Key Events This Extremely Busy Week: Central Banks, Earnings Galore, And Trump-Xi Summit

As noted earlier, investors face a monumentally important and extremely busy week ahead that includes rates decisions by four of the G7 central banks, with the Fed and BoC on Wednesday followed by the BoJ and ECB on Thursday. A packed earnings calendar will see reports from five of the Mag-7 (Microsoft, Alphabet, Meta, Apple and Amazon), together representing a quarter of the S&P 500 market cap. But ahead of all that, markets are in a buoyant mood this morning as US and China officials indicated that they have largely aligned a deal to ease trade tensions ahead of the Trump-Xi meeting this Thursday.

Starting with the US-China news, China’s Ministry of Commerce said that the sides reached an initial consensus on a range of issues including an extension of the tariff truce, fentanyl, agricultural trade, export controls and shipping levies. In turn, US Treasury Secretary Bessent suggested that China would defer its new rare-earth export controls for one year and make “substantial” purchases of US soybeans, while the US threat of 100% tariffs on China was “effectively off the table”. Bessent signaled that the agreed “framework” should allow Presidents Trump and Xi to have “a very productive meeting” when they meet on Thursday on the sidelines of the APEC summit. The details from that meeting should give a clearer sense whether this represents a genuine stabilisation in US-China trade relations or only a return to the uneasy trade truce in place before the rhetoric escalated earlier this month. Any reduction of the 20% fentanyl tariffs by the US will be one key barometer to watch.

In other weekend trade news, Trump signed trade framework pacts with Malaysia, Thailand, Vietnam and Cambodia. The countries will allow preferential access for US goods in return for tariff exemptions on some of their exports to the US, though many of exact details are still to be finalised. By contrast, Trump announced a 10% additional tariff on Canada amid a spat over an anti-tariff ad released by the government of Ontario. It’s not clear whether USMCA-compliant goods would remain exempt from the extra 10% levy, which would mitigate much of its impact, but it’s a reminder that tariffs remain a go-to policy tool for the US administration even if peak trade uncertainty is behind us.

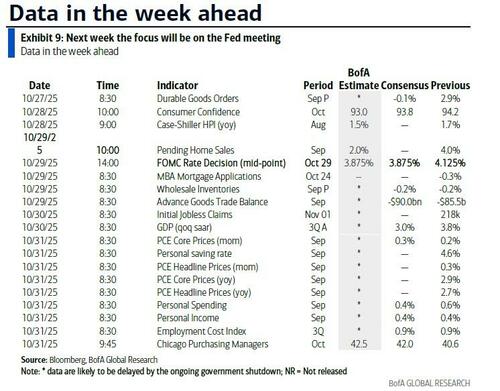

Looking to the week ahead, a second consecutive 25bps Fed cut looks locked in for Wednesday’s FOMC meeting, with markets pricing 49bps of cuts across the next two meetings. With a dearth of data and a still-divided FOMC, economists think Chair Powell is unlikely to provide clear signals on the policy path ahead, focusing more on topics including balance sheet policy and financial stability. Meanwhile, as we first discussed here first, the emerging baseline is that the Fed will this week announce an end to QT in response to the recent tightening in funding markets.

In Europe, the ECB is widely expected to keep the deposit rate steady at 2% for a third consecutive meeting. DB economists think ECB President Lagarde will again describe policy as “in a good place” and will be watching whether she maintains the net hawkish tone that she struck in July and September (see their preview here). The Bank of Japan (Thursday) is expected to maintain its current policy stance (see preview here), while the Bank of Canada is likely to deliver its own 25bp rate cut on Wednesday.

The Q3 earnings season will reach its apex this week with key reports due from Microsoft, Alphabet and Meta on Wednesday as well as Apple and Amazon on Thursday. The five biggest companies in the world after Nvidia now make up $15tn in total market capitalization or 25% of the S&P 500. The full list of key reports is in the week ahead calendar at the end as usual.

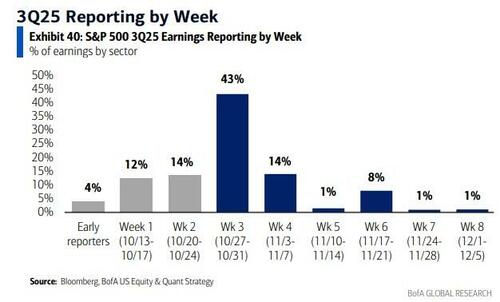

Overall, some 43% of the S&P500 by market will report this week.

On the data front, in the US the Conference Board’s October consumer confidence readings (Tuesday) are likely to be the main indicator of note amid the government shutdown. In the euro area, Germany’s ifo survey today will receive extra attention after last Friday’s jump in the PMIs, the ECB’s quarterly Bank Lending Survey (Tuesday) will precede its rates decision, and we’ll get the October inflation readings for Germany and Spain on Thursday, followed by France, Italy and the Eurozone on Friday. In Asia, we have the October PMIs in China (Friday) as well as September retail sales, industrial production and the Tokyo CPI for October in Japan (Thursday).

Here is a day-by-day calendar of events

Monday October 27

- Data: US September durable goods orders, October Dallas Fed manufacturing activity, China September industrial profits, Germany October Ifo survey, Eurozone September M3

- Central banks: ECB September consumer expectations survey

- Earnings: Welltower, Cadence Design Systems, Deutsche Boerse, Keurig Dr Pepper

- Auctions: US 2-yr Notes ($69bn), 5-yr Notes ($70bn)

Tuesday October 28

- Data: US October Conference Board consumer confidence index, Richmond Fed manufacturing index, Richmond Fed business conditions, Dallas Fed services activity, August FHFA house price index, Germany November GfK consumer confidence, Italy October consumer confidence index, economic sentiment, manufacturing confidence, EU27 September new car registrations

- Central banks: ECB bank lending survey, ECB’s Panetta speaks

- Earnings: Visa, UnitedHealth, Novartis, HSBC, NextEra Energy, Booking, Iberdrola, American Tower, BNP Paribas, Royal Caribbean Cruises, Advantest, Sherwin-Williams, Mondelez, UPS, Corning, PayPal, Electronic Arts

- Auctions: US 7-yr Notes ($44bn)

Wednesday October 29

- Data: US September advance goods trade balance, wholesale inventories, pending home sales, UK September net consumer credit, M4, Japan October consumer confidence index, Italy September PPI, hourly wages, Australia September CPI, Sweden September GDP indicator

- Central banks: Fed’s decision, BoC decision

- Earnings: Microsoft, Alphabet, Meta, SK hynix, Caterpillar, ServiceNow, Airbus, Verizon, Boeing, KLA, Santander, UBS, CVS Health, Keyence, Starbucks, GSK, Carvana, Equinor, Mercedes-Benz, Chipotle, BASF, eBay, adidas, Kraft Heinz

- Auctions: US 2-yr FRN ($30bn)

Thursday October 30

- Data: US Q3 GDP, initial jobless claims, Japan September retail sales, industrial production, jobless rate, job-to-applicant ratio, October Tokyo CPI, Germany Q3 GDP, October CPI, unemployment claims rate, France Q3 GDP, September consumer spending, Italy Q3 GDP, September unemployment rate, August industrial sales, Eurozone October economic confidence, Q3 GDP, September unemployment rate

- Central banks: ECB decision, BoJ decision, Fed’s Logan speaks

- Earnings: Apple, Amazon, Eli Lilly, Mastercard, Samsung Electronics, Merck, Shell, Gilead Sciences, S&P Global, Stryker, TotalEnergies, Hitachi, BYD, AB InBev, BBVA, Comcast, Bristol-Myers Squibb, ROBLOX, Cigna, Howmet Aerospace, Cloudflare, ING Groep, Credit Agricole, Volkswagen, Vale, Universal Music Group, Cheniere Energy, Societe Generale, Monolithic Power Systems, Atlassian, Standard Chartered, Haleon, Reddit, Estee Lauder

Friday October 31

- Data: US September PCE, personal income and spending, October MNI Chicago PMI, Q3 employment cost index, China October PMIs, UK October Lloyds Business Barometer, Germany September retail sales, import price index, Japan September housing starts, France October CPI, September PPI, Italy October CPI, Eurozone October CPI, Canada August GDP, Australia September PPI

- Central banks: Fed’s Logan, Hammack and Bostic speak, ECB’s survey of professional forecasters

- Earnings: Exxon Mobil, AbbVie, Chevron, Linde, Intesa Sanpaolo, Tokyo Electron, Colgate-Palmolive, Charter Communications

Finally, looking at just the US, several key data releases will almost certainly be postponed this week because of the government shutdown, including the durable goods report scheduled for release on Monday, the advance goods trade balance scheduled on Wednesday, the Q3 advance GDP report scheduled on Thursday, and the core PCE inflation scheduled on Friday. The Department of Labor will also postpone the official release of the jobless claims report if the government shutdown continues through Thursday, but preliminary state-level claims data will likely be available. There are no speaking engagements by Fed officials this week, reflecting the FOMC’s blackout period.

Monday, October 27

- 08:30 AM Durable goods orders, September preliminary (GS +1.0%, consensus +0.2%, last +2.9%); Durable goods orders ex-transportation, September preliminary (GS +0.2%, consensus +0.2%, last +0.4%); Core capital goods orders, September preliminary (GS +0.1%, consensus +0.3%, last +0.6%); Core capital goods shipments, September preliminary (GS +0.2%, last -0.3%): We estimate that durable goods orders increased 1.0% in the preliminary September report (month-over-month, seasonally adjusted), reflecting an increase in commercial aircraft orders. We forecast a 0.1% increase in core capital goods orders—reflecting an improvement in the new orders components of manufacturing surveys but potential payback for the outsized increase in the prior month—and a 0.2% increase in core capital goods shipments—reflecting the increase in orders in the prior month.

Tuesday, October 28

- 09:00 AM S&P Case-Shiller home price index, August (GS -0.2%, consensus -0.1%, last -0.1%)

- 10:00 AM Conference Board consumer confidence, October (GS 93.0, consensus 93.4, last 94.2)

Wednesday, October 29

- 08:30 AM Advance goods trade balance, September (GS -$78.0bn, consensus -$90.0bn, last -$85.5bn): We forecast that the goods trade deficit narrowed by $7.5bn to $78.0bn, reflecting an increase in gold exports and a sharp pullback in imports of electronic products from Taiwan.

- 10:00 AM Pending home sales, September (GS +3.5%, consensus +2.0%, last +4.0%)

- 02:00 PM FOMC statement, October 28-29 meeting: As discussed in our FOMC preview, we expect the FOMC to deliver another 25bp rate cut to 3.75-4% at its October meeting. The median projection in the September dot plot showed a baseline of three cuts this year, and with the official data paused by the government shutdown and alternative labor market data mixed at best, there is no reason to deviate from the plan to support the labor market for now. We do not expect formal guidance about the December meeting, but if Chair Powell is asked, he will likely be comfortable referencing the September dots, which imply a third cut in December.

Thursday, October 30

- 08:30 AM Initial jobless claims, week ended October 25 (GS 230k, consensus 229k, GS estimate of last 227k); Continuing jobless claims, week ended October 18 (consensus 1,925k, GS estimate of last 1,935k)

- 08:30 AM GDP, Q3 advance (GS +3.3%, consensus +3.0%, last +3.8%); Personal consumption, Q3 advance (GS +3.1%, consensus +3.2%, last +2.5%); Core PCE inflation, Q3 advance (GS +2.91%, last +2.6%): We estimate that GDP rose 3.3% annualized in the advance reading for Q3, following a +3.8% annualized increase in Q2. Our forecast reflects a rebound in imports growth (-6.4%, quarter-over-quarter annualized vs. -29.3% in Q2 and +38.0% in Q1) after frontloading ahead of tariff increases distorted imports growth in the prior quarters. We expect a further acceleration in consumption growth (+3.1% vs. +2.5% in Q2) but another quarter of soft residential investment growth (-8.6% vs. -5.1% in Q2). We estimate that domestic final sales rose 2.4% in Q3, and that the core PCE price index increased 2.91% annualized (or 2.88% year-over-year) in Q3.

Friday, October 31

- 08:30 AM Personal income, September (GS +0.3%, consensus +0.4%, last +0.4%); Personal spending, September (GS +0.1%, consensus +0.4%, last +0.6%); Core PCE price index, September (GS +0.24%, consensus +0.2%, last +0.2%); Core PCE price index (YoY), September (GS +2.87%, consensus +2.9%, last +2.9%) ; PCE price index, September (GS +0.30%, consensus +0.3%, last +0.3%); PCE price index (YoY), September (GS +2.83%, consensus +2.8%, last +2.7%): We estimate that personal income and personal spending increased by 0.3% and 0.1%, respectively, in September. We estimate that the core PCE price index rose 0.24% in September, corresponding to a year-over-year rate of +2.87%. Additionally, we expect that the headline PCE price index increased 0.30% in September, corresponding to a year-over-year rate of +2.83%. We estimate that market-based core PCE rose 0.18% in September.

- 08:30 AM Employment cost index, Q3 (GS +0.8%, consensus +0.9%, last +0.9%): We estimate the employment cost index rose by 0.8% in Q3 (quarter-over-quarter, seasonally adjusted), which would leave the year-on-year rate unchanged at 3.6% (year-over-year, not seasonally adjusted). Our forecast reflects a sequentially slower pace of wage and salary growth—reflecting the signals from the Atlanta Fed’s wage tracker and average hourly earnings—but a slight rebound in ECI benefit growth after a weak increase in Q2.

Source: BofA, Goldman

Tyler Durden

Mon, 10/27/2025 – 10:15ZeroHedge NewsRead More

R1

R1

T1

T1