Cooling Labor Market Drives Uptick In Gig-Platform Hours

We haven’t heard much in corporate media about short-term, flexible, on-demand work, otherwise known as the gig economy, but a new Goldman note offers color into what’s happening with these part-time jobs as the labor market cools.

Let’s take a look at the news cycle for mentions of “gig economy.” Notice how the topic surged in the early days of the Covid pandemic, when it became all the rage as people lost their jobs due to government-mandated shutdown of the economy. Many quickly turned to gigs for supplemental income, like driving for Uber or delivering for DoorDash. Now, mentions in corporate media have fallen back to roughly 2016 levels.

However, as the labor market cools, analyst Jessica Rindels said gig-platform hours have increased, suggesting displaced or underemployed workers are turning to Uber, DoorDash, and other gig opportunities.

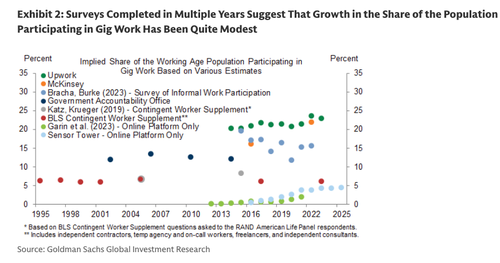

Estimates suggest that 5% to 15% of Americans work gig jobs, with 2% to 4% involved in platform-based gigs. Overall, gig work has grown only modestly in recent years, but platform gig work has expanded at a 5% to 8% annual pace.

Here are the key takeaways about current gig economy trends via Rindels (full report can be viewed by ZeroHedge Pro subs in usual place):

-

This Analyst takes a deeper look at the gig economy, including both traditional gig work as well as platform-based opportunities such as Uber. With the labor market cooling, we ask whether the gig economy provides a meaningful source of income support to those who experience job loss or reduced hours and what it can tell us about the current state of the labor market.

-

Estimates of employment in the gig economy are wide-ranging, but the most credible suggest that 5-15% of the US population participates in gig work, broadly defined as any income-generating work outside of standard, long-term, direct-hire employment. Estimates of participation in platform-based gig work such as Uber are lower at 2-4% of the population. Most surveys that have been run for multiple years suggest, perhaps surprisingly, that growth in total gig employment has been modest at best, though growth in the number of platform gig workers has been much faster at roughly 5-8% annualized over the past few years.

-

How do gig workers compare to workers in traditional jobs? Recent Fed research using the NY Fed’s Survey of Informal Work Participation (SIWP) finds that gig workers are more likely to be younger, female, work part-time, and to hold multiple jobs compared to workers in traditional jobs. Unique data from Gridwise, an app that allows platform gig workers to compare potential earnings across services, show that platform gig workers spent 14 hours per week on average doing gig work this year and earned roughly $18 per hour of work.

-

How is gig work reflected in the official employment statistics? While only a subset of gig workers should be captured by the establishment survey, they should all in principle be captured by the household survey. That said, the SIWP suggests that some gig work is not reported in the household survey and that roughly 15% of people reported as unemployed or not in the labor force actually do some gig work, which implies that the employment to population ratio would be roughly 65% rather than 60% if it fully included gig workers.

-

Recent academic research shows that many lower-wage workers face high income volatility due to unpredictable changes in the weekly hours their employers give them. Does the gig economy—especially platform-based work—offer a meaningful new source of income support with a low barrier to entry to those who face job loss or reduced hours? Data from the SIWP indicate that nearly 50% of gig workers do gig work to earn extra money versus just 15% who do it as a primary source of income, and that 20% of people who took a pay cut, lost their job, or had their hours reduced took up gig work in response. However, gig workers only earn 50-65% as much per hour of work as they did in previous traditional jobs, and the support available to some workers in normal times would likely be inadequate for all job losers in a recession.

-

What can the gig economy tell us about the current state of the labor market? As the broader labor market has cooled this year, platform-based gig work opportunities have held up so far. We find that hours worked on gig platforms increased more this year in cities where payroll growth has slowed, suggesting that some workers might have taken up gig work to cushion negative labor market outcomes.

Earlier on Monday, White House economic adviser Kevin Hassett told CNBC hosts about “mixed signals in the job market …”

“I think that there could be a little bit of almost quiet time in the labor market because firms are finding the AI is making their workers so productive that they don’t necessarily have to hire the new kids out of college,” Hassett said.

This all suggests that a cooling labor market could push more workers into the gig economy, which in turn could increase the conversation around gig jobs.

Tyler Durden

Mon, 11/17/2025 – 13:25ZeroHedge NewsRead More

R1

R1

T1

T1