinet Secretary Kihara said US President Trump is to visit Japan from October 27th to 29th and is to meet Japan’s Emperor and PM Takaichi during the visit.

- Japanese Minister for Economic Security Kiuchi says it is important that the government and the BoJ continue to cooperate and carry out responsible macroeconomic policies, while he hopes the BoJ will closely coordinate with the government to achieve the 2% inflation target, and stated that the economy needs to be supported until strong real wage growth is achieved.

- Japan’s Finance Minister Katayama announces that Prime Minister Takaichi will proceed with fiscal reform both in terms of spending and revenue. Says weak JPY boosts food costs, so there needs to be a quick measurement to cushion impact. “Takaichi Trade” has somewhat calmed down.

European equities (STOXX 600 -0.2%) are mostly lower today, but with outperformance in the FTSE 100 (+0.4%) after the UK’s inflation report, which has boosted bets around a cut in December. European sectors hold a negative bias. Energy and Utilities lead the pile, with the former benefiting from strength in oil prices today. To the downside, Consumer Products is pressured by post-earning losses in L’Oreal (-6.2%), Hermes (-4.4%) and Adidas (-2%). Beauty name L’Oreal is pressured after a notable quarterly sales miss, Hermes was more-or-less in-line, yet still disappointed investors after recent resilience; Adidas is seemingly swept away with the sectoral losses, given it reported a beat on its headline metrics, and lifted guidance. US equity futures are modestly incrementally lower today, continuing similar price action seen in the prior session. Key pre-market movers today include; Netflix (-7.1%, Q3 profit miss, hit by a Brazilian tax dispute, but sales were in line), Texas Instruments (-8%, co. issued a soft forecast for the next quarter). Apple (AAPL) is reportedly drastically cutting iPhone Air production orders but boosting other 17 models, via Nikkei citing sources; reflecting lukewarm Air demand ex-China and unexpectedly robust 17 & 17 Pro demand.

Top European News

- UK Chancellor Reeves targets tax partnerships in crackdown on UK’s wealthy with Reeves preparing a crackdown on lawyers, accountants, doctors and other professionals who use tax partnerships, according to FT.

- Politico reports that a decision on whether to postpone the French Social Affairs Committee’s examination of the Social Security Budget will be taken this morning; in the context of a “rectifying letter” re. pensions likely being adopted on Thursday.

- SNB’s Schlegel says inflation is expected to rise slightly in the coming quarters Planned US tariffs on some pharma products could increase downside risk for the economy. Uncertainty in the economy remains high. Will continue to observe the situation and adj. monetary policy where necessary.

FX

- USD is mildly firmer/flat. Nothing really driving things at the moment, but traders are mindful of trade/shutdown developments, and as some begin to position themselves ahead of Friday’s inflation report. For context, some of the recent upside seen in the dollar has been attributed to; a) reversal of debasement trade, b) steep correction in gold, c) easing credit concerns. DXY is currently trading at the upper end of the day’s 98.84-99.05 range

- EUR is essentially flat and trades in an incredibly tight 1.1590-1.1615 range; nonetheless, the bias for today’s price action has been mildly downward. Lacklustre price action, which comes amidst a lack of pertinent newsflow. Some focus on reports that several EU leaders have called for the bloc to review, reduce and restrain legislation to reduce the burden on business, via Reuters.

- JPY is essentially flat/mildly lower vs USD, and currently trades in a 151.48-151.95 range, just shy of the 152.00 mark. On trade, Reuters reported that PM Takaichi is to tell US President Trump that the country will buy US soybeans, pickups and LNG, though may not commit to a new defence spending target. As a reminder, the POTUS will visit Japan from October 27-29. On economic policy, Takaichi is reportedly readying an economic stimulus which is set to top JPY 13.9tln; Reuters suggested measures are to counter inflation, investment in growth industries and national security. Elsewhere, Japan’s Finance Minister Katayama echoed her PM’s recent remarks, pushing back on the government’s involvement with the BoJ. Katayama said it is up to BoJ on specifics on monetary policy but should work together to have effective economic policies.

- GBP is the clear underperformer vs USD today, following the region’s soft inflation report. In detail, headline Y/Y was unchanged from the prior at 3.8% (exp. 4%), with the Services components also softer-than-expected. In an immediate reaction, GBP/USD fell from 1.3384 to 1.3343, before extending to a trough of 1.3314 where the pair currently resides. Further levels to the downside include the low from October 15th and then last week’s worst at 1.3248. Following the release, market pricing has shifted dovishly, with markets now assigning a 74% chance of a cut by year-end vs 44% pre-release; the first full 25bps cut is priced in by Feb 2026.

- Antipodeans are the marginal G10 performers today, benefiting from a recent bounce back in metals prices as spot gold and base metals clamber off from the hefty pressure seen in the prior session.

- PBoC set USD/CNY mid-point at 7.0954 vs exp. 7.1225 (Prev. 7.0930)

Fixed Income

- USTs are flat. In a very thin 113-21 to 113-25 band. Focus thus far has been on the mixed trade rhetoric out of the US yesterday with Trump previewing his potential meeting with China’s Xi saying he expects the negotiation to be good. However, he then added that maybe the meeting will not occur. Otherwise, the US docket is limited owing to the shutdown and Fed blackout; note, Barr is scheduled. On the shutdown, Trump overnight poured some cold water on the situation by saying he won’t be meeting with Dem. leaders until the gov’t reopens.

- Bunds are contained, but has experienced a slightly choppy morning. Picked up to a 130.38 peak with gains of c. 15 ticks on the discussed UK inflation report before paring and falling back to a 130.16 low, with downside of around five ticks at most. Ahead, ECB’s de Guindos and Lagarde due, though recent comments from officials have not changed the narrative into the end-October meeting. A weak German auction (b/c 1.2x) sparked some very marginal pressure in Bunds.

- OATs trade broadly in-line with EGB peers in a 123.19 to 123.44 band while the OAT-Bund 10yr yield spread remains steady around the 80bps mark. For OATs, Amova’s Williams spoke to Bloomberg and outlined that they added to their overweight position on French debt in September, and believes OATs are still at attractive levels despite recent sovereign downgrades. On the spread, he believes a move above 100bps would cause the ECB to step in.

- Gilts are the clear outperformer today following the region’s inflation report. CPI for September remained at 3.8% Y/Y, cooler than the market and BoE forecast of 4.0%; pertinently, September represented the peak in the BoE’s inflation forecast horizon. Accompanying measures were also cooler-than-expected and while there were some slightly more mixed internals behind the headline figure and somewhat unusual moves in some subset components, the overall narrative is clearly a dovish one vs. consensus. As such, Gilts gapped higher by 54 ticks to 93.45 and then extended further to a 93.78 peak, notching a contract high. Action that pushed the UK 2yr yield down to 3.77% and below the 3.80% mark that desks have been attentive to recently, the 10yr also moderated to 4.4%, convincingly taking out 4.45%.

- Germany sells EUR 2.284bln vs exp. EUR 3.0bln 2.50% 2032 Bund: b/c 1.2x (prev. 1.5x), average yield 2.33% (prev. 2.52%), retention 23.87% (prev. 23.88%)

Commodities

- Crude benchmarks extended on Tuesday’s high during the APAC session as Mint citing sources reported that a US-India trade deal is near, that could see India cut Russian oil imports for a lower export tariff to 15-16% from 50%. WTI and Brent peaked at USD 58.50/bbl and USD 62.62/bbl respectively following the trade news but are currently trading slightly off best levels at USD 58.20/bbl and USD 62.30/bbl.

- Spot XAU began the European morning firmer, bouncing back from Tuesday’s 5% selloff, which was its biggest selloff since November 2020. Although, XAU was then pressured once again to currently trade around USD 4,065/oz – trough for today’s session was made overnight at USD 4,005.98/oz.

- Base metals have rebounded from Tuesday’s selloff following a trade deal near its completion between India and the US. 3M LME Copper dipped to a low of USD 10.54k/t before reversing a trending back through Tuesday’s range and is currently trading near session highs at USD 10.66k/t.

- US Private Inventory Data (bbls): Crude -3.0mln (exp. +1.2mln), Distillate -1.0mln (exp. -1.9mln), Gasoline -0.2mln (exp. -0.8mln).

- Russian overnight attack on Ukraine’s Poltava region damaged oil and gas industry facilities.

Geopolitics

- Russia obtained security guarantees from Ukraine to restore power to the Zaporizhia nuclear power plant, according to RIA.

- US President Trump said he has not made a determination yet regarding a meeting with Russian President Putin and doesn’t want to have a wasted meeting, while he still sees a chance for a Russia-Ukraine ceasefire.

- Russia’s Special Economic Envoy said ‘preparations continue’ for a Trump-Putin meeting.

- Russia’s Deputy Foreign Minister Ryabkov says preparations for a Russia-US summit is ongoing and there has been no agreement on a Lavrov-Rubio meeting; sees no major obstacles for a Trump-Putin meeting via RIA.

- Russia’s Kremlin says their position is well known with nothing else to add in regard to reports of a non-paper passed to USA on Ukraine. Preparation is necessary for Putin-Trump summit.

- Ukraine’s President Zelensky calls US President Trumps’ idea a good compromise in regards to the concept of stopping at the current lines.

- North Korea fired a missile, which the South Korean military said was a ballistic missile, while Japanese PM Takaichi later confirmed there was no damage to Japan’s exclusive economic zone and waters from the North Korean missile.

- US is reportedly trying to drive a wedge between Argentina and China with the Trump administration pushing officials in Argentina to limit China’s influence over the distressed South American nation, according to WSJ.

- China’s Defence Ministry said it is strongly dissatisfied with Australia’s statement about military aircraft around the Paracel Islands, while it added that organised troops are to resolutely block and drive away Australian military aircraft that ‘invaded’ China’s airspace.

- “Israel’s Channel 12: The security establishment warns that accelerating the implementation of the Trump plan may harm Israel’s security interests”, via Sky News Arabia

US Event Calendar

- 7:00 am: Oct 17 MBA Mortgage Applications -0.3%, prior -1.8%

- Fed’s External Communications Blackout (October 18 – October 30)

DB’s Jim Reid concludes the overnight wrap

Most markets put in another steady performance yesterday, with the S&P 500 (+0.003%) and the STOXX 600 (+0.21%) closing just below their record highs from a couple of weeks ago, whilst the 10yr Treasury yield (-1.7bps) hit a one-year low of 3.96%. Several factors contributed, including some positive noises on the trade outlook, alongside decent earnings releases. But even as bonds and equities were mostly rallying, it was a completely different story for commodities, with several posting very sharp falls. Indeed, gold prices (-5.30%) posted their biggest decline since August 2020, whilst silver (-7.12%) saw its biggest decline since the Liberation Day market turmoil in April.

That sudden selloff for precious metals really captured the market headlines, but to be honest there wasn’t a single catalyst that sparked the declines, and the big multi-year moves weren’t happening in other asset classes or commodities either. Moreover, the slump happened despite a decline in nominal and real bond yields, which usually help to support gold prices given it’s relatively more attractive to hold a zero-interest asset like gold when bonds aren’t yielding as much. So in many respects, it looked like a classic pullback after a relentless bull run over recent weeks, and it’s worth noting that the rolling two-month gain of more than +30% on Monday was already the strongest since the GFC. Indeed, last month saw real-terms gold prices move above their inflation-adjusted peak in January 1980, so it had never been more expensive. And even with yesterday’s moves, its gains of +57% since the start of the year would still make it the strongest annual performance since 1979, back when gold prices more than doubled after that year’s oil shock triggered a huge wave of inflation.

Whilst gold saw the biggest headline moves, there was plenty going on for US Treasuries, with a decent rally that pushed longer-dated yields to their lowest in some time. That was partly driven by a weak survey print from the Philadelphia Fed, as their non-manufacturing activity index came in at -22.2 in October, which is its lowest level in 4 months. To be fair, that isn’t a release that normally gets too much attention, but given the government shutdown, investors are more focused on the data that’s still coming out. So the print added to speculation that the Fed would cut rates rapidly in the months ahead if the economy weakened, particularly given the ongoing government shutdown. And in turn, 10yr Treasury yields (-1.7bps) closed at 3.96%, which is their lowest level since October 2024, whilst the 30yr Treasury yield (-2.6bps) fell to 4.54%, its lowest level since the Liberation Day turmoil in April.

Sentiment got a bit of a boost yesterday from various trade headlines, which added to investor optimism that a tariff escalation would be avoided. For instance, Trump said at the White House that he would see President Xi in South Korea, and that “I expect to be able to make a good deal with him”. However, Trump also floated that the meeting might not happen, saying “Maybe it won’t happen. Things can happen where, for instance, maybe somebody will say, I don’t want to meet”, so that briefly pushed the S&P 500 into negative territory again. And separately, Canadian PM Mark Carney said that they were in “intensive negotiations” with the US, and it was “possible” that a trade deal could be reached ahead of the APEC summit in South Korea next week.

The S&P 500 had traded slightly in the green for most of the day, before closing virtually unchanged (+0.003%), leaving the index just over a quarter of a percent from its record high two weeks ago. The equity moves were pretty mixed, with nearly 60% of the S&P 500 higher on the day, but the NASDAQ (-0.16%), Mag-7 (-0.31%) and the Russell 2000 (-0.49%) all fell back as value stocks outperformed. Bank stocks were among the underperformers, with the KBW Bank index (-0.37%) losing ground after rebounding the previous two sessions. And after the close, we heard from Western Alliance Bancorp, who saw a -10.81% fall in their share price last Thursday as the concerns around regional banks and private credit gathered pace. The banking group delivered an earnings and revenue beat even as it raised credit loss provisions to $80m (vs. $42.4m est.), and its share price was up +2.85% in after-hours trading. So that offered reassurance to markets after last week’s jitters, particularly after the smooth reaction to Zions Bancorp’s earnings the previous day, and S&P 500 futures are up +0.16% this morning.

In the meantime, the US government shutdown is entering day 22, which now makes this the second-longest shutdown, behind the 2018-19 shutdown that lasted for 35 days. Republican Senate Majority Leader John Thune said yesterday that Republican lawmakers were “hopeful that this will be the week we break out of this”, but there’s still no obvious sign of a compromise emerging between Republicans and Democrats. Indeed, the Polymarket odds for the end of the shutdown have continued to drift into the distance, with the chances of the shutdown lasting beyond November 16 up from 29% this time yesterday to 40% now. So that’s still impacting the usual flow of data, although we will get a delayed CPI report for September this Friday.

Over in Europe, markets put in a strong performance, and France’s CAC 40 (+0.64%) finally exceeded its record high from May 2024. That came alongside fairly broad-based gains, and the STOXX 600 (+0.21%) closed less than -0.1% beneath its own record high. Likewise, sovereign bonds rallied across the continent, with yields on 10yr bunds (-2.5bps), OATs (-2.0bps) and BTPs (-2.2bps) all moving lower. And for 10yr bunds, that took them down to 2.55%, their lowest level since June.

One exception to the global pattern of lower yields was in Canada, after their latest inflation report surprised on the upside. It showed headline CPI rising to +2.4% in September (vs +2.2% expected), whilst both the trim core and the median core measures tracked by the Bank of Canada also moved higher. So that led investors to dial back the likelihood of a rate cut next week, with markets pricing in a 73% chance by the close, down from 77% the previous day. And in turn, Canada’s 10yr government bond yield moved up +2.4bps to 3.08%, making it the only G7 country where yields moved higher yesterday.

Elsewhere, Brent crude oil prices (+0.51%) rebounded from their 5-month low on Monday to $61.32/bbl, on news that the US administration would begin refilling its Strategic Oil Reserve, starting with 1 million barrels. The oil move was also supported by more negative noise between the US and Russia, with Bloomberg reporting that the White House has no immediate plans for a Trump-Putin meeting given differences between the sides on potential ceasefire terms in Ukraine. Meanwhile, Trump himself said he did not want to have “a wasted meeting” with Putin.

Over in Japan, Sanae Takaichi became the new PM yesterday after winning a parliamentary vote. On monetary policy, she said that “I believe the BOJ should retain discretion over the tools of monetary policy”, and that she didn’t see a need to review the 2013 accord between the BOJ and the government. Against that backdrop, the yen weakened by -0.78% against the US Dollar yesterday, making it the weakest-performing G10 currency, although it’s stabilised again this morning. The Nikkei is also up +0.13% currently, leaving the index on track for another record high. And elsewhere in Asia, South Korea’s KOSPI (+0.77%) is also at a record high, although Chinese equities are struggling this morning, with the CSI 300 (-0.70%) and the Shanghai Comp (-0.44%) both losing ground.

To the day ahead now, and data releases include the UK CPI print for September, whilst central bank speakers include ECB President Lagarde and Vice President de Guindos. Otherwise, earnings releases include Tesla and IBM.

Tyler Durden

Wed, 10/22/2025 – 08:34ZeroHedge NewsRead More

R1

R1

T1

T1