As Auto Loan Delinquencies Soar, Repossessions On Track To Break Record

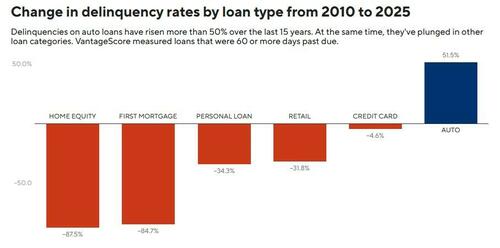

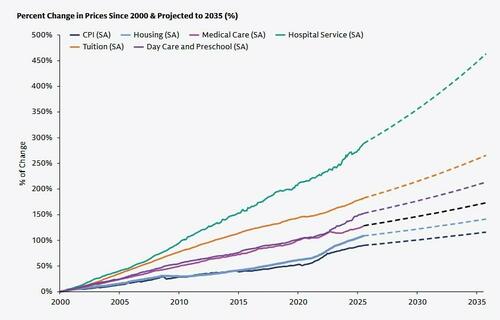

On Friday we noted that auto loan delinquencies among low-tier consumers have surged 50% since 2010, as new vehicle prices have spiked over 25% since 2019 and 20% of borrowers forking over at least $1,000 per month for their depreciating asset (at 9% APR, no less).

And so it makes perfect sense that with over 100 million auto loans in America, the number of cars being repossessed is approaching records.

According to data from the Recovery Database Network (RDN), there have been over 7.5 million repossession assignments in the United States so far this year – meaning, authorizations given to an agency to recover a vehicle on behalf of a lender. This figure is on track to exceed 10.5 million by the end of the year. Of note, an assignment =/= a repossession, as repo men aren’t always successful.

Yet despite recovery ratios having fallen in recent years, over three million cars could be repossessed this year, a level not seen since 2009.

Paycheck to Paycheck

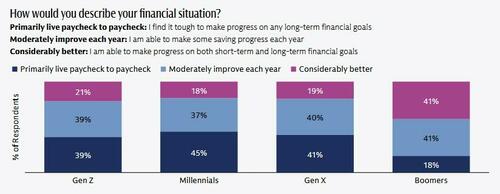

According to a Goldman survey published earlier this month, around 40% of Americans under the age of boomer report living paycheck to paycheck as inflation continues to erode purchasing power.

For those living primarily paycheck to paycheck, the top issue cited by 87% of those asked was “Too many monthly financial expenses” – like an auto loan. In second place is financial hardship (81%) such as home repairs, followed by credit card debt (77%).

Meanwhile, Fitch reports that 6.43 percent of subprime auto loans were at least 60 days past due in August, while Cox Automotive reported last week that the average transaction price for a new vehicle hit $50,000 last month – the highest level eva.

“Auto finance is at a breaking point, as Americans owe over $1.66 trillion in auto debt. Delinquencies, defaults, and repossessions have shot up in recent years and look alarmingly similar to trends that were apparent before the Great Recession,” wrote the Consumer Federation of America, a nonprofit advocacy group.

“Cars are more expensive than ever, due in part to economic factors, but also due to the fraught experience of buying and financing a car. Dealers and lenders have long engaged in deceptive and predatory practices that jack up prices for car buyers in order to line their pockets.”

Tyler Durden

Wed, 10/22/2025 – 11:30ZeroHedge NewsRead More

R1

R1

T1

T1