MAHA And GLP-1s Are About To Deal A Big Blow To The Processed-Foods Industrial Complex

The US processed-food industrial complex, partly controlled by globalist mega-corps, is beginning to reckon with a new reality: Make America Healthy Again and rising weight-loss drug use are reshaping what Americans eat – and what they’re walking away from, mostly junk food loaded with toxic seed oils, as well as alcohol.

In the coming weeks, Robert F. Kennedy Jr., President Donald Trump’s Health and Human Services (HHS) Secretary, will be releasing new dietary guidelines to reset America’s food supply chain away from toxic seed oils and highly processed foods toward real food. This is part of the MAHA trend.

MAHA, combined with the expected surge in GLP-1 demand (thanks to Trump’s deal with Novo Nordisk and Lilly to cut costs), is likely to wipe out tens of billions in food and beverage sales in the coming years.

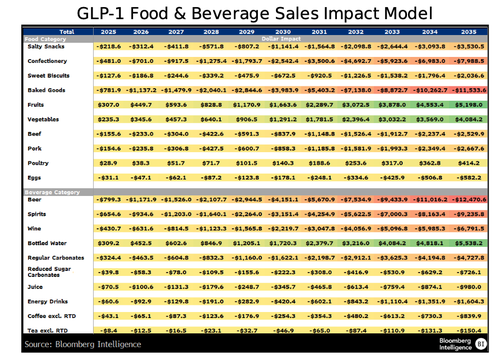

Bloomberg Intelligence analysts Jibril Lawal and Jennifer Bartashus forecast that the rapid adoption of GLP-1 weight-loss drugs will reduce US and European food and beverage sales by $53 billion by 2035.

Weight-loss drugs are reshaping consumption, and our analysis shows GLP-1s are set to erase $53 billion in food and beverage sales by 2035. Volume losses will be steepest in snacks, baked goods and confectionery — a 4-6% sales drag in the US and 3-5% in Europe. Alcohol also faces a 2-4% drop as consumers shift to healthier options. -Lawal

Here are the key takeaways from the report that only suggest a coming food revolution across the West:

1. GLP-1s Could Cut Food, Beverage Sales by Billions

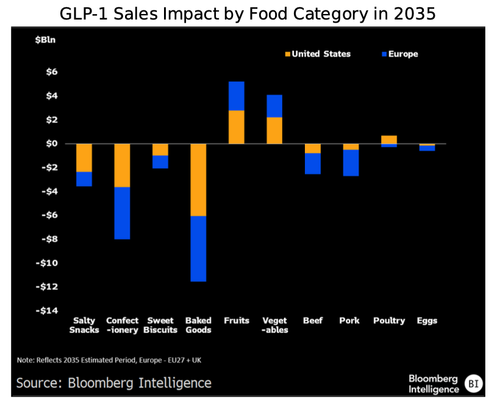

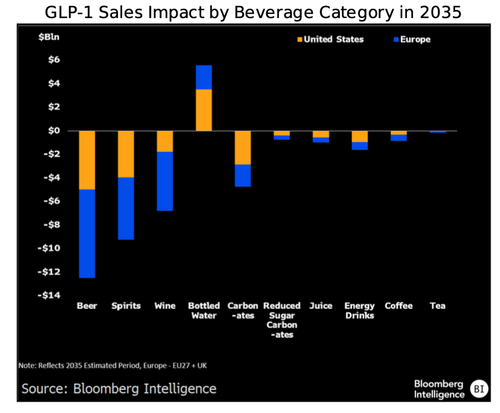

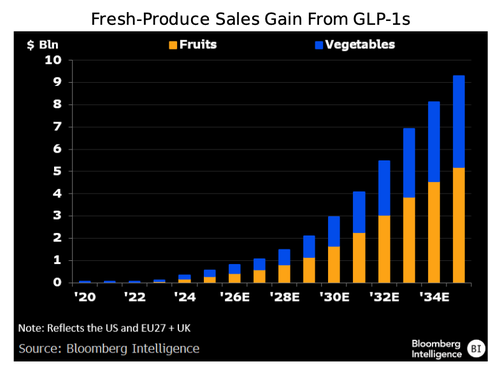

The adoption of GLP-1 drugs will significantly reduce US and European food and beverage consumption if uptake reaches 19.5% and 13.1% of the adolescent and adult population (ages 12-65+) by 2035, BI’s high-end scenario analysis shows. Our model isolates volume impact only and excludes pricing increases or reformulations that might offset lower consumption. Under these assumptions, baked-goods sales are expected to drop by $11.5 billion and confectionery $8 billion — the largest food declines — while beer and spirits may fall by $12.5 billion and $9.2 billion, the steepest beverage contractions. Concurrently, we anticipate demand to shift toward healthier alternatives, with bottled water, fruits and vegetables each gaining more than $4 billion over the period.

2. Food Losses Exceed $21 Billion in US and Europe

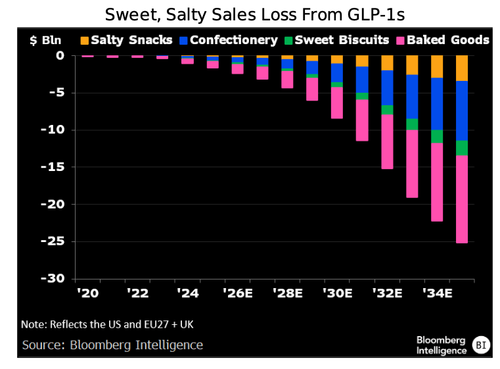

3. Sweet, Salty Sales to Drop $25 Billion on GLP-1s

Consumption of salty snacks and sweet treats, including confectionery, baked goods and cookies, looks set to significantly decline if GLP-1 use expands over the next decade, with our scenario analysis showing as much as a $25.1 billion decrease in total category sales by 2035 — $13 billion in the US and $12.1 billion in Europe. In the US, confectionery intake is expected to drop 28% per GLP-1 user, followed by baked goods and biscuits (23.7% each), translating to a 4-6% category sales drag by 2035, based on our model. Europe could have even sharper reductions, with confectionery down 31% and baked goods and salty snacks off 28%, weighing on sales 3- 5%.

Companies most exposed, like PepsiCo, Mondelez, Hershey, General Mills and Conagra, may accelerate R&D investments to reformulate products and retain demand.

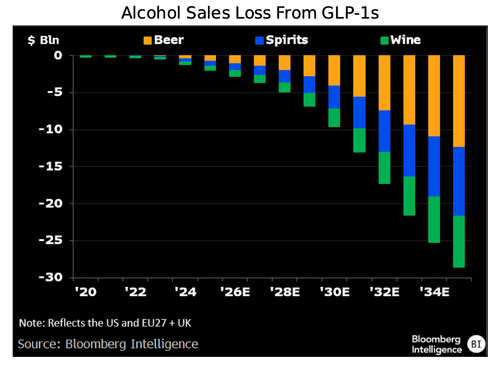

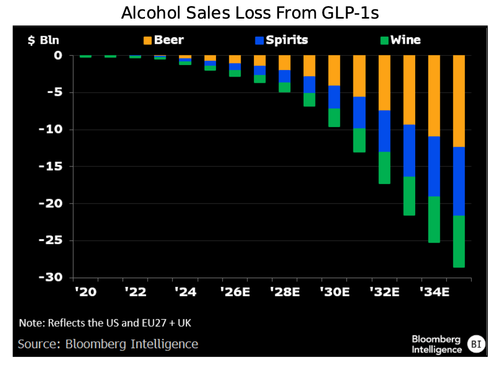

4. Beer and Spirits Face $29 Billion GLP-1 Hangover

Use of weight-loss drugs stand to deepen alcohol’s demand slump in the US and Europe, as moderation and wellness trends gain ground. By 2035, consumption of beer and spirits is expected to drop 20.3% and 19.2% among GLP-1 users, and 22.5% and 23.2% in Europe, according to our analysis. Total losses could reach $28.5 billion, which translates to a 3-4% sales drag in the US and 2-3% in Europe. Major players at risk include Diageo (17.5% share of the $112 billion US spirits market, 16.7% of the $109 billion Western Europe market), AB InBev (31.9% of the $111 billion US beer market), and Heineken (18.3% of the $166 billion Western Europe beer market), based on Euromonitor data

5. Total Beverage Net Losses Could Reach $32 Billion

6. Beer and Spirits Face $29 Billion GLP-1 Hangover

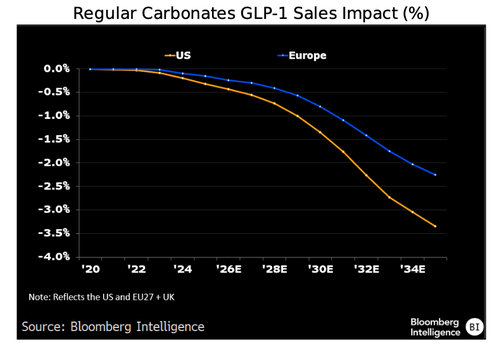

7. Weight-Loss Drugs Trim Soft Drinks’ Fizz

As the use of GLP-1s widens, demand for full-calorie sodas will likely erode. BI’s model shows US consumption of regular (full calorie) soda will fall about 19.2% among these drug users and 17.2% in Europe a year between 2024-35, equating to a combined $4.7 billion sales hit — about 3.3% in the US and 2.3% in Europe. The effect on low- or no-sugar drinks might be less pronounced at under 1% in both regions. Leading soft-drink makers such as Coca-Cola, with a 36% share of the $99 billion US soda market, and PepsiCo (20.5%) are most adversely affected. In Western Europe, Coca-Cola has a 48.6% share, while PepsiCo holds 12.9%, according to Euromonitor data.

8. Fresh Produce Sales to Get $9 Billion GLP-1 Bump

Demand for fresh fruits and vegetables is rising, fueled in part by greater GLP-1 use, and food retailers can benefit as sales for produce are expected to climb to $9.3 billion across the US and Europe by 2035, according to BI’s model. Each GLP-1 user is expected to consume about 11.6% more produce, driving a 1-3% sales boost, our analysis shows. Consumer trends emphasizing wellness and nutrition support this as health-focused baskets shift. Retailers such as Kroger, Albertsons, Sprouts, and Walmart are investing in fresh supply chains to enhance produce quality and extend shelf life, while an uptick in consumption of perishables could drive store visits and long-term loyalty.

MAHA and soaring GLP-1 adoption are pushing consumers away from ultra-processed junk food, seed-oil-laden snacks, and alcohol. The emergence of this trend has already been observed, read here and here. The shift is set to accelerate once RFK Jr. unveils new federal dietary guidelines aimed at steering the nation back to real, whole foods after mega corps hijacked the food supply with toxic processed foods and seed oils.

Tyler Durden

Thu, 11/20/2025 – 19:40ZeroHedge NewsRead More

R1

R1

T1

T1