Ugly, Tailing 20Y Auction Sees Slide In Bid To Cover, Foreign Demand, As Directs Soar To Record

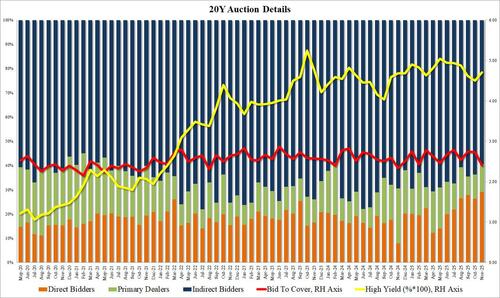

In this week’s lone coupon auction, which just happens to print an hour before the release of the October FOMC minutes, moments ago the US sold $16BN in 20Y bonds at a high yield of 4.706%, up 20bps from 4.507% last month and the highest since August. The auction also tailed the When Issued 4.704% by 0.2bps, the first tail since June.

Everything else about the auction was ugly too: the bid to cover slumped from 2.73 to just 2.41, the lowest since November 2024, and far below the six auction average of 2.66.

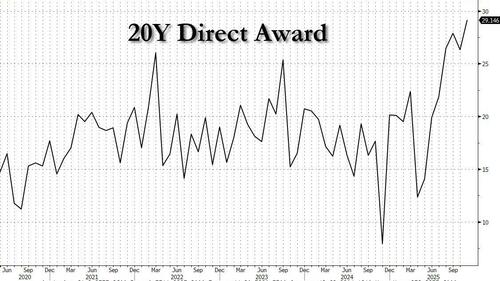

The internals were just as ugly, with Indirects sliding to 59.5% from 63.6% and the lowest since Feb 2024 (clearly far below the recent average of 65.3%). And with Directs stepping up aggressively, and awarded 29.1%, up from 26.3%, and the highest on record…

… Dealers were left with 11.4%, the highest since August.

Overall, this was a piss poor auction and yet thanks to the broader risk off tone during today’s session, one which has seen beatcoin tumble below $89K, 10Y yields barely budged and are still trading lower on the session.

Tyler Durden

Wed, 11/19/2025 – 13:40ZeroHedge NewsRead More

R1

R1

T1

T1