Stellar 5Y Auction Stops Through, As Foreign Demand Jumps

90 minutes after the day’s first auction, which saw foreign demand for $69Bn in 2Y paper slide, moments ago the Treasury concluded its second coupon auction of the day, and this one was far stronger.

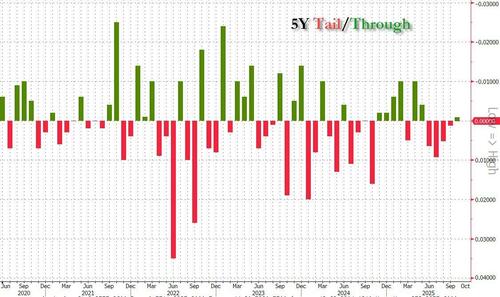

Pricing at a high yield of 3.625%, not only was this the lowest high yield since Sept 24, but also stopped through the 3.626% When Issued by 0.1bps, the first stop through for the 5Y tenor since May, in many ways a mirror image of what we said in today’s earlier auction.

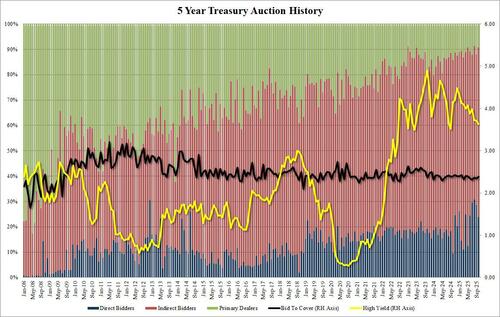

The bid to cover – which has traded in an extremely narrow range in the past year between 2.30 and 2.50 – rose from 2.34 to 2.38, the highest since May, and above the 2.36 recent average.

The internals were more impressive, with Indirects jumping from 59.42 last month to 66.84, the highest since May and above the 64.2% recent average: this sharp increase in foreign demand was also a mirror image to the slide in Indirects in today’s earlier 2Y auction. And with Directs awarded 23.9%, or down from 28.6% and the lowest since May (a far cry from the near record Directs in today’s 2Y auction, if above the recent average of 22.1%), Dealers were left with a modest 9.3% of the 5Y auction, below the recent average of 10.7%.

Overall, this was a much more solid auction than the earlier 2Y sale, and yields reflected this with 10Y yields dipping below 4.00% having risen as high as 4.04% earlier.

Tyler Durden

Mon, 10/27/2025 – 13:32ZeroHedge NewsRead More

R1

R1

T1

T1