Existing Home Sales Beat In October As Mortgage Rates Tumbled

With mortgage rates tumbling, housing market participants have been disappointed by the lack of enthusiasm by homebuyers to apply for mortgages (though there was a decent bounce in refi activity)…

Source: Bloomberg

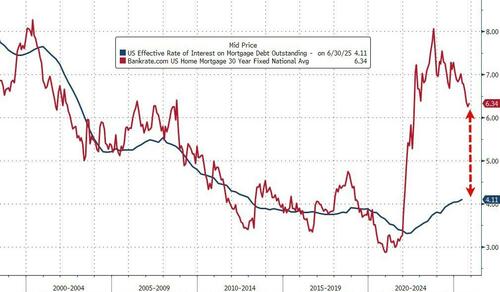

This morning’s existing home sales data (admittedly for October) will give us a further glimpse into the reality oh home-buying vs home-selling as the gap between current mortgage rates and the average existing mortgage rates remains vast…

Source: Bloomberg

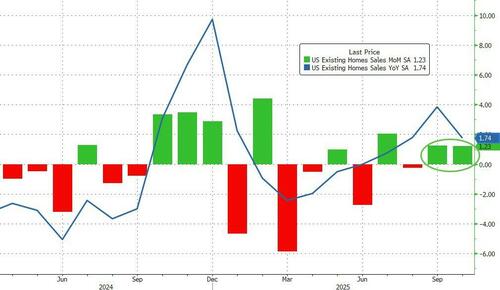

Analysts (rightfully, given the shift in rates) expected a bounce, albeit tiny (+0.5%), in existing home sales for October and were surprised to the upside with a 1.2% MoM rise…

Source: Bloomberg

Which lifted the home sales SAAR a little more off record lows (to eight month highs)…

Source: Bloomberg

This print represents signings – so when sales probably went through from August and September (before rates really started to decline).

“Home sales increased in October even with the government shutdown due to homebuyers taking advantage of lower mortgage rates,” NAR Chief Economist Lawrence Yun said in a statement.

Is momentum about to start picking up?

The median sales price gained 2.1% from a year ago to $415,200, furthering a run of year-over-year price increases dating back to mid-2023.

Last month, the supply of previously owned homes for sale fell 0.7% to 1.52 million, still near its highest level since mid-2020, NAR data show.

Homes remained on market 34 days last month, the longest stretch for any October since 2019, Yun said on a conference call.

But to get back to pre-Covid levels, “it requires drastically larger supply,” Yun said.

“We’re not seeing that. And much more meaningful decline in mortgage rates.”

In the NAR report, sales in the South, the nation’s biggest home-selling region, increased 0.5%, marking the strongest rate since February.

Sales in the West fell 1.3%, while sales were flat in the Northeast. The Midwest led US regions with a 5.3% sales gain.

Nationwide, sellers outnumbered buyers last month by about 500,000, giving the latter some power to demand discounts and other concessions, Redfin estimated in a separate report this month.

Tyler Durden

Thu, 11/20/2025 – 10:10ZeroHedge NewsRead More

R1

R1

T1

T1