WTI Holds Gains Despite Big Crude Build, New Record US Crude Production

Oil prices are bouncing modestly off of yesterday’s ugly drop driven by OPEC+’s outlook for a sizable surplus (glut) ahead. The IEA also flagged a deteriorating outlook for a sixth consecutive month, saying in a report on Thursday that supply will exceed demand by just over four million barrels a day next year.

“There’s a lot of oil supply that’s coming back from the OPEC+ countries,” Chevron Corp. Chief Executive Officer Mike Wirth told Bloomberg Television.

“There’s a period of time when it would appear we’re going to see more supply coming into the market than demand will be able to absorb.”

At the same time, Bloomberg reports that the Trump administration has moved to raise the pressure on Russia to end the war in Ukraine, including sanctions on Rosneft PJSC and Lukoil PJSC. An oil trading firm that’s a unit of Russian oil giant Lukoil is starting to terminate jobs with days to go until sanctions fully kick in.

“The latest round of sanctions appear significant and there’s clear risk to supply,” Toril Bosoni, head of the oil markets division at the International Energy Agency, said in a Bloomberg TV interview.

That, coupled with Ukraine attacks against Moscow’s energy infrastructure, has helped to support fuel prices and offer a support to oil markets otherwise weighed down by oversupply fears.

Overnight, API reported a modest crude build.

Quick reminder that this week’s data won’t include the effect of the US government shutdown on aviation and, therefore, jet fuel demand and inventories. That will come in next week’s data after airlines began curtailing flights on Nov. 7.

API

-

Crude +1.3mm

-

Cushing -43k

-

Gasoline -1.4mm

-

Distillates +944k

DOE

-

Crude +6.413mm – biggest build since July

-

Cushing -346k

-

Gasoline -945k

-

Distillates -637k

Crude inventories surged higher for the second week in a row (biggest build since July), modestly offset by small drawdowns for products (down for six straight weeks)…

Source: Bloomberg

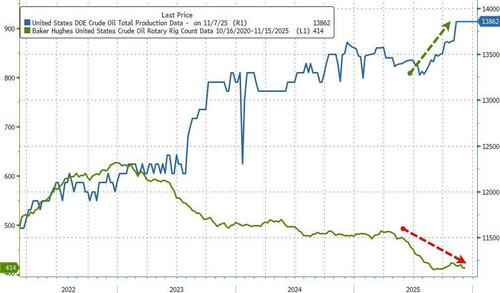

US Crude production surged by over 200k b/d last week to a new record high despite the ongoing slide in the rig count…

Source: Bloomberg

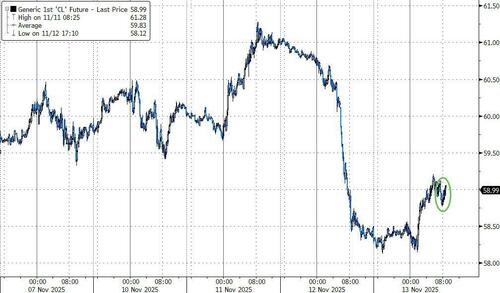

WTI is holding on top its modest gains off yesterday’s plunge lows for now…

Source: Bloomberg

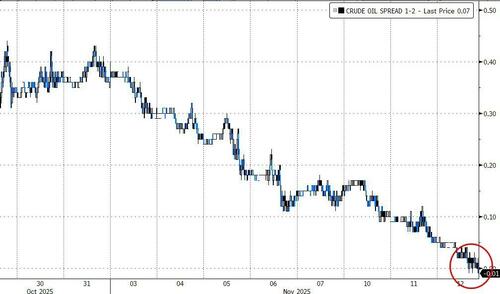

The bearish outlook for next year has triggered a key indicator – WTI’s prompt spread – to sink into contango…

Source: Bloomberg

That pricing pattern, with the nearest contracts trading at discounts to further-out ones, signals ample short-term supplies, though it also recovered Thursday.

Tyler Durden

Thu, 11/13/2025 – 12:10ZeroHedge NewsRead More

R1

R1

T1

T1