FT Confirms Our Report From 2024 That China Is Buying 10x More Gold Than Officially Disclosed

One year ago, Goldman’s precious metal analyst Lina Thomas made the case that gold would rise to $3000 by the end of 2025 (it ended up rising more than $1000 higher) as a result of relentless central bank purchases in general, and thanks to China’s ravenous appetite for gold in particular. The bank promptly got pushback on this thesis, with skeptics countering that it is unlikely that gold will manage to keep its ascent at the same time as the dollar rises to new record highs, one of the largest consensus Trump trades.

In response, Thomas also – correctly – pushed back, writing that she disagrees with the argument that “gold cannot rally to $3,000/toz by end-2025 in a world where the dollar stays stronger for longer”, for four reasons:

- First, it will be US policy rate that drives investor gold demand, with no significant additional role for the dollar.

- Second, Thomas disagreed with the view that dollar strength will halt structurally higher central bank purchases because central banks tend to buy gold internationally from their dollar reserves. In fact, the large central bank buyers tend to raise their gold demand amid local currency weakness to boost confidence in their currency.

- Third, the tendency for the dollar and gold prices to rise with uncertainty supports their roles as portfolio hedges, including against tariff escalation.

- Finally, the yuan depreciation and broader easing that Goldman economists expect should have a roughly neutral net effect on China’s retail gold demand, as the gold demand boost from lower China rates roughly offsets the hit from higher local gold prices.

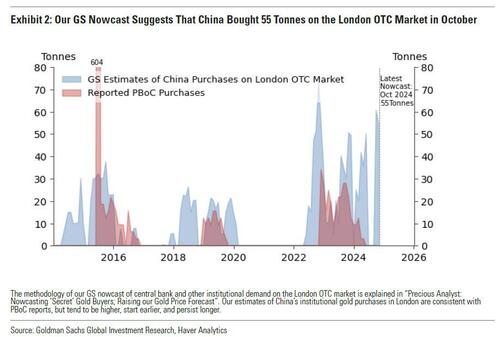

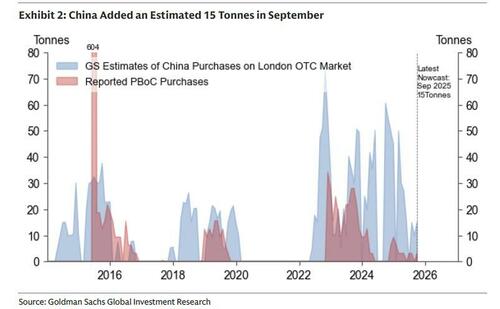

And while it took less than a year for gold prices to surge far above the bank’s (in retrospect) conservative forecast, there was one aspect of the prediction that was already playing out: as we showed at the time using an analysis of central bank and other institutional gold buying on the London OTC market, China was secretly buying up 10x more gold than it admits.

A few months later we repeated this observation: China continued to secretly buy 10x more gold (27 tonnes) than it reports (3 tonnes).

China continues to secretly buy 10x more gold (27 tonnes) than it reports (3 tonnes) pic.twitter.com/uKMMQGvGXX

— zerohedge (@zerohedge) June 13, 2025

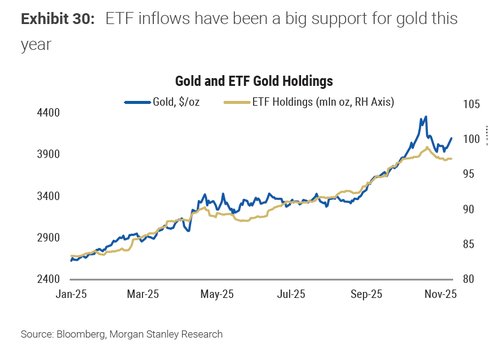

While that alone was sufficient to validate the bullish thesis, another key factor that also emerged was the aggressive ramp up of gold ETF purchases by retail investors, something we predicted over a year ago…

Gold ETF holdings have a long way to go: they have been mostly net sold since 2022 (weaponization of USD after Ukraine war), when central bank buying engaged and bought everything retail had to sell https://t.co/2fFhWQfp7s pic.twitter.com/TyGvKSNNqq

— zerohedge (@zerohedge) October 16, 2024

… and which Morgan Stanley confirmed over the weekend had been a “big support for gold this year.”

But while ETF purchases come and go as price momentum ebbs and flows, in retrospect the biggest shocker was our revelation that – in keeping with tradition – China was secretly buying up most of the available gold in the open market (presumably in anticipation of some major event which has yet to be unveiled). Needless to say, there was tremendous pushback to this claim, with the “serious” strategists balking at the possibility that China would be allocating its precious reserves to a barbarous relic.

Not any more: fast-forwarding to one year later when over the weekend, the FT reported that “China’s actual gold purchases could be more than 10 times its official figures as it quietly tries to diversify away from the US dollar, highlighting the increasingly opaque sources of demand behind bullion’s record-breaking rally.” Or precisely what we said last December.

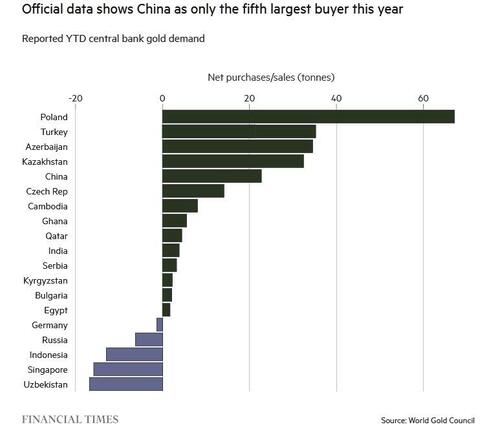

The FT notes that publicly reported buying by China’s central bank has been so low this year – 1.9 tonnes purchased in August, 1.9 tonnes in July and 2.2 tonnes in June – that few in the market believe the official figures. Instead, echoing the same trade data analysis we did back in 2024 (and ever since), the newspaper points to work done by analysts at Société Générale who estimate that China’s total purchases could reach as much as 250 tonnes this year, or more than a third of total global central bank demand.

The scale of the country’s unreported purchases highlights the growing challenges facing traders trying to work out where prices go next in a market increasingly dominated by central bank purchases.

“China is buying gold as part of their de-dollarisation strategy,” said Jeff Currie, chief strategy officer of energy pathways at Carlyle, who says he does not try to guess how much gold the People’s Bank of China is buying.

“Unlike oil, where you can track it with satellites, with gold you can’t. There’s just no way to know where this stuff goes and who is buying it.”

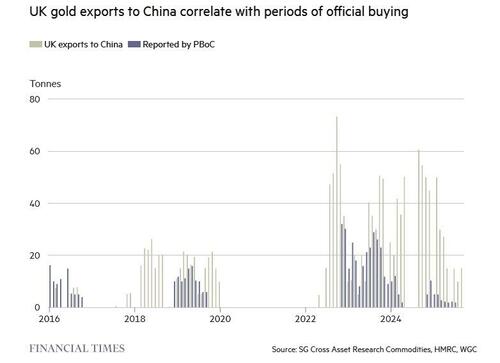

And since official Chinese data is unreliable at best, or simply fake, traders had turned to alternative sources of data to gauge demand, such as orders for freshly cast 400oz bars with consecutive serial numbers, which are typically refined in Switzerland or South Africa, shipped via London and flown to China, for evidence of the country’s purchases. The same analysis we have been doing since 2022.

China Said To Be Mystery Buyer Stockpiling Gold To “Cut Dollar Dependence” https://t.co/qtqv2SgnfX

— zerohedge (@zerohedge) November 22, 2022

“This year, people are really not believing the official figures, especially about China,” said Bruce Ikemizu, director of the Japan Bullion Market Association, who believes China’s current gold reserves are nearly 5,000 tonnes, double the level it publicly reports.

Of course, China is not alone: ever since the US weaponized the dollar in response to the Ukraine war, Central banks have been buying up huge quantities of bullion fuelling a rally that has pushed the price above $4,300 per troy ounce.

Gold price decoupled from ETF flows after Ukraine war (weaponization of dollar), but now even ETF flows are turning positive https://t.co/BoMY0hzTSJ pic.twitter.com/LICCLClIR1

— zerohedge (@zerohedge) August 25, 2024

This accumulating has been so relentless, that gold’s share of global reserves outside the US has climbed from 10% to 26% over the past decade, World Gold Council data shows, making it the second-largest reserve asset after the dollar. Yet fewer and fewer of these purchases are being reported to the IMF, which collects data voluntarily.

In the most recent quarter, only about one-third of official buying was publicly reported, down from about 90% four years ago, according to WGC estimates based on Metals Focus data.

Central banks may choose not to report their gold activity to avoid front-running the market or for political reasons. Some fear that publicly buying bullion, which is often a hedge against the dollar, could worsen relations with the Trump administration.

“It makes sense to just report the bare minimum, if need be, for fear of reprisal from the US administration,” said Nicky Shiels, analyst at Swiss refinery MKS Pamp. “Gold is seen as a pure USA hedge. In most emerging markets it is in central banks’ interest to not fully disclose purchases.”

At the same time, sellers are also keen not to move prices against themselves by announcing their intentions. Former UK chancellor Gordon Brown’s well-publicized statements in 1999 that the Bank of England would sell half its gold reserves helped push prices even lower, and the sale yielded just $275 per ounce on average, about one-fifteenth of today’s price.

Michael Haigh, an analyst at Société Générale, said this opacity made the gold market “unique and tricky” compared with commodities such as oil, where Opec plays a role in regulating production.

“What is different with gold is that the tonnage going in and out of central banks is so impactful. Without having clarity on that, it is a bit more of an issue.”

And while China is the world’s biggest producer and consumer of gold, it is also the least transparent, leaving analysts to run their own numbers based on import data, guesswork and tips.

Its official gold-buying program, which is managed by the State Administration of Foreign Exchange, part of the People’s Bank of China, has officially bought just 25 tonnes this year. Reserve gold is typically stored either in Shanghai or in Beijing. And yet, applying the same proxy we used one year ago, namely looking at UK gold exports to China (as the PBOC favors large bars which are mainly traded in London), SocGen estimates that Safe will import about 250 tonnes this year, or 10x more. This number sure sounds familiar…

Another method is to calculate the gap between China’s net imports and domestic gold production, and the change in the amount held by commercial banks or purchased by retail consumers. Using this method, Plenum Research, a Beijing consultancy, calculates a “gap” attributable to official buying of 1,351 tonnes in 2023 and 1,382 tonnes in 2022, more than six times the public purchases China made in those years.

But while the actual numbers are unclear, one thing is certain: China will buy much more gold than it officially reports. Safe has one-year and five-year targets for its purchases of gold, and current official holdings remain far below target, according to a former Safe official. The purchases are made not only by Safe and its intermediaries, but also by China’s sovereign wealth fund CIC and the military, which are not mandated to disclose their holdings on a timely basis.

Complicating the picture is China’s status as the world’s largest gold miner, accounting for 10% of global production last year, which means that it also has the option of buying bullion domestically for its reserves. But in a geopolitical statement of force, as China expands its gold holdings, it is also courting developing nations to store it in the country. As BBG recently reported, Cambodia recently agreed to place newly purchased gold, paid for in renminbi, in the Shanghai Gold Exchange’s vault in Shenzhen.

In light of all these variables, many gold analysts will not even hazard a guess as to the true scale of purchases by the PBoC.

“It’s ultimately unknowable,” said Adrian Ash, research director of BullionVault, an online trading platform. “Any apparent route to figuring it out . . . misses the problem that it is only one part of the enigma wrapped in the riddle which is China’s bullion market.”

One thing is clear: it will keep rising.

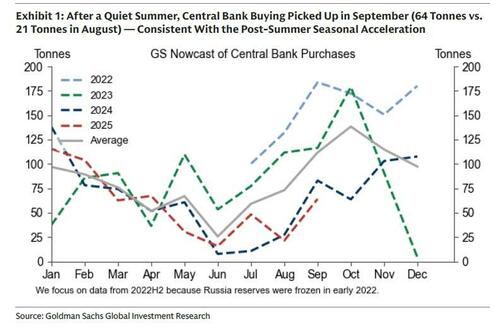

In a note published earlier today Lina Thomas (and available to pro subs), the Goldman gold analyst who correctly calculated China’s true purchases over a year ago, she writes that the bank’s latest gold nowcast estimates that central bank purchased 64 tonnes for September vs. 21 tonnes in August, and central bank buying likely continued in November: “We continue to see elevated central bank gold accumulation as a multi-year trend, as central banks diversify their reserves to hedge geopolitical and financial risks. We maintain our assumption of average monthly central bank buying of 80 tonnes in 2025Q4-2026“, Thomas wrote.

Some more details from her note (available to pro subs):

The gold price broke higher last week, jumping about $25 in a vertical move during last Monday’s Asia hours and rising nearly 6% before correcting on Friday to just under $4,100. The timing, size and speed of last Monday’s price increase are consistent with Asian [ZH: read Chinese] central bank buying, which often appears in London prices around Asian trading hours and thus sees an initial decrease in the Shanghai-London price premium but is then often followed by delayed momentum buying in retail China and then the West.

We continue to see elevated central bank gold accumulation as a multi-year trend as central banks diversify their reserves to hedge geopolitical and financial risks.

Our GS nowcast of central bank and institutional gold demand on the London OTC estimates September purchases at 64 tonnes (67 tonnes on a 12-month moving-average basis), up from 21 tonnes in August and consistent with the typical post-summer seasonal acceleration (Exhibit 1).

Goldman estimates that September purchases were led by the Middle East – Qatar at 20 tonnes and Oman at 7 tonnes – and China at 15 tonnes, extending the trend of massively underreporting its actual purchases (the official number was roughly 10% of that estimate).

Goldman concludes that the pickup in central bank buying, together with the largest monthly gold Western ETF inflow (112 tonnes) since mid-2022, marks the first time in this cycle that strong post-2022 central bank demand and such a sizable increase in ETF holdings have occurred simultaneously, something we predicted back in 2024. Thomas believes that this combination, alongside likely additional off-ETF physical buying by ultra-high net worth individuals, as well as the ongoing buying spree by Tether which is increasingly diversifying into gold alongside T-bills, likely contributed to September’s 10% rally, the strongest monthly increase in gold prices since 2016.

Going forward, Goldman expects continued central bank buying, alongside private investor flows under Fed easing, to lift gold prices to $4,900 by end-2026, and predicted even more “significant upside” if the private investor diversification theme gains more traction.

More in the full Goldman note available to pro subs.

Tyler Durden

Mon, 11/17/2025 – 20:05ZeroHedge NewsRead More

R1

R1

T1

T1