Rotation, pAIn, Or Smooth Sailing?

Submitted by Peter Tchir of Academy Securities

pAIn Ahead?

Last weekend we published pAIn Ahead? which had two major problems:

-

It is a bad idea to start a title with a small letter, as our publishing system is designed to force Capital Letters in titles, including the first word of the report.

-

It is more than a little embarrassing to have a title “pAIn Ahead” out there as stocks opened strong and went higher throughout the next few days with the Nasdaq 100 closing up 790 points!

But, on the week, the index fell slightly, making last weekend’s report far less misplaced than where it started the week. If we hadn’t had a major “buy the dip” moment on Friday at its lows, the Nasdaq could have closed down 2% on the week.

Since we had a small loss on the week, a 4.4% pullback from its high on Monday to its low on Friday, it makes sense to revisit the points we made when expressing concern about the potential for an AI- driven pullback.

-

Bitcoin. Whether it is leading the market or just going along with the “momentum” stocks, crypto had a tough week, with Bitcoin dropping from $104k last Friday to $94k this Friday. It is rebounding a bit this weekend, and is worth watching as virtually every regulatory and administration headline remains positive, but it cannot seem to rally significantly. I think it is safe to say that everyone keeps an eye on Bitcoin as a barometer for risk assets, especially on weekends, when markets are closed, but the news flow doesn’t stop.

-

Retail Dip Buying. I remain suspicious that the longs are held by “pros” at this stage as I’ve seen evidence of profit taking by retail. Having said that, the “retail” favorite names and ETFs had a very volatile week (even more so than the market as a whole) and we did see some inflows into some of the most “beat up” names. Maybe it was retail that led the surge, but it could have also been pro traders getting “cute” and trying to anticipate positive weekend news (the admin has been quick to provide positive headlines, especially over the weekend and on Monday morning, when stocks stumble). We will see what happens, but I think the almost 1% late-day fade off of the highs is telling. Of late, dip buying isn’t always providing instant gratification.

-

Volatility. VIX inched higher on the week, while realized stock market volatility rose rather aggressively. The MOVE Index (a measure of bond market volatility) rose more rapidly than the VIX. Higher overall volatility can force some “risk parity” strategies to de-risk. Any shift in correlations between major asset classes can cause them to reduce as well. This could be happening already, but I doubt it has been meaningful. Another week like the past week (especially if the net result is more to the downside) could cause real de-risking.

-

Sentiment and Inflation. The admin is dialing back tariffs on many agricultural goods. Coffee is high on my list. I’m having difficulty wrapping my head around the fact that the admin is signaling that they are championing lower prices by eliminating these tariffs.

-

Hmmmm…this admin put the tariffs in place, so not sure how much credit they deserve for removing them. I think it is good that they are changing policy, but it always seemed weird to tariff things that we don’t grow or produce domestically (and have climate limitations to doing so).

-

Hmmmm…is this a low-key acknowledgement that on some goods, where there is no obvious replacement, tariffs get paid for by the consumer? This has been pretty clear since day 1, so it is good that it is being acknowledged, if only tacitly, but how many other tariffs are finding their way to the consumer? We suspect that number is still small, but growing over time.

-

-

There is a lot of rhetoric about affordability, and that is only increasing as both sides dig in to fight over costs and who is responsible.

-

Bonds and the Fed. The probability of a Fed cut has moved from over 60% to “only” 43% according to Bloomberg’s WIRP function. Now that the probability has dropped below 50% the Fed may lean towards not cutting, since the market isn’t “forcing” their hand. Yes, the Fed will make its own deliberations, but it does pay attention to the market. A lot could still happen between now and the December 10th meeting, but this is yet another indicator of dialing back cuts until the new year. I’m told much of the recent selling was triggered by the concern that the Fed could be less aggressive. I could see that being a part of the whole discussion, but we are susceptible in so many ways that it didn’t take much to shake our belief in the biggest momentum trades of the year. The “old” 10- year (August 2035 maturity) rose from 4.10% to close out the week at 4.14%, though it briefly got to 4.05% on Friday morning (around the timing of OPEX). I continue to expect more downside for Treasuries with the 10-year yield to approach 4.3%. That will weigh on stocks if it turns out to be correct.

Rotation

There is certainly a rotation trade and I think it will continue to work.

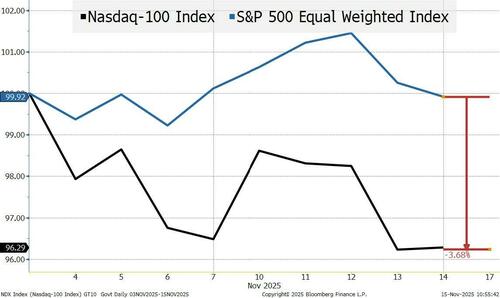

For this trade, I like the S&P 500 equal weight versus the Nasdaq 100. In the past year, QQQ (a Nasdaq 100 ETF), is up about 20% while RSP (a S&P 500 equal weight ETF) is up only 4.5%. There is room for significant outperformance on this relative value trade.

Bottom Line

Sticking to our ProSec (Production for Security) themes. See any of our recent reports at Academy Macro. Look for the “rotation” to continue.

Also, I think the pain continues. The Nasdaq 100 is down on the month and the issues facing it (discussed above and detailed last weekend), have not been resolved. If anything, the big move on Monday and then the fierce dip buying on Friday may well have left a lot of short-term “trading” longs exposed to a further pullback.

I don’t like Treasuries (targeting at least 4.25% on 10s).

We continue to think credit spreads will remain under a bit of pressure. Nothing major, but the combination of:

-

Some private credit “fiascos” (not sure what else you can call something that seemed to go from par to default almost overnight). Again, I don’t think there are a lot of “cockroaches” out there, but it is weighing on the market – and I believe this is making it more difficult for small companies to access credit – which is a real-world problem.

-

Increasing “concern” about how much debt needs to be raised to build out data centers, AI, and the electricity generation capacity to power those data centers. Not alarming and will play out over time, but this will weigh on credit spreads.

-

The low income consumer. Increasing concerns about delinquencies and the fact that the number of households having delinquencies may be set to rise.

It was a very memorable Veterans Day week here at Academy, and now we set our sights on Thanksgiving with friends and family! In the meantime:

-

Rotation? Yes.

-

pAIn Ahead? Likely

-

Smooth Sailing? Unlikely

This is a “normal” or even “run of the mill” adjustment to valuations, current conditions, and various outlooks. Certainly not alarming, but not yet time to fully reload into the momentum names.

Tyler Durden

Sun, 11/16/2025 – 14:00ZeroHedge NewsRead More

R1

R1

T1

T1