Germany’s Industrial Core Is Collapsing As PwC Warns Of “Decisive Year”

Submitted by Thomas Kolbe

Germany’s Minister of Economic Affairs, Katherina Reiche (CDU), hopes her new debt package will trigger an economic turnaround. But new data from consulting firm PwC shows the downward spiral in the industrial heart of Germany – its machinery sector – is accelerating.

The path back from economic depression keeps getting longer. PwC’s latest industry analysis shows conditions in machinery manufacturing continued to worsen over the course of the year. For 2024, a sales decline of 5.6 percent is now expected.

No Light at the End of the Tunnel

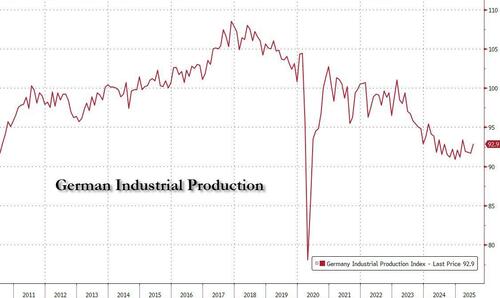

This brings the total production slump since pre-Covid times to over 22 percent. Average capacity utilization has fallen to 80.8 percent – its lowest level in five years. Rising energy-related cost pressures, suffocating regulation, and weakening demand in major export markets such as China and the U.S., also a result of Washington’s tariff policy are pushing output into the basement.

PwC’s industry expert Bernd Jung says: “2025 will be a decisive year for machinery and plant engineering. After the government collapses in France and Germany, alongside geopolitical conflicts, fears are growing about the viability of the sector’s business model.”

This assessment is reinforced by a surge in insolvencies reported by industry association VDMA and Creditreform. Compared to last year, bankruptcies increased by 22 percent. Since January, around 12,000 jobs have been lost in machinery manufacturing. PwC warns another 20,000 could disappear by year’s end if the expected recovery fails to materialize.

A Rabbit in Front of the Snake

Where should the turnaround come from? The federal government remains a monolithic obstacle. Its reaction to this dramatic situation exposes a political class unable to diagnose problems or correct them.

Coalition parties are tangled up in internal disputes and tax-hike fantasies. The only consensus? Defending Brussels’ eco-socialist agenda at any cost. Climate targets—and their catastrophic downstream effects on German industry—are non-negotiable.

The sole measure actually enacted to ease industry pressure is a 30 percent degressive depreciation allowance introduced on July 1. But where little or no investment happens, tax write-offs are meaningless.

A tiny tax cut of €11 billion annually from 2027 for four years is an even smaller band-aid.

To recap: Germany is now the most expensive business location in the OECD—and with a regulatory cost burden of €60 billion, hardly an investor’s paradise.

Investors Are Fleeing Germany

PwC’s report confirms the trend: companies relocate wherever possible. Automakers like BMW and Audi now invest heavily in Hungary—BMW’s expansion in Debrecen being one prime example.

Berlin hopes to counter this trend with a capped industrial electricity price. If adopted into law, about 1,200 energy-intensive firms in chemicals, metals and glass could apply for subsidies capping wholesale power costs at five cents per kWh for up to half their consumption.

The €4 billion relief package is another drop in the ocean—and predictably tied to “climate-friendly production.”

One can’t shake the impression that policymakers have consciously turned against traditional German industry to impose their ideological experiment.

The Myth of Growth

PwC offers a clear view of the near- and mid-term economic outlook—and it’s bleak. While the government celebrates its debt package with fairy tales of an imminent boom, Germany digs itself deeper into economic depression.

Machinery manufacturing is the industrial seismograph: once it shakes, the entire economic engine rattles. These companies are the first to feel when corporate investment is slashed.

The sector is also burdened by the collapse of the German auto industry. What politicians and powerful climate NGOs—such as German Environmental Aid, long suspected of serving foreign interests—call “transformation” was in truth a direct assault on the core of national prosperity.

China, meanwhile, plays a major role in financing anti-industry climate activism in the EU and U.S.

While Beijing showers its automakers with support, Berlin has pulled the rug out from under its own flagship sector—triggering cascading damage throughout the industrial value chain.

Cascading Decline

A cumulative production decline of 22 percent since the 2018 peak is a glaring alarm signal—proof of an economic depression that not only cripples industry but threatens social insurance funds with a debt spiral.

This crisis is triggering a massive social shock, driven by an eco-socialist crash policy that imposes ideology regardless of economic reality. It carries the potential for explosive societal upheaval.

A social crisis of historic scale will erupt the moment the state can no longer reliably provide pensions, ensure basic living standards, or maintain adequate healthcare. Germany has overextended itself—trying to run the world’s social welfare office and a centrally planned green economy at the same time. That “green miracle” now stands revealed for what it always was: a utopian illusion detached from reality.

* * *

About the author: Thomas Kolbe, born in 1978 in Neuss/ Germany, is a graduate economist. For over 25 years, he has worked as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

Tyler Durden

Mon, 10/27/2025 – 07:20ZeroHedge NewsRead More

R1

R1

T1

T1