All Hell Breaks Loose In Repo Markets… And Why A Historic Meltup Could Follow

Back on October 15, when looking at the sudden and dramatic deterioration in funding markets, we wrote “On The Verge Of A Funding Crisis: Fed’s Emergency Liquidity Facility Unexpectedly Soars Most Since COVID” in which we explained why, well before it became a consensus view (as the banks “agreed” one week later), the Fed should not only immediately suspend its Quantitative Tightening (which it did last week) but also restart purchases of securities (as Bank of America’s Mark Cabana echoed two weeks later).

Cabana: “we see room for Fed to not only end QT in October but restart balance sheet growth” https://t.co/76BmjxRXoE

— zerohedge (@zerohedge) October 29, 2025

And while funding conditions continued their deterioration even after the Fed officially announced the end of QT (if not, however, from Nov 1 as some suspected but decided to wait for one full month until Dec 1) as measured by such repo market metrics as SOFR and General Collateral rates, as well as activity on the Fed’s Standing Repo Facility, many were expecting that liquidity might stabilize after month end, when banks traditionally “window-dress” their books and soak up liquidity.

That has not happened… and instead it appears that our observation that waiting until December to end QT may be the latest policy error delivered by the Powell Fed.

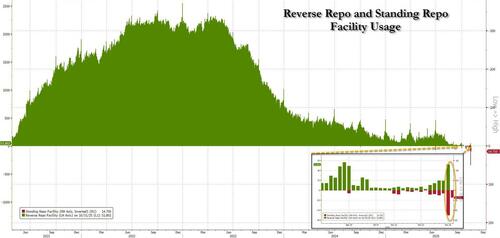

Here’s the problem: after the Fed’s Standing Repo Facility hit a record $50.35 billion on Friday (a surge driven in large part by month-end dynamics), and which was offset almost perfectly by reverse repo facility usage (at $51BN), it was expected that the repo usage slide today. Well it did… but nowhere near where it should have if the repo situation had normalized.

As shown below, today at 8:30am, the Fed’s Standing Repo Facility operation saw $14.75BN in accepted repos ($7.5BN TSY and $7.25BN MBS), which while below Friday’s outlier record, was still the 2nd highest since the SRF facility became permanent.

Some more context: with the Reverse Repo facility now more or less empty, the only repo that will be used going forward will be on the standing repo facility, which – all else equal – will lead to further repo market tightness, especially since QT is still operational for the month of November.

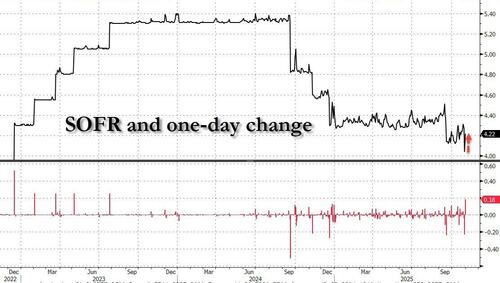

It gets worse: to get a sense of just how tight funding markets got on Friday, look no further than the SOFR rate which on Oct 31 surged 22bps – the biggest jump in a year – to 4.22%. Indicatively, the rate should be at around 4.00% to account for last week’s rate cut. Instead, it’s as if the Fed never cut…

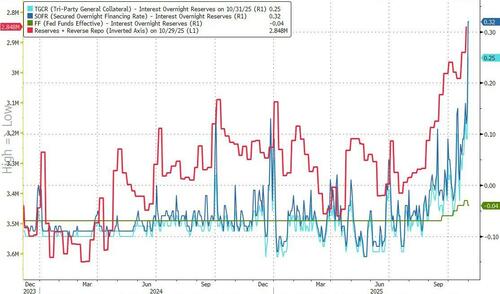

Of course, a better way to show this rate normalized for the Fed Funds rate, is to show the SOFR less Interest on Overnight Reserve spread (the de facto mid-line target of the Fed funds corridor), and here one can see just how bad the situation was at month end, as the spread blew out to 32bps, the highest since March 2020 when the repo market had virtually frozen amid the basis trade implosion after the covid collapse.

It wasn’t just SOFR blowing out: the tri-party General Collateral rate spread (to IOR) also soared to 25bps, the highest since covid.

While these are all rates as of Friday, general collateral prints from this morning shows that there is little stabilization as rates remained volatile on Monday, even as market participants expected funding costs to normalize now that month-end, Canadian year-end and Treasury coupon auction settlements have passed.

According to ICAP, overnight GC repo rates first traded at 4.24%, 4.23%, 4.22%, 4.20%, 4.18%, 4.17%, 4.18%, 4.19%, 4.20%, 4.18%, 4.17%, 4.14% with a bid-ask of 4.20%-4.14%. By comparison, on Friday overnight GC for Monday last traded at 4.25%/4.23% after opening at 4.19%, 4.20%, 4.22%, 4.25%, 4.28%. MBS for Monday traded at 4.31%/4.28% after opening at 4.23%, 4.25%, 4.30%, 4.31%

Those numbers are far above the Federal Reserve’s interest on reserve balances rate (IORB) of 3.9% and outside the range for the effective federal funds rate, which is now 3.75% to 4%.

All of this brings us to the first chart showing the surprising usage of this morning’s SRF facility, which should have been far lower if last week’s repo market meltdown was just a function of month-end tightness. And now we have the day’s second SRF auction just after 1pm to see how liquidity is moving throughout the trading day (if Bitcoin is any indication here, it won’t be an improvement).

And while we previously discussed some of the key drivers behind the ongoing funding squeeze, perhaps the most important one bears repeating as it will continue to deteriorate until the government remains shut.

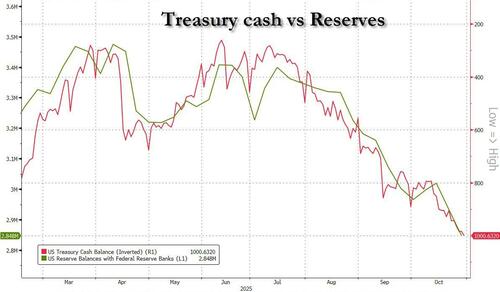

Recall, that one of the biggest uses of market funding is the Treasury itself, and specifically the Treasury General Account. Well, as of Friday’s close, the cash parked at the Treasury just surpassed $1 trillion for the first time in almost 5 years, the highest since April 2021.

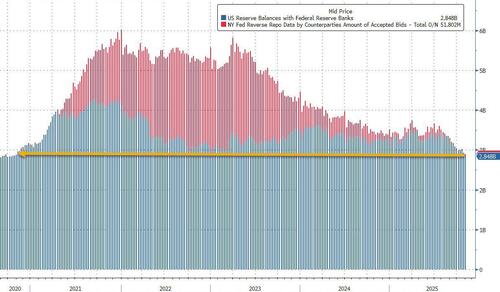

As a result of the continued government shutdown which has forced the Treasury to soak up all free cash, and the immediate consequence has been the plunge in Fed reserves, which have tumbled to just $2.85 trillion, the lowest since early 2021…

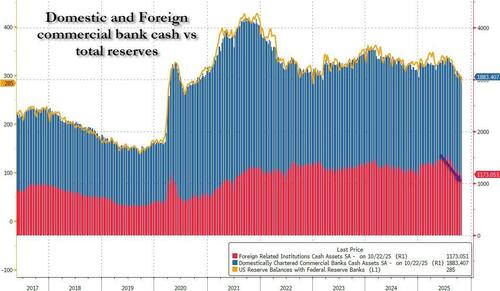

… and the result of a sharp drop in cash assets at foreign Commercial Banks (as seen in the Fed’s H.8 statement), which peaked at just over $1.5 trillion in July and has since fallen by over $300 billion to $1.173 trillion. In other words, it appears that the biggest casualty of the government shutdown, and the primary reason why funding conditions have tightened so much, is cash held by foreign banks, which has plunged in the past 4 months and has effectively been commandeered by the Treasury to pay for day to day items while the government is shut down.

Finally, showing just how precarious the broader funding situation is, consider this chart showing Fed Reserves plus Reverse Repos (which for the past 3 years served as an excess liquidity storage facility used primarily to fund purchases of T-Bills, and which has now run dry). As one can see, the total is now the lowest it has been since late 2020!

At this point we can make several observations.

Yes, the funding situation is dire and could deteriorate rapidly from here, as the Fed’s ongoing QT continues to drain liquidity from a system already on the edge. And since market funding is brutally reflexive, should daily indicators of repo tightness (SOFR, General Collateral, Standing Repo usage) deteriorate even more, it is possible that markets will retrench, draining even more liquidity and creating a toxic feedback loop, similar to the one observed during the Sept 2019 repo crisis and the March 2020 basis trade crash.

That’s the bad news. The good news is that the primary reason for the funding drain, as shown above, is the Treasury itself, which has prompted some tongue-in-cheek observations that Bessent is now de facto in charge of the Fed as his fiscal policy (largely during the government shutdown period) determines monetary policy.

And just like that, Bessent replaced Powell pic.twitter.com/dSLqNNBuXO

— zerohedge (@zerohedge) November 1, 2025

In fact, one could argue that the Fed would not have ended QT has the Treasury General Account (i.e. cash balance) not soared from $300 billion to $1 trillion in the past 3 months.

Which of course, leads us to the conclusion: since the government shutdown has acted as de facto rate hikes, draining over $700 billion in liquidity from the market, a reversal of the current status quo would lead to a flood of new funding being released into the market, as the Treasury is no longer subject to the special government shutdown accounting, and release hundreds of billions in cash from the Fed’s Treasury General Account into the broader economy.

Indeed, similar to our accurate prediction in early 2021 when we lived through the exact same scenario (see :”Mind-Boggling Liquidity”: Nobody Is Paying Attention To The $1.1 Trillion Flood About To Hit Markets“) once the government is reopened, the accelerated drain of the Treasury cash balance – which would be the 2025/2026 equivalent of the Stealth QE we noted back in 2021 – could spark a huge scramble for risk assets, just in time for year end, sending the stock market sharply higher.

Which is why the fate of the capital markets – and such liquidity-heavy assets as bitcoin, small caps and pretty much everything non-AI – is now in the hands of Chuck Schumer. Once the Democrat capitulates and agrees to reopen the government, expect a prompt normalization of the repo market and a slingshot higher across all risk assets.

Of course, this is not a viable, long-term solution: America’s massive budget deficits mean that funding conditions will once again deteriorate and the Fed will have to step in, only with real asset purchases this time, just as BofA’s Mark Cabana predicted recently. However, we will cross that bridge in time – for now focus on the day to day funding conditions, and keep in mind that the worse it gets in the near-term, the better it will be over the medium-term as all the stored up liquidity is released.

Tyler Durden

Mon, 11/03/2025 – 13:00ZeroHedge NewsRead More

R1

R1

T1

T1