Lower The Steaks, Raise The Stakes

By Benjamin Picton, Senior Market Strategist at Rabobank

US stocks closed mixed on Friday to cap off a week where concerns over valuations caused substantial wobbles. The NASDAQ was in the red for the week while the Dow Jones and S&P500 managed to eke out minor gains. Markets have seemingly begun to pay attention to the heroic P/E multiples that many AI-adjacent names are trading on, with more questions being raised about the ability of AI hype to be converted into tangible profits for shareholders.

Scion Capital’s Michael Burry (of Big Short fame) made headlines last week by shutting down his hedge fund, telling investors that “my estimation of value in securities is not now, and has not been for some time, in sync with the markets”. Burry had been critical of tech darlings Palantir and NVIDIA, disclosing on X that he had spent $9.2m buying up puts against Palantir stock as he questioned the economics of the AI boom and suggested that some accounting practices concerning depreciation schedules looked rubbery. News emerged this morning that Palantir co-founder Peter Thiel has sold his entire stake in NVIDIA and substantially trimmed his position in Tesla while adding to longs in Microsoft and Apple.

There was also a geopolitical element to risk-off sentiment last week. Crude oil prices lifted after Iran’s Revolutionary Guard Corps seized a tanker in the Strait of Hormuz – the first such seizure since the end of the war between Iran and Israel in June – and Donald Trump said that he had “made up [his] mind” on Venezuela, hinting that the 15,000 US troops and more than a dozen warships (including the US’s largest warship, the USS Gerald R. Ford carrier) recently moved to the area as part ‘Operation Southern Spear’ could see action to oust the Maduro regime. Maduro, clearly sensing the danger, broke into a rendition of John Lennon’s ‘Imagine’ (yes, really) at a rally on Saturday as he urged peace.

Events in the Russia-Ukraine war also added to pressure on energy markets. Ukrainian strikes on the Russian Black Sea port of Novorossiysk has reportedly interrupted up to 2% of Russian oil supply while drone strikes on a refinery near Ryazan south of Moscow put further pressure on Russia’s ability to produce refined hydrocarbons used as transport fuels. Consequently, European gasoil futures closed the week 2.86% higher.

According to the Guardian, Russia has responded to Ukrainian strikes by targeting Ukrainian rail infrastructure and train drivers. The Guardian cites a Ukrainian government Minister who says that there has been a threefold increase in strikes on the Ukrainian rail system since July. Degrading Ukrainian rail infrastructure makes it more difficult for Ukraine to move troops and supplies to the front lines, but it will also make it harder to move grain cargoes out of the country. RaboResearch’s Agri Commodity Market Research team have just published their 2026 annual outlook available here.

Geopolitical risks have also been rising elsewhere. Relations between China and Japan have deteriorated over recent comments by Japanese PM Takaichi suggesting that a Chinese strike on Taiwan could be considered “existential” for Japan, and therefore justify Japanese military intervention under the country’s pacificist constitution. Meanwhile, tensions between India and Pakistan have been rising following a series of bombings and the government of Thailand has said that it is suspending its ceasefire with Cambodia, accusing the latter of laying landmines at the border. The US has responded by suspending trade deal talks with Thailand in a bid to pressure the latter to recommit to the ceasefire.

Spot gold benefited from rising geopolitical risks to close more than 2% higher on the week at $4,082/oz. Bitcoin has been heavily sold off and is dealing just over $94,000/coin at time of writing. The DXY missed a safe-haven bid last week and US 10-year yields rose by almost 3 basis points on Friday to 4.15%. That’s a rise of just over 5 basis points on the week, but US 10s outperformed their counterparts in Australia and the UK after a strong jobs report all but dashed hopes of another rate cut in the former and the rolling political and budgetary shambles in the latter scared investors away. Yields on 10-year French OATs fell slightly on the week while Bunds performed similarly to Treasuries.

Having felt the sting of recent election losses, the Trump administration has moved quickly to shore up support via cost of living measures for America’s middle and working classes. Notable recent items include a $2,000 tariff “dividend” for low and middle-income Americans, a $1,000 tax-advantaged ‘Trump Account’ invested in US stocks for babies born from 2025 through 2028, hinted 50-year mortgages and mooted changes to health insurance arrangements to see government funding redirected from insurance companies direct to individuals’ accounts.

The administration also announced on Friday that it would be exempting certain food items from tariffs. Exempt items include beef, coffee, cocoa, bananas, tomatoes, avocadoes, coconuts, pineapples, oranges, tea, nutmeg and cinnamon. Many of these items share the characteristic of having little or no domestic supply source in the USA or, in the case of beef, supply that is heavily constrained by the lowest US herd numbers since the 1950s. Consequently, tariff protection is unlikely to induce a near-term domestic supply response and (contingent on demand elasticities) is likely to be passed through to consumers as higher prices.

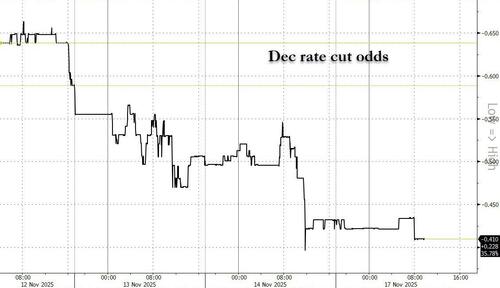

The reduction in tariffs on imported foodstuffs is therefore likely to reduce inflation pressures. This will be an interesting point of consideration at the December FOMC meeting as Fed rate-setters sift through the backlog of data that had been delayed by the US government shutdown and try to guess at the path ahead for inflation, employment and growth while also weighing up threats from frothy asset markets and geopolitical risks. OIS futures are currently pricing a 41% probability of a 25bp cut at the December meeting…

… but perhaps lowering the cost of steaks raises the stakes for the FOMC?

Tyler Durden

Mon, 11/17/2025 – 10:40ZeroHedge NewsRead More

R1

R1

T1

T1