TJ Maxx Hikes Outlook As Consumers Trade Down In Ominous Economic Signal

We’ve been hammering on the same theme for months: low- and middle-income consumers are getting financially squeezed.

Goldman has flagged imploding sentiment, UBS has revealed the tale of two consumer worlds, and consumer behavior and spending trends show a pullback in discretionary spending, from restaurants to big-box retailers.

The strain has become large enough that the Trump administration rolled out “Operation Affordability” last week, an attempt to ease pressure ahead of the midterm election cycle.

The latest evidence of the ongoing consumer squeeze is one of the largest off-price retail chains in the US, known for selling brand-name and designer merchandise at steep discounts, reported a very solid third quarter.

TJ Maxx’s earnings report shows sales beat expectations for the third quarter, prompting it to raise its full-year outlook. This is a sign that an increasing number of consumers are trading down for the off-price retailer.

Third-quarter revenue came in at $15.1 billion, beating the Bloomberg Consensus estimate of $14.9 billion, with comparable sales also outperforming. Management boosted full-year comp-sales guidance to +4% (from +3%) and raised its earnings forecast.

“The fourth quarter is off to a strong start, the availability of merchandise continues to be outstanding, and we are excited about the deals we are seeing in the marketplace. With our compelling values and ever-changing, fresh assortments of good, better, and best brands, we are convinced that our stores and e-commerce sites are strongly positioned as gifting destinations for value-conscious shoppers this holiday season. Going forward, we see great potential to continue capturing market share,” TJ Maxx CEO Ernie Herrman wrote in a statement.

Shares of TJX rose nearly 3% in premarket trading in New York. As of Tuesday’s close, the stock was up 20.5% on the year and trading at a record high.

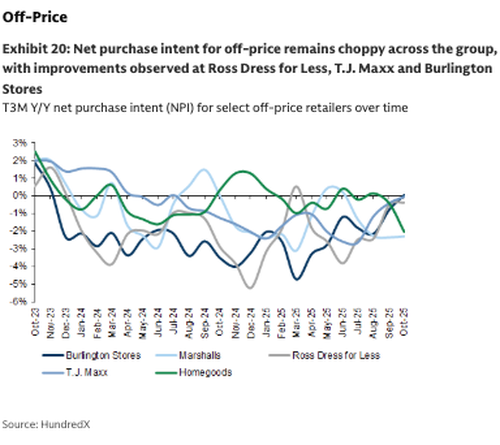

At the start of the week, Goldman analysts led by Brooke Roach commented on off-price retailers, citing HundreX data showing consumer net purchase intent toward retailers such as Ross Dress for Less, T.J. Maxx, and Burlington Stores, which are improving.

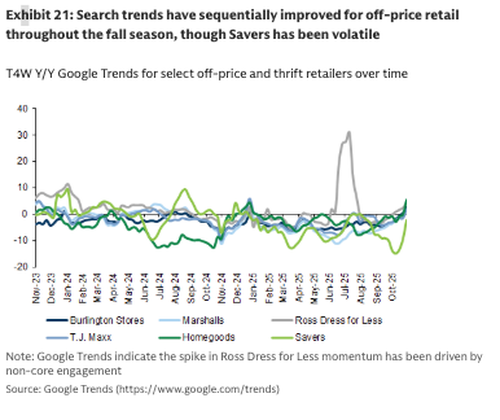

Roach showed that Google Trends data for off-price retailers has improved this fall.

The takeaway is that rising traffic at off-price chains is a clear “trade-down” signal. Target’s already-reported soft demand reinforces the view that more consumers are shifting toward discounters as financial pressure intensifies.

Tyler Durden

Wed, 11/19/2025 – 09:10ZeroHedge NewsRead More

R1

R1

T1

T1