Retail & Central Bank ‘Dip-Buyers’ Emerge As Gold Drops Below $4000

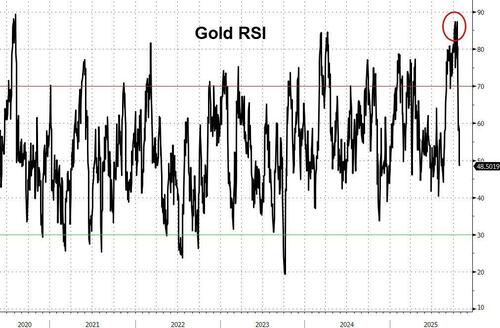

Gold is “an overcrowded trade that’s overextended by every technical metric,” Nicky Shiels, head of research at precious metals refiner MKS Pamp SA, wrote in early October, getting ever more overbought.

The reckoning came last week and extended losses this week, with the precious metal back below $4,000…

Source: Bloomberg

The crash that everyone saw coming has now dragged the commodity well off the ledge of overboughtness…

Source: Bloomberg

The ‘dip’ has, however, brought out a new wave of buyers – from retail lurkers to central banks finally waking up.

Amid pictures of lines outside gold stores around the world flooding social media over the past month, Bloomberg reports that, in Bangkok’s Chinatown, the nation’s gold trading hub, Sunisa Kodkasorn, a 57-year-old textile factory worker, had no doubt about whether this move is a turning point in gold’s multiyear bull market, or just a dip?

“Gold is the best investment,” she said.

“We decided to gather all our money and come today because we knew prices had dropped.”

She’s not alone: from Singapore to the US, dealers told Bloomberg they had seen a rush of interest from people looking to buy gold as prices dropped this week. Kodkasorn’s attempt to buy the dip was stymied because the size of gold bar she could afford was sold out.

“Bull markets always need a healthy correction to weed out froth and ensure the cycle has duration,” Shiels, whose initial note came a fortnight before prices peaked, said this week.

“Prices should consolidate and revert to a more measured bullish trajectory.”

It remains hard to find a gold bear among precious metals analysts whose forecasts – for the most part – have been bullish but not bullish enough over the course of the last two years.

When the London Bullion Market Association carried out a survey of analysts at the start of the year, almost every respondent expected prices to rise, but none thought it could trade above $3,300 during 2025.

“We expect de-risking and profit taking by investors to be met by dip buying from other segments of demand including central banks and other physical buyers, ultimately keeping reversals relatively shallow,” Gregory Shearer at JPMorgan Chase & Co. said in a note this week.

Pete Walden, deputy chief executive officer at BullionStar, a dealership in Singapore, said his company had had its busiest day ever on Tuesday.

“We had a queue before opening, with many more buyers than sellers,” he said. “I think many are using it as an opportunity to buy the dip.”

In the US, Stefan Gleason of dealer Money Metals Exchange LLC, said his company had more interest from “bargain hunting” buyers than it could handle.

But it’s not just the retail market participant who is buying this precious metals dip…

Bloomberg reports that South Korea’s central bank is weighing plans to add to its gold reserves for the first time in more than a decade.

“The Bank of Korea plans to consider additional gold purchases from a medium- to long-term perspective,” said Heung-Soon Jung, director of the Reserve Investment Division at the bank’s Reserve Management Group.

The last time the bank added to its gold holdings was 2013, according to Jung, speaking at an event hosted by the London Bullion Market Association and London Platinum and Palladium Market in Kyoto on Tuesday.

His remarks offer a rare insight into the attitude of central banks to bullion reserves.

While their purchases have become an ever more important driver of prices in recent years, central bankers rarely speak in public about the gold market.

Jung said the Bank of Korea would monitor markets to decide the timing and size of any gold purchases.

Any decision would be based on the evolution of its international reserves, as well as the trajectories of gold and the Korean won, he added.

The Bank of Korea faced criticism domestically after purchasing gold in 2011-2013, just before the metal entered a multiyear price slump.

It hasn’t bought gold since, even as a wave of buying by other central banks has helped drive up prices in recent years.

Now may well be the time to follow retail in and BTFD for the next wave of global liquidity.

Tyler Durden

Tue, 10/28/2025 – 18:00ZeroHedge NewsRead More

R1

R1

T1

T1