“I Feel Safer Holding Gold”: Vietnamese Govt Cracks Down On Hoarding

In the sweltering chaos of Hanoi, 67-year-old Le Thi Minh Tam is waging a desperate guerrilla war against vanishing stockpiles – scrambling from one gold shop to the next, only to find Soviet-style queues where the shiny salvation sells out faster than a central banker’s excuses.

“I’m getting worried, as I still don’t have enough,” she tells Bloomberg, the weight of her son’s impending nuptials crushing her, helped by the State Bank’s iron fist.

“They don’t sell gold bars anymore, only gold rings with a very limited amount for each customer.”

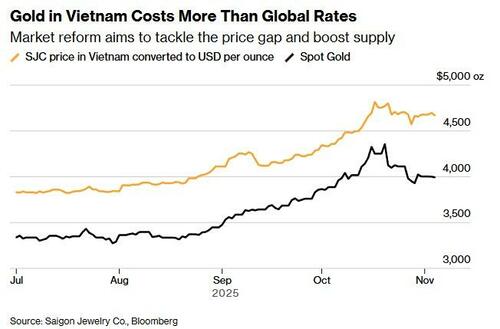

But as Bloomberg goes on to note, Tam’s not some outlier in this fever dream; she’s the face of a nationwide gold apocalypse triggered by the yellow metal’s moonshot to $4,380 an ounce last month.

Vietnam, where gold isn’t just bling but a cultural bunker against the fiat apocalypse – stashed under beds like contraband ammo for the next economic blitzkrieg – is in full-blown mania mode.

Weddings? Forget flowers; it’s all about gifting the one asset that laughs at inflation’s grim reaper. This isn’t optional; it’s ritual, a hedge forged in the fires of the Vietnam War when paper promises turned to ash, and even now, when bank deposits feel like IOUs from a Ponzi scheme run by Hanoi apparatchiks.

Down in Ho Chi Minh City (HCMC) – 1,700 km south, where the humidity matches the desperation – shoppers are turning into urban nomads, camping overnight like it’s the last chopper out of Saigon. Nguyen Kim Hue, a 57-year-old online food peddler scraping by in the gig economy’s underbelly, showed up at 6 a.m. thinking she’d outfox the horde.

“I thought coming at 6 a.m. was early, but it was already crowded,” she recounts, the bitter taste of empty-handed defeat still fresh from her last raid.

“The last time I came, I couldn’t buy anything because they ran out of gold.”

Cue the “sold out” signs, those scarlet letters of supply-chain sabotage.

Flashback to the glory days of communist control: Back in 2012, as inflation clawed at the dong like a rabid dog, the geniuses in Hanoi slapped a state monopoly on gold imports and production. The State Bank of Vietnam became the gatekeeper, funneling scraps through Saigon Jewelry Co.’s exclusive chokehold on bars. Result?

A yawning chasm between local premiums (10-15% over spot) and the global “free” market, birthing a black market beast that chewed up the currency and spat out volatility.

Fast-forward to October: The politburo finally cracks the door, ending the 13-year stranglehold in a half-hearted liberalization play.

But don’t pop the champagne – Hanoi’s still doling out import quotas like candy from a miser’s pocket, with the central bank playing quota czar.

“We’ll have to wait until mid-December to see how much gold import quota the central bank grants,” says Huynh Trung Khanh, vice chairman of the Vietnam Gold Traders Association, sounding like someone who has questioned his fair share of ‘five-year-plans’.

“It’ll probably be far below what the market needs to meet demand.”

Vietnam ‘demands’ 55 tons a year – a Southeast Asia heavyweight – but last year’s official imports were a measly 13.5 tons, courtesy of the same bureaucrats now pretending to “reform.”

The goal? Squeeze that premium down to 2-3%, turning Vietnam’s gold bazaar into a semi-respectable shadow of Shanghai or Mumbai. Good luck with that.

And why the frenzy? Because in a nation scarred by wars, famines, and fiat fuckery, gold is the ultimate protection against ‘the system’.

“We’ve been through wars and hard times, so people here have seen gold as the safest place for their money—a safe haven, something they can rely on when life gets tough,” Khanh remarks, echoing the global chorus from Delhi to Istanbul where central bank bids and retail panic are sending bullion to the stratosphere.

Globally, gold’s the cockroach of commodities this year – up big on ETF inflows and BRICS finger-flipping at the dollar – while wedding seasons worldwide turn jewelers into mints on steroids.

Prices have dipped from the peak, but the “sold out” apocalypse rolls on. Last week in HCMC, hordes queued for hours outside a flagship shop, tickets rationed like bread lines in the gulag. Hue dragged her husband into the fray and sweet-talked the clerk into five rings instead of one:

“At first the shopkeeper told me I could only buy one ring, but I persuaded her to sell me more,” she beamed.

“I’m so happy now.”

So what are the new rules?

As Bloomberg lays out, cash-for-gold’s dead; anything over 20 million dong ($760) demands a bank transfer, leaving grandma types fumbling for their kids’ apps like Luddites in a crypto winter.

Hue kicked off her hoard in June at 120 million dong per tael (that’s ~1.2 troy ounces for the uninitiated). Now? 147 million, a 22% gut-punch that’d make even Jamie Dimon wince.

“Before, I used to keep my savings in the bank, but now I feel safer holding gold,” she confesses.

“It’s my way of making sure my money doesn’t lose value. This is for my children’s education and my retirement.”

Translation: When the dong’s a dumpster fire and banks are just vaults for the elite’s digital funny money, you bet on the barbarous relic.

Even the kids are in on it.

Tran Thi Yen Nhi, 20 and slinging construction swag in HCMC, endured a three-hour vigil for her sister’s big day.

“My parents asked me to help, because it’s hard for them to stand in line for so long,” she says, generational torch-passing in action.

“I’ve made it a habit to buy gold whenever I can save some money, just little by little. Since I was a little girl, I saw my grandmother do the same. She bought gold whenever she saved a bit and then kept it under her bed.”

The World Gold Council pegs Vietnam’s under-mattress stash at 500 tons – pocket change next to India’s 34,600-ton elephant, but enough to make regulators sweat.

Enter the fixers

The Vietnam Association of Financial Investors is hawking a 10% tax on buys to “discourage hoarding” and shove peons toward their approved stock ponzis.

For now, it’s a measly 0.1% on bars for “data trails” and revenue grabs, plus a three-phase gold exchange rollout to drag the rings, coins, and bars out from under the bed and into the light (and sync prices with the world).

Because nothing says “trust us” like taxing the one thing folks trust more than your printing press.

But spare a thought for Tam, still grinding through the gauntlet as her son’s wedding looms like a debt collector.

“I’m so tired and worried,” she laments.

“The wedding is coming soon, and I still haven’t been able to buy enough. In Vietnam, gold isn’t just a gift. It’s how we show our love.”

In a world where governments peddle stability while inflating away your future, that’s not sentiment – it’s survival. And as Vietnam’s gold wars rage on, bet on this: The real mania’s just getting started.

Tyler Durden

Mon, 11/17/2025 – 07:45ZeroHedge NewsRead More

R1

R1

T1

T1