Elliott Mgmnt Builds ‘Large’ Stake In Barrick Mining As Central Bank Gold Buying Accelerates

Elliott Management has built a large stake in Barrick Mining Corp., the Financial Times reported, citing people familiar with the matter.

Elliott’s stake – valued at at least $700 million – puts it among Barrick’s 10 biggest investors, the FT cited the people as saying, and comes after the Canadian gold giant struggled to benefit from the metal’s rally.

Bloomberg reports that Barrick Interim CEO Mark Hill recently said he’s “shifting the focus” to assets in North America, where the company owns a bundle of lucrative gold mines that have considerable potential to expand. Previously, projects in Asia and Africa were at the core of the growth strategy.

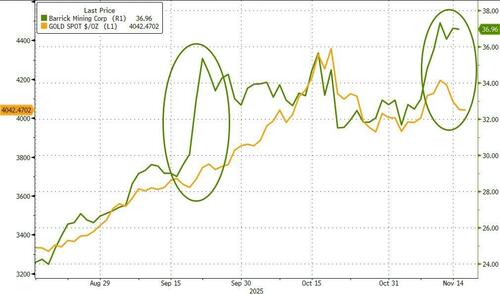

Barrick Mining is trading around 4% higher in the pre-market, at its highest since 2012…

…notably outperforming gold in the last few weeks…

Elliott’s reported ‘buy the dip’ of Barrick comes as Goldman Sachs precious metals team notes that central banks are also accelerating their buying of the barbarous relic.

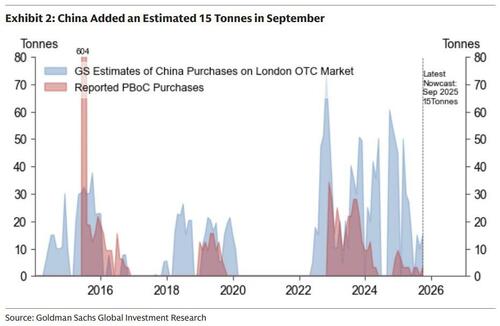

The timing, size and speed of last Monday’s price increase are consistent with Asian central bank buying, which often appears in London prices around Asian trading hours and thus sees an initial decrease in the Shanghai-London price premium but is then often followed by delayed momentum buying in retail China and then the West.

We continue to see elevated central bank gold accumulation as a multi-year trend as central banks diversify their reserves to hedge geopolitical and financial risks.

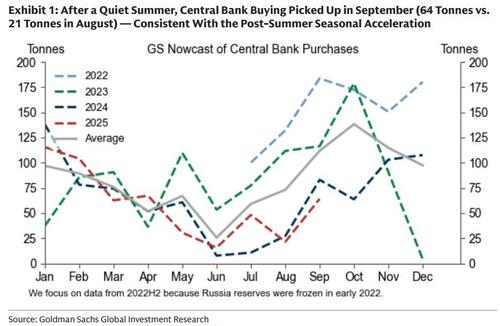

Goldman’s nowcast of central bank and institutional gold demand on the London OTC estimates September purchases at 64 tonnes (67 tonnes on a 12-month moving-average basis), up from 21 tonnes in August and consistent with the typical post-summer seasonal acceleration…

Estimated purchases were led by the Middle East – Qatar at 20 tonnes and Oman at 7 tonnes — and China at 15 tonnes…

The pickup in central bank buying, together with the largest monthly gold Western ETF inflow (112 tonnes) since mid-2022, marks the first time in this cycle that strong post-2022 central bank demand and such a sizable increase in ETF holdings have occurred simultaneously.

This combination alongside likely additional off-ETF physical buying by ultra-high net worth individuals (based on client conversations), likely contributed to September’s 10% rally – the strongest monthly increase in gold prices since 2016.

Finally, Goldman still expects continued central bank buying, alongside private investor flows under Fed easing, to lift gold prices to $4,900 by end-2026, with significant upside if the private investor diversification theme were to gain more traction.

Professional subscribers can read Goldman’s full Precious Metals team note at our new Marketdesk.ai portal

Tyler Durden

Tue, 11/18/2025 – 09:45ZeroHedge NewsRead More

R1

R1

T1

T1