Blue Horseshoe Doesn’t Like Blue Owl: Private Credit Provider Abandons Merger Plan

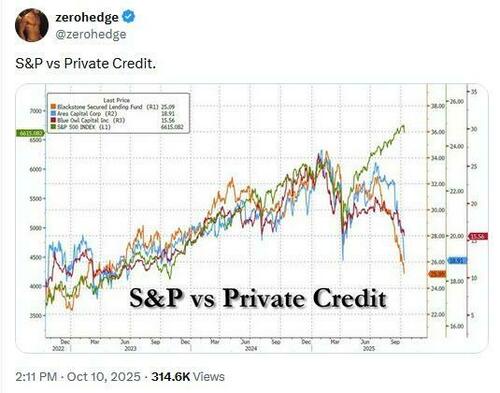

Less than 24 hours ago, we noted that Goldman’s Delta-One Desk head, Rich Privorotsky, warned, “while we’re all laser-focused on ORCL CDS and NVDA, maybe what we should have been watching was OWL and COF,” following up on our extensive writing on the subject of private, as far back as March 2024 “What’s Behind The Recent Explosion In Private Credit“, and certainly the precipitous plunge in stock prices within the sector…

Again, as we highlighted, it got far worse in recent days following news that the alternative asset manager restricted investors from redeeming capital from one of its oldest private credit funds, sending the stock to a 2 year low.

Two days ago, Bloomberg reported that Blue Owl announced earlier this month that it would merge its $1.8 billion non-traded business development company, Blue Owl Capital Corporation II, with its $17.6 billion publicly listed vehicle, Blue Owl Capital Corp., or OBDC.

But investors in the non-traded fund won’t be able to redeem their capital until the merger closes, which is expected to happen early next year, according to a statement.

Investors in the acquired vehicle will swap their holdings for OBDC stock.

That means they could see paper losses of as much as 20% if the deal closes at current share prices, given that OBDC shares are trading at that much of a discount compared to the value of the fund’s assets.

Fears over asset quality, manager selection and lower earning potential following rate cuts have led to shares of publicly traded business development companies taking a hit this year. Shares of the traded Blue Owl vehicle have declined about 22% so far this year.

Worse, as Privo lamented at BIZD’s performance, “those pesky BDC ETFs have failed to have any substantive recovery at all, are now a glaring disconnect to the rest of the credit complex.”

Well things just got a little more stressful in the credit complex as Blue Owl Capital Inc. is calling off the merger of two of its private-credit funds after its shares were hit.

“While we continue to believe that combining OBDC and OBDC II could create meaningful long-term value for shareholders, we are no longer pursuing the merger at this point given current market conditions,” said Craig W. Packer, Chief Executive Officer of OBDC and OBDC II.

“Both funds remain strong, with excellent fundamentals, and we are confident in our ability to deliver attractive returns independently as we continue to work with the Board to consider the best future opportunities for OBDC II.”

OBDC’s $200 million share repurchase program that was announced concurrently with the merger remains in place.

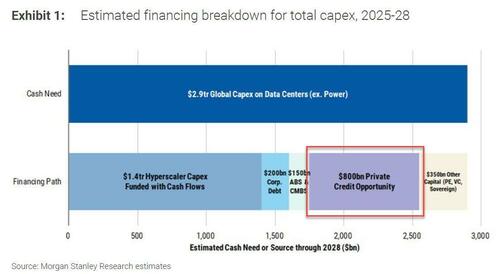

Finally, evaporating liquidity conditions in these BDCs is a major problem for the entire market as MS concluded recently, “the point we want to drive home is that credit markets will play a major role in enabling AI-driven technology diffusion” and of all the available sources of credit, the chart below shows just how big the debt hole is that private credit will have to plug.

Translation: private credit is by far the weakest link in the column that supports the US legs of the AI arms race… which is why not if but when the government comes rushing in to backstop the entire space with trillions in taxpayer funds (as it will have to do to prevent China from victory by filling a $1+ trillion gap), private credit will also be bailed out.

Not tomorrow, of course, but one day, when the pain in the sector hits unbearable levels – and Blue Owl’s merger collapse is just another cockroach croking in the coal-mins (to mix metaphors).

The Blue Owl CEO is about to be interviewed on CNBC to clear all the confusion up.. so stay tuned.

Tyler Durden

Wed, 11/19/2025 – 09:40ZeroHedge NewsRead More

R1

R1

T1

T1