Deeply-Divided Bank Of England Leaves Rates Unchanged, Warns Of “AI Bubble”

The Bank of England kept its key interest rate at 4.0% this morning, opting against a cut (as the market expected) ahead of the UK government’s annual budget this month (which is expected to feature tax hikes).

“We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our two-percent target before we cut them again,” BoE governor Andrew Bailey said in a statement following the widely-expected decision.

The decision was very tight as policymakers including Bailey voted 5-4 to maintain the rate.

Four members of the Monetary Policy Committee (MPC) called for a cut to 3.75 percent.

The BoE last cut its key rate in August amid concerns over the impact of US tariffs on the UK economy.

Importantly, the minutes of the meeting noted that “overall the risks [to the inflation outlook] are now more balanced” but that more evidence is needed. The last reference essentially conditions the next interest cut to further progress in the data.

As regards the forward guidance, the MPC left the overall message broadly unchanged but did change the wording by removing “careful” and now saying that “[i]f progress on disinflation continues, Bank Rate is likely to continue on a gradual downward path.”

Interestingly, while the BoE’s guidance is dovish, its forecasts continue to have an inflation overshoot for the whole of next year and into 2027 – CPI is seen at 2.5% in Q4 2026 and 2.0% in Q4 2027 2.0%, based on market rates.

The BoE’s December meeting is definitely in play based on Governor Bailey’s comment:

“The downside scenario seems more likely. It could help explain the elevated saving rate, and Agents’ intelligence on uncertainty. Rather than cutting Bank Rate now, I would prefer to wait and see if the durability in disinflation is confirmed in upcoming economic developments this year. Current market pricing is close to the path suggested by a forward-looking Taylor rule, which is a fair description of my position at present”.

OIS pricing for the December meeting has moved to around 16.5bp, from around 11bp priced before the decision (or a 66% chance of a cut.

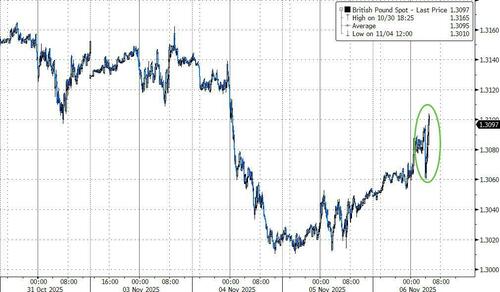

Cable strengthened on the ‘hold’…

Finallym, during his press conference, Bailey also weighed in on the frothy valuations in stock markets, led by US tech stocks and the AI megatrend, saying that “we could have an AI bubble” and that is being watched closely for any implications on financial stability.

Tyler Durden

Thu, 11/06/2025 – 08:15ZeroHedge NewsRead More

R1

R1

T1

T1