Qualcomm Debuts AI Data-Center Chips, Stock Soars Most In Nearly 7 Years

Qualcomm shares jumped the most in years on Monday morning in New York following the major unveiling of next-generation data center chips aimed at challenging Nvidia’s control of the AI data center chip market.

Qualcomm introduced two new chips, the AI200 (launching in 2026) and the AI250 (launching in 2027), both designed to scale into full, liquid-cooled server rack systems. This move marks its expansion beyond traditional mobile and wireless chip business and into high-performance data center AI.

Details on the new chips:

AI200 is designed for efficient large-scale inference for large language models and multimodal models. It features 768 GB of LPDDR memory per accelerator card, supporting high memory capacity at a lower cost.

AI250 builds on that foundation with a new near-memory computing architecture that delivers more than 10 times the effective memory bandwidth while using significantly less power. This enables disaggregated inference, letting data centers allocate compute more flexibly while maintaining performance efficiency.

Both chips are supported by Qualcomm’s hyperscaler-grade software stack, offering easy deployment (including Hugging Face integration), compatibility with leading AI frameworks, and tools for secure, scalable generative AI.

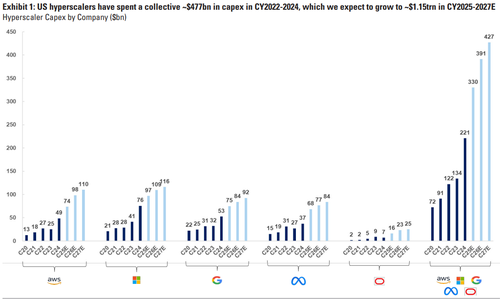

Qualcomm’s shift into the data center chip market is mostly because management is following the money: AI data center spending is projected to reach about $6.7 trillion by 2030, and Nvidia currently controls more than 90% of today’s AI accelerator market. Meanwhile, OpenAI and major cloud providers such as Google, Amazon, and Microsoft have been searching for new alternatives to Nvidia by developing or sourcing competing chips.

“With Qualcomm AI200 and AI250, we’re redefining what’s possible for rack-scale AI inference,” said Durga Malladi, SVP & GM of Technology Planning, Edge Solutions & Data Center at Qualcomm. “These new AI infrastructure solutions enable generative AI at unprecedented TCO while maintaining the flexibility and security modern data centers require.”

Malladi added that Qualcomm’s software ecosystem is designed for easy integration, management, and scaling of already trained AI models across businesses and cloud environments.

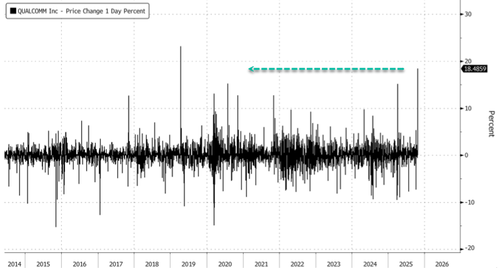

Qualcomm shares surged nearly 20%, the largest gain since April 16, 2019…

… and reached the highest level since April 2024. Meanwhile, Nvidia shares were also up 2%..

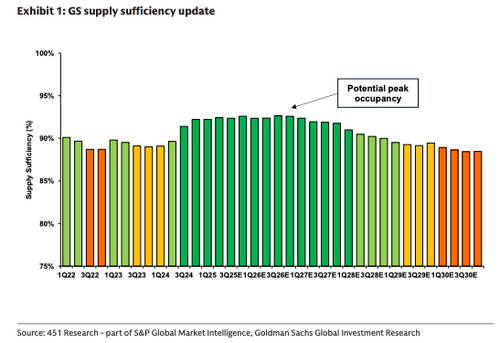

Goldman Sachs analyst James Schneider recently told clients that peak data center build-out demand now appears likely to extend well into 2026 before gradually easing in 2027 (read here).

Follow the money.

Qualcomm also announced that Saudi Arabia’s AI startup Humain will be the first customer, targeting 200 megawatts of compute capacity based on the new chips beginning next year.

Tyler Durden

Mon, 10/27/2025 – 10:55ZeroHedge NewsRead More

R1

R1

T1

T1