Key Events This Week: Jobs Report Could Come As Soon As Thursday Once Govt Reopens; Fed Speakers Galore

As DB’s Jim Reid puts it poetically, it looks like white smoke is finally emerging from Capitol Hill as late on Sunday night in the Senate there was a 60-40 procedural vote to advance a bill that would end the shutdown as enough moderate Democrats broke ranks with party leadership to progress a bill that would fund Agriculture, Veterans Affairs and the operations of Congress for the full-year, even if other agencies would only be funded through to January 30th. It seems to persuade the moderate Democrats to support the bill, a vote has been promised in December in extending the Affordable Care Act (ACA) subsidies that run out at year-end. The timetable from here is slightly less clear but we could get a full vote today or tomorrow assuming no procedural delays.

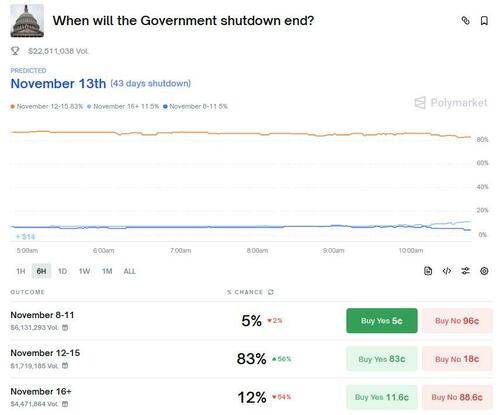

Probability markets are starting to price in the end game with a 88% expectation that the shutdown will be over by November 16th on Polymarket, a contract high.

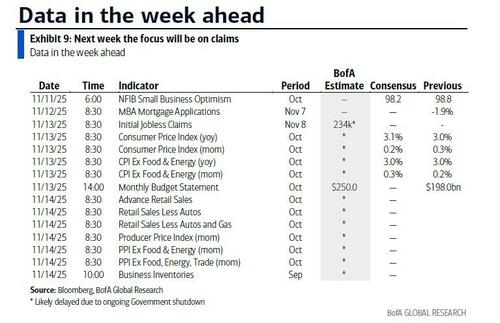

Once the government reopens, markets will face a surge of delayed data releases. Historical precedent from the 2013 shutdown suggests that September’s employment report could be among the first to hit the wires, potentially within three business days of reopening. DB expects payrolls to rebound sharply, with headline and private payrolls both forecast at +75k, leaving the unemployment rate steady at 4.3%. So we could get this Thursday or Friday. The October CPI print is also scheduled for Thursday although it is likely that that number won’t come on time, even if the government reopens before then.

Expanding upon this week, on the policy front, the Federal Reserve calendar is busy but unlikely to deliver major surprises. Today brings remarks from St. Louis Fed’s Musalem, who has maintained a hawkish tone. Wednesday is the most crowded day, featuring speeches from Williams, Waller, Bostic, Miran and Collins across conferences on Treasury markets, fintech and community banking. Later in the week, Musalem and Hammack will join fireside chats, while Schmid and Bostic close out Friday with discussions on energy and economic trends.

Beyond Capitol Hill and the Fed, investors will monitor the Supreme Court following last week’s oral arguments in the IEEPA tariff case. Judging by the tone of questioning, the Court appears skeptical of the Administration’s position, suggesting a likely affirmation of lower court rulings. A decision could potentially come quickly, but history points to a longer timeline— with the average time line around 15 weeks – but it could stretch out to the end of the term in June.

While US politics and data dominate, global developments will also shape sentiment. In Europe, the UK releases third-quarter GDP on Thursday and labour market data on Tuesday, alongside inflation prints in Denmark and Norway (today) and Germany’s ZEW survey (tomorrow). In Asia, China has its monthly economic activity data dump on Friday. Japan will publish the Economy Watchers Survey tomorrow and producer price inflation on Wednesday.

Corporate earnings remain in focus globally. In the United States, results from Cisco, Walt Disney and Applied Materials will be closely watched. European heavyweights reporting include Siemens, Deutsche Telekom and Enel, while Asia sees Tencent, JD.com, SoftBank and Sony. With nearly 90% of S&P 500 companies having reported, the bulk of earnings season is behind us, but these names will still provide important signals on sectoral health and global demand. Of the S&P 500 companies that have reported earnings for the third quarter — about 80% of the index by market cap — have grown the bottom line by 14.6%, effectively doubling what analysts were expecting.

Here is a day-by-day calendar of events

Monday November 10

- Data: Japan September leading index, coincident index, BoP current account balance, BoP trade balance, October bank lending, Denmark and Norway October CPI

- Central banks: BoJ’s Nakagawa speaks, BoE’s Lombardelli speaks

- Earnings: CoreWeave, Barrick Mining, Rocket Lab, AST SpaceMobile, Venture Global, Paramount Skydance, Rigetti Computing, Maplebear

- Auctions: US 3-yr Notes ($58bn)

- Other: COP30 starts in Brazil (through Nov 21)

Tuesday November 11

- Data: UK September average weekly earnings, unemployment rate, October jobless claims change, Japan October Economy Watchers survey, M2, M3, Germany November Zew survey, Eurozone November Zew survey

- Central banks: ECB’s Vujcic and Kocher speak, BoE’s Greene speaks

- Earnings: SoftBank, Sony, Sea, Munich Re, Vodafone, Oklo

- Other: US Veterans Day, G7 foreign ministers meeting (through Nov 12)

Wednesday November 12

- Data: Japan October PPI, machine tool orders, Germany September current account balance, Italy September industrial production, Canada September building permits

- Central banks: Fed’s Barr, Williams, Waller, Miran, Paulson and Bostic speak, ECB’s Schnabel and Guindos speak, BoE’s Pill speaks

- Earnings: Cisco, TransDigm, Infineon, Flutter Entertainment, RWE, Bayer, On Holding

- Auctions: US 10-yr Notes ($42bn)

- Other: US Treasury market conference

Thursday November 13

- Data: UK October RICS house price balance, September monthly GDP, Eurozone September industrial production, Australia October labour force survey

- Central banks: Fed’s Musalem speaks, ECB’s economic bulletin, ECB’s Villeroy and Elderson speak, BoE’s Greene speaks

- Earnings: Tencent, Siemens, Walt Disney, Applied Materials, Deutsche Telekom, Enel, Merck KGaA, JD.com, Burberry

- Auctions: US 30-yr Bonds ($25bn)

Friday November 14

- Data: China October retail sales, industrial production, investment, home prices, Japan September Tertiary industry index, Italy September trade balance, general government debt, Eurozone September trade balance, Q3 employment, Canada September manufacturing sales

- Central banks: Fed’s Bostic and Schmid speak, ECB’s Lane, Elderson and Vujcic speak

- Earnings: Allianz, Cie Financiere Richemont, Siemens Energy

- Other: EU’s economic and financial affairs council on the EU budget

Turning just to the US, Goldman says that assuming the shutdown ends in mid-November, the bank expects the release of the September employment report a few days after reopening. The statistical agencies will announce new release dates for the other postponed releases in advance. If the BLS decides to release the October employment report, expect its release along with the November report either on schedule on December 5 or delayed by one week.

Monday, November 10

- There are no major economic data releases scheduled.

- 09:45 AM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will be interviewed on Bloomberg TV. On November 6, Musalem said that the cuts at the September and October FOMC meetings were “appropriate, but we have to be very careful to continue to lean against above-target inflation, while continuing to provide some insurance to the labor market.” He also said, “Monetary policy is somewhere between modestly restrictive and neutral, and it’s getting close to neutral in terms of financial conditions.”

Tuesday, November 11

- 06:00 AM NFIB small business optimism, October (consensus 98.2, last 98.8)

- 10:25 PM Fed Governor Barr speaks: Fed Governor Michael Barr will speak on AI and innovation at the Singapore FinTech Festival. Speech text and moderated Q&A are expected. On October 9, Barr said that “although several data points indicate that the labor market may be roughly in balance, we also know there has been a sharp drop in job creation since May, which suggests risks to the labor market going forward.” However, he also noted that the “Federal Reserve’s price stability goal faces significant risks,” adding that he is “skeptical of assurances that we should fully look through higher inflation from import tariffs.”

Wednesday, November 12

- There are no major economic data releases scheduled.

- 09:20 AM New York Fed President Williams (FOMC voter) speaks: NY Fed President John Williams will deliver the keynote address at the 2025 US Treasury Market Conference. Speech text is expected. On October 9, Williams said that “the risk of a further slowdown in the labor market is something I’m very focused on.” He added that “if anything, the information suggested that the tariffs effects have been a little smaller than I expected,” highlighting that “there are more downside risks to the labor market and employment.”

- 10:00 AM Philadelphia Fed President Paulson (FOMC non-voter) speaks: Philadelphia Fed President Anna Paulson will speak at the Ninth Annual Fintech Conference hosted by the Federal Reserve Bank of Philadelphia. Speech text is expected. On October 13, President Paulson noted that her “base case is that tariffs will increase the price level, but they won’t leave a lasting imprint on inflation” and that “given this base case, monetary policy should look through tariff effects on prices.” She added that “over the rest of this year, I view easing along the lines of the median Summary of Economic Projections policy path as appropriate.”

- 10:20 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak on payments at the Philadelphia Fed’s Ninth Annual Fintech Conference. Q&A is expected. On October 31, Governor Waller said that “the biggest concern we have right now is the labor market.” He added that “we know inflation is going to come back down, so this is why I’m still advocating that we cut policy rates in December, because that’s what all the data is telling me to do.”

- 12:15 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak about economic trends at the Atlanta Economics Club. Speech text and Q&A are expected. On October 31, Bostic said, “I was able to get behind [the cut at the October meeting] because I still think we’re in restrictive territory and that, to me, is the most important thing. We can’t really forget that inflation is a significant problem, and we have to get that back down to our 2 percent target. I think we can still do it, but with each step we get closer and closer to neutral in ways that make me uncomfortable.”

- 12:30 PM Fed Governor Miran speaks: Fed Governor Stephen Miran will participate in a fireside chat at the University of Cambridge Judge Business School. Q&A is expected. On November 6, Miran said, “I would expect based on current information that we end up cutting in December, but nothing is absolutely guaranteed at the end of the day.”

- 04:00 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will speak at the Boston Fed’s 4th Annual Regional & Community Bankers Conference. Speech text is expected. On October 14, Collins said, “With inflation risks somewhat more contained, but greater downside risks to employment, it seems prudent to normalize policy a bit further this year to support the labor market.”

Thursday, November 13

- 08:30 AM Initial jobless claims, week ended November 8 (GS 230k, consensus 230k, GS estimate of last 228k); Continuing jobless claims, week ended November 1 (GS estimate of last 1,954k)

- 12:15 PM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will speak at a fireside chat on the US economy and monetary policy at the Evansville Regional Economic Partnership’s Economic Impact and Policy Forum. Q&A is expected.

- 12:20 PM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak in a fireside chat at the Economic Club of Pittsburgh. Q&A is expected. On November 6, Hammack said, “After last week’s meeting, I see monetary policy as barely restrictive, if at all, and it’s not obvious to me that monetary policy should do more at this time.”

Friday, November 14

- 09:20 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated discussion at the Association for Public Policy Analysis and Management annual conference.

- 10:05 AM Kansas City Fed President Schmid (FOMC voter) speaks: Kansas City Fed President Jeff Schmid will speak on monetary policy and the economic outlook at the Kansas City Fed and Dallas Fed’s energy conference. Q&A is expected. In his dissent essay on October 31, Schmid said, “By my assessment, the labor market is largely in balance, the economy shows continued momentum, and inflation remains too high. I view the stance of policy as only modestly restrictive. In this context, I judged it appropriate to maintain the policy rate at this week’s meeting.”

Source: DB, Goldman

Tyler Durden

Mon, 11/10/2025 – 11:10ZeroHedge NewsRead More

R1

R1

T1

T1