Emails Reveal Under Armor CEO Urged Maryland To Buy Horse Farm After No Buyers – Will Gov. Moore Return Favor?

The pattern emerging from Under Armour CEO Kevin Plank and his Maryland-based real estate ventures suggests mounting financial strain beneath the surface. This comes as UA shares have collapsed 48% year to date, trading near record lows, raising questions about Plank’s sudden need for liquidity.

In February, we noted that Plank relisted his $18.5 million, 500-acre racehorse farm, Sagamore Farm, located in upper Baltimore County, just 15 minutes north of Towson, signaled a clear need for liquidity.

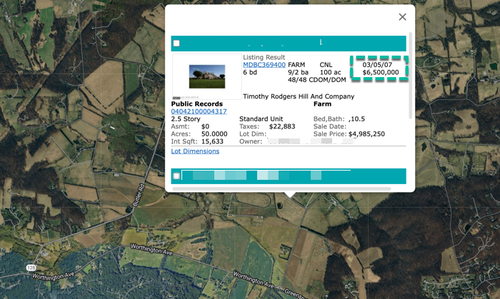

Plank purchased the farm in mid-2007 for $6.5 million, invested $22 million in upgrades, and still hasn’t found a buyer.

In fact, the property, located just down the street from the Hunt Cup steeplechase race, has drawn so little interest that Plank’s representatives have asked Maryland Gov. Wes Moore’s office to consider purchasing the horse farm.

Local outlet The Baltimore Banner reports that emails between Plank’s Sagamore Ventures and Gov. Wes Moore’s office show Plank’s team pitched the farm as a state-owned horse training facility, which could be part of Moore’s broader effort to revitalize Pimlico Race Course and the Preakness Stakes.

In one email, Brendan Tizard, Sagamore Ventures’ vice president, listed off several reasons why Sagamore Farm would be a better fit for the state.

Tizard’s top reasons:

-

Sagamore Farm is closer to Pimlico; the land is better suited for horse training;

-

and Sagamore’s facilities are largely turnkey.

“Although Sagamore’s acquisition cost is higher than Shamrock’s, the reduction in development time, permitting, and capital make the project more cost-effective for the state,” Tizard said in one of the email documents shared with Moore’s office.

Why does this matter? Because Sagamore Farm has been on and off the market for years without finding a buyer. At the same time, Under Armour’s stock has crashed, and Plank has been unwinding pieces of his real estate empire, mansions, a hotel, and other assets. The pattern paints a broader picture of someone under growing financial pressure.

“Plank has sold two other high-profile homes in the past decade, a Georgetown mansion for $17.25 million in 2020 and his Park City, Utah condo for $18 million in 2023,” WSJ noted earlier this year.

In recent months, Plank and his brother Scott Plank sold their ownership interest in a luxury hotel tucked into Baltimore’s historic Fells Point neighborhood.

The urgent need for cash?

- Inside World Of High-Net-Worth Lending: Kevin Plank Pledges Georgetown Home For $15M Commercial Loan

And Plank built a “billion-dollar ghost town” in crime-ridden and far-left-controlled Baltimore City…

Meanwhile, UA’s turnaround plan sputters:

Stock is spiraling lower.

UA shares are 27.5% short, equivalent to 51.8 million shares sold short. A massive short position has been building over the past few years as the stock slides. One has to wonder what Plank’s plan is to trigger a squeeze.

However, not everyone sees the UA spiraling to zero. UBS analyst Jay Sole recently noted…

And by the way, Plank recently hosted a closed-door fundraiser for the leftist Gov. Moore at Sagamore.

A lingering question remains: Why the sudden need for liquidity? Could the answer be stock-backed loans that are now underwater?

And we’ll end with the ultimate question: After Plank’s private fundraiser for Moore at Sagamore, will the governor return the favor?

Tyler Durden

Tue, 11/18/2025 – 14:25ZeroHedge NewsRead More

R1

R1

T1

T1