Futures Slide As Bitcoin Flash Crashes To April Low Ahead Of $3.1 Trillion Opex

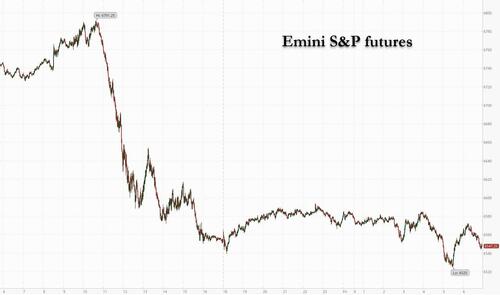

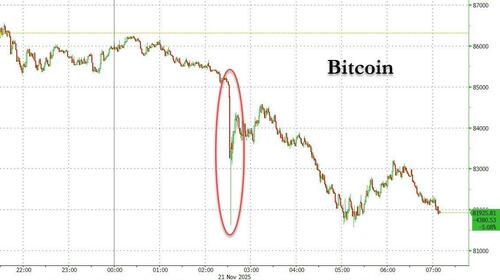

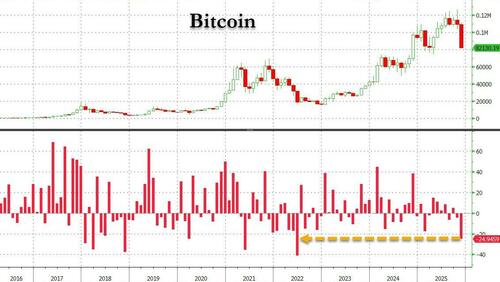

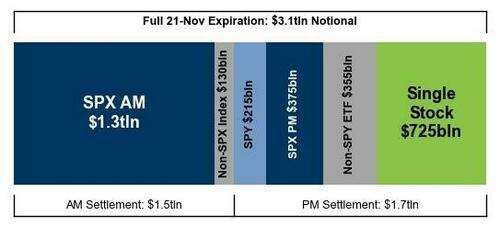

US stock futures continued to sink following yesterday’s remarkable reversal – from +2% to -2% intraday, a move which according to Goldman has only happened 2 other times before: April 7th 2020 (after COVID crash) April 8th 2025 (after Liberation Day crash) – and broad underperformance in Asia (NKY -2.4%, HSI -2.4%, Kospi -3.8%). As of 7:15am, S&P futures were down 0.3% and Nasdaq futures slid 0.4% with a $3.1 trillion option expiration on today’s calendar. Pre-mkt, Mag 7 were mixed, with Nvidia falling more than 1% in premarket trading as the biggest artificial-intelligence stocks remained under pressure. Meanwhile the collapse in bitcoin is accelerating, and after a flash crash in overnight trading, it’s on pace for its worst month since the June 2022 crypto crash. Bond yields are 1-3bp lower; USD is largely unchanged. Commodities are mostly lower: oil -2.6%, Silver -3.3%. Today’s we’ll get the global flash November PMIs, the November Kansas City Fed services activity update, and the Final UMIch numbers.Central bank speakers include the Fed’s Williams and Logan, the ECB’s Lagarde, de Guindos, Kocher, Muller and Nagel, and the BoE’s Pill.

In premarket trading, Mag 7 stocks are mixed: Nvidia falls 1.4%, on track to extend losses, with shares in the semiconductor giant lagging other Magnificent Seven stocks in premarket trading (Alphabet +0.7%, Tesla +0.8%, Amazon +0.2%, Meta +0.3%, Apple +0.1%, Microsoft -0.4%)

- AnaptysBio (ANAB) fell 15% after GSK initiated litigation against the company in the Delaware Chancery Court.

- Cryptocurrency-exposed stocks (MSTR -2.9%, COIN -1.3%, MARA 1.5%) tumble as Bitcoin is on track for its worst monthly performance since a string of corporate collapses rocked the wider crypto sector in 2022.

- Gap Inc. (GAP) rises 4.5% after it reported stronger-than-expected sales, a sign that celebrity-fueled marketing, flashy collaborations and a revamped inventory are luring in consumers.

- New Fortress Energy (NFE) rises 12% after it reported third quarter earnings.

- VinFast Auto (VFS) falls 5.1% after it reported total revenue for the third quarter that missed the average analyst estimate.

- Enviri shares (NVRI) rise 34% after Veolia agreed to buy the US hazardous waste firm Clean Earth for an enterprise value of $3b.

In corporate news, Netflix, Comcast and Paramount Skydance submitted bids for Warner Bros. Discovery by the Nov. 20 deadline. OpenAI is partnering with Hon Hai to design and manufacture hardware for data centers and Hon Hai aims to spend up to $5 billion growing its US manufacturing footprint.

The Trump administration is proposing to open new areas off of California, Florida and Alaska to crude drilling that would dramatically expand the sale of oil and natural gas rights. Trump’s 28-point peace plan would force Ukraine to cede large chunks of territory taken by Russia, cap the size of its military and lift sanctions on Moscow over time.

A $5 trillion slide in global equities has left investors questioning how much further the tech-led pullback can go. The S&P 500 saw its sharpest intraday reversal since April’s tariff turmoil on Thursday as concerns over lofty valuations and waning prospects for US interest-rate cuts rattled sentiment.

“This is a rational selloff after the rally in tech stocks this year,” said Rory McPherson, chief investment officer at Magnus Financial Discretionary Management. “It could go even further as the market’s not oversold yet. The Fed’s rates policy outlook at the next meeting will absolutely be key.”

US stock futures struggled for direction after the S&P 500 sank to its lowest level since September amid a sustained retreat from the market’s riskier corners. Bitcoin fell below $82,000, after suffering a 3000 point flash crash just before the European open.

Bitcoin is now down 35% from its October highs, with the November drop wiping out a quarter of bitcoin’s value, and is on pace for the worst monthly drop since the June 2022 Crypto collapse.

Fed’s Barr, who had supported rate cuts in September and October, added to the hawkish narrative signaling discomfort over inflation. Meanwhile, JPMorgan abd Morgan Stanley’s economists said they no longer expect a December rate cut, citing the bounce back in payrolls for September lowering the risk of a higher unemployment rate.

Thursday’s dramatic reversal in equities failed to deliver the “all clear” for risk that traders sought, instead sending them for cover against further losses, said Goldman partner John Flood. Today’s November options expiry, including $1.7 trillion of S&P 500 options and $725 billion notional of single stock options, has the potential to fuel erratic moves in the index.

Other concerns include brewing worries about over investment in AI, frothy valuations and the ongoing vacuum of macro data. Oracle is emerging as the credit market’s barometer for AI risk and the price of the company’s CDS have surged. Big tech’s debt binge isn’t limited to just Oracle, with risks rising in the race to create an AI world, as highlighted by Ryan Vlastelica in today’s Tech Watch column.

Stocks in Europe are also sliding, following from the sharp reversal in sentiment on AI and tech stocks in yesterday’s US session and heavy declines in Asia. Stoxx 600 down by 1.1% with technology and energy stocks the biggest drags. The benchmark is on track for its worst week since April. Here are the biggest movers Friday:

- CTS Eventim surges as much as 12%, the most in five years, after the events firm delivered adjusted Ebitda growth above analyst expectations in the third quarter and reiterated its full-year guidance

- Ubisoft shares turn higher, reversing initial declines, as the stock resumes trading following a week-long suspension caused by a delay to the publication of second-quarter results

- Hammerson shares rise as much as 2.8%, , after the real estate firm said it has taken full control of The Oracle retail and leisure destination in Reading after buying a 50% stake from its joint venture partner

- Canal+ shares rise as much as 9.6%, after the broadcaster announced it has retained exclusive rights to the Champions League and two other UEFA cup competitions in France for the period 2027-2031

- ITM Power gains as much as 8.4% after being selected by Stablegrid Group as the technology partner and supplier for two energy infrastructure projects in Germany

- European defense shares fall on Friday after Ukrainian President Volodymyr Zelenskiy said he’s agreed to work on a peace plan drafted by the US and Russia and expects to talk with Donald Trump in the coming days about the proposals

- Tullow Oil shares plummet as much as 32% to a new record low after the company issued a trading update. Analysts said there has been a lack of progress on the refinancing of its mountain of debt

- Babcock drops as much as 6.7% following its first-half results, and amidst wider weakness in defense stocks on Friday after Ukrainian President Volodymyr Zelenskiy said he’s agreed to work on a peace plan

- Ithaca Energy shares fall as much as 11%, the most in two months, as Goldman Sachs downgrades its rating on the North Sea oil company to sell from neutral, with a 180p price target

Earlier in the session, Asian equities posted their steepest weekly decline since April as technology shares followed a sharp selloff in US peers, driven by renewed concerns over stretched AI valuations. The MSCI Asia Pacific Index fell as much as 1.7%, bringing the week’s losses to nearly 4%. Benchmarks in Taiwan and South Korea led declines in the region, with shares in China and Hong Kong also traded lower. Some banks, such as HSBC, are starting to look at countries with lower exposure to AI, including India and Indonesia, as alternatives. Asia’s leading chip suppliers to Nvidia led losses on the regional gauge. TSMC and Samsung Electronics dropped more than 4% each before paring some of those losses.

In FX, the Bloomberg Dollar Spot Index slightly higher, with the yen outperforming after Japan’s government unveiled its biggest stimulus plan since the pandemic. Indian rupee hit a record low.

In rates, bonds rallying in the risk-off environment, with outperformance in gilts after weak retail sales data, a borrowing overshoot and scant growth shown in PMIs. Eurozone activity remained solid, boosted by services.

In commodities, oil prices dragging on energy companies, with Brent down over 2% below $62/barrel as traders weigh a Ukraine-Russia peace plan and sanctions on two Russian oil majors. Bitcoin sliding below $82,000 and set for worst month since 2022. Gold prices lower, down about $40 to $4,038/oz.

The US economic calendar includes September real average hourly earnings (8:30am), November preliminary S&P Global US PMIs (9:45am), November final University of Michigan sentiment, August wholesale inventories (10am) and November Kansas City Fed services activity (11am). Fed speaker slate includes Williams (7:30am), Collins (8am), Barr and Miran (8:30am), Jefferson (8:45am) and Logan (9am)

Market Snapshot

- S&P 500 mini -0.4%

- Nasdaq 100 mini -0.8%

- Russell 2000 mini -0.4%

- Stoxx Europe 600 -1.1%

- DAX -1.2%

- CAC 40 -0.7%

- 10-year Treasury yield -3 basis points at 4.05%

- VIX +1.1 points at 27.54

- Bloomberg Dollar Index little changed at 1227.51

- euro -0.1% at $1.1516

- WTI crude -2.5% at $57.53/barrel

Top Overnight News

- OpenAI CEO Sam Altman is bracing for possible economic headwinds in catching up to a resurgent Google (GOOGL), according to The Information. He told colleagues last month that Google’s recent AI progress could “create some temporary economic headwinds” for OpenAI, and the company’s narrowing tech lead and rising cash-burn projections have raised questions among investors.

- Treasury Secretary Bessent said the Fed should keep going with its cutting cycle and should be looking at the data, via Bloomberg.

- JPMorgan no longer expects the Federal Reserve to cut rates in December, vs its prior forecast of a 25bp cut.

- Standard Chartered no longer expects the Fed to cut by 25bps in December following the jobs data; expects a Q1-2206 cut, most likely January (prev. forecast no 2026 cuts)

- Republican senators have been privately lobbying US President Trump to support a limited short-term extension of Obamacare subsidies, according to Punchbowl. Adds that save the GOP from a 2026 drubbing and buy time for Congress to pass a more favourable longer-term health care plan. Multiple GOP senators were set to meet with US President Trump on Thursday, but the meeting was cancelled for unrelated reasons.

- Fed’s Paulson (2026 voter) said she is approaching the December rate decision cautiously and that the September labour-market report was encouraging overall, though she remains, on balance, more worried about the labour market than inflation. She said rate cuts so far have been appropriate but each one raises the bar for the next, and with upside risks to inflation and downside risks to employment, monetary policy must walk a fine line. She expects to learn a lot between now and the December meeting and said her longer-term policy thinking is focused on balancing inflation and labour-market risks. Paulson said the US economy is doing OK, but aggregate growth is unusually dependent on high-income earners and is particularly sensitive to equity valuations. She added that tariff effects are smaller than feared and that the overall demand environment is helping contain inflation, according to Reuters.

Trade/Tariffs

- US President Trump signed an order modifying the scope of tariffs on Brazil, stating that certain agricultural products will not be subject to the additional ad valorem duty imposed under Executive Order 14323, according to the White House. Bloomberg reported that Trump has expanded his reductions of certain food tariffs by extending them to the 40% surcharge placed on Brazil over the Bolsonaro case, noting that last week’s exemptions did not apply to that portion of the tariffs. White House said US President Trump’s order on Brazilian imports removes tariffs announced on July 30th on imports of Brazilian beef, coffee, and orange juice.

- EU Trade Commissioner said momentum is improving on the Australia–EU trade deal and expects another round of talks early next year, according to Reuters.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower across the board as the sharp Wall Street selloff reverberated through the region despite the absence of fresh catalysts. ASX 200 was dragged down by all sectors, with gold and mining leading declines; tech held up relatively better alongside defensive names. Nikkei 225 slipped at the open, pressured by mining and metals, while financials found some relief as yields eased off highs. No move was seen on the budget, which came in line with expectations. Hang Seng and Shanghai Comp both opened softer but recovered to trade firmer, though still reflecting the cautious global tone.

Top Asian News

- Japan’s cabinet approved a JPY 21.3tln economic stimulus package (vs expectations of JPY 20–21.3tln), with JPY 17.7tln in fresh spending via the extra budget and an overall impact of JPY 42.58tln, according to Bloomberg. Japan PM Takaichi said new bonds will be issued to fund the package if tax revenue falls short, but total JGB issuance will be smaller than last year, adding that sustainable state finances must be achieved through economic growth, according to Reuters.

- Japanese Finance Minister Katayama said she will take appropriate action if there are excessive FX moves, noting that FX intervention is an option as it was mentioned in the Japan–US agreement in September. She said the government will issue debt to fund part of the stimulus package as needed, is not trying to increase the size of spending, and is alarmed by recent one-sided and rapid foreign-exchange moves, according to Reuters.

- Japanese Finance Minister Katayama said she is closely watching FX moves with a high sense of urgency and will take appropriate action based on the US–Japan forex agreement. She declined to comment on FX levels, noted that recent moves have been sharp and one-sided, and stressed that currencies should move in a stable manner reflecting fundamentals. She said that at her meeting with BoJ Governor Ueda and the Economy Minister, Ueda explained the BoJ will gradually adjust monetary support in line with economic and price improvements, adding that specific policy decisions are up to the BoJ. She said the three officials also reaffirmed they will coordinate closely on market developments, according to Reuters.

- Japanese Finance Minister Katayama said JGB yields move based on domestic economic, price and monetary-policy developments, fiscal conditions, and overseas market moves. She added that Japan will guide appropriate debt-management policy to ensure it does not lose market trust in its finances, according to Reuters.

- Japanese Finance Minister Katayama said Japan is only halfway toward achieving sustainable, stable price increases accompanied by wage gains. She also said Japan’s debt-to-GDP ratio should edge down from last year, even after an extra budget for the stimulus package, according to Reuters.

- BoJ Governor Ueda said a weak JPY lifts import prices and contributes to higher consumer inflation, and that FX moves may have a larger impact on prices given current conditions. He said companies are increasingly willing to raise wages and prices, noted he is mindful that FX moves could affect inflation expectations and underlying inflation, and said the BoJ will scrutinise the impact of FX volatility on prices, according to Reuters.

- Japan may intervene before USD/JPY reaches 160, according to Bloomberg, citing a government panellist.

- Foxconn (2317 TT) said it will launch a joint venture with Intrinsic to build an AI factory and plans to invest USD 2–3bln per year in AI. Foxconn and OpenAI will also collaborate to strengthen US manufacturing across the AI supply chain, with OpenAI receiving early access to evaluate Foxconn’s systems and an option to purchase them, according to Reuters.

- Foxconn’s (2317 TT) VisionBay AI unit said it plans to deploy 27MW using NVDA’s GB300 chips in the first half of 2026. This will be Taiwan’s largest advanced GPU cluster and the first GB300 AI datacenter in APAC, according to Reuters.

- Singapore raised its 2025 GDP growth estimate to around 4%, from the previous 1.5–2.5%, according to Reuters.

- Japan’s Finance Minister Katayama says she can’t comment on expected size of additional bond issuance to fund the latest package. She believes markets have stabilised after various announcement. Also adds that she doesn’t believe the latest package is sufficiently big to ignite demand driven inflation.

European bourses (STOXX 600 -0.6%) have opened lower across the board, as Europe plays catch-up to the hefty losses seen on Wall St, where NVIDIA fell into negative territory – erasing all of its initial post-earnings strength. AEX (-1.5%) underperforms in Europe with ASML sinking nearly 6%. European sectors are broadly in the red, with a clear defensive bias given the risk tone. Energy is hampered by pressure in the oil complex amidst constructive Russia-Ukraine developments. Basic Resources and Tech have been hit by the risk tone.

Top European News

- NBH’s Virag has quit, Bloomberg reports citing the NBH; to be replaced with Banai. Virag will now be an advisor to the Governor.

- ECB’s Lagarde says the ECB will continue to adjust policy as needed to ensure that inflation remains at the 2% target. Internal barriers in services and good markets are equivalent to tariffs of around 100% and 65% respectively.

- SNB’s Tschudin says inflation will rise slightly in upcoming quarters.

FX

- DXY is flat/modestly firmer today and trades at the lower end of a 99.98 to 110.26 range. Not much driving things for the index this morning, focus remains firmly on the NFP report in the prior session, which led to some major banks adjusting their calls for a December rate cut. JPMorgan no longer sees a cut in December; Standard Chartered also looks for unchanged, instead favouring a Q1’26 move, likely January. Money markets currently assign a 27% chance of a Dec. cut. Focus ahead now on US Flash PMIs and UoM Sentiment data. Most recently, the USD has picked up a touch and continues to make fresh highs – seemingly as the risk tone continues to deteriorate. Nothing fresh to explain the dip in sentiment, but comes as NVIDIA continues to slip in the pre-market, hawkish Fed re-pricing, and negative growth implications of European PMIs.

- EUR is a little lower and trades within a 1.1514 to 1.1552 range. Some choppy two-way action on the French/German PMI metrics, before then moving lower as the USD attempts to move higher in recent trade. To recap the PMI figures, the EZ-wide PMI didn’t have much impact as the woes for the manufacturing sector were clearly illustrated by France and Germany before. HCOB notes that, for France in particular, the political instability in the region is weighing and is expected to remain complicated, “meaning that the EZ is unlikely to receive any positive impetus from this quarter in the short term”. In terms of price action, EUR/USD moved a touch lower on the French figures (which were weaker across the board), before then moving higher on the German metrics (strong across the board).

- GBP is a little lower vs USD, with much of the downside seen in recent trade amidst some broader Dollar demand; currently at the bottom of a 1.3051 to 1.3102 range. Earlier, UK PMIs were mixed – Services missed expectations, whilst Manufacturing surprisingly climbed into expansionary territory; nonetheless, Composite dipped more than expected. The inner report suggested that the “debate will shift further away from inflation worries toward the need to support the struggling economy, hence adding to the chances of interest rates being cut in December”.

- JPY the strongest G10 currency, buoyed by the risk tone and comments via Finance Minister Katayama, who suggested that intervention was on the table. USD/JPY traded within a 157.10-157.54 range, before edging to fresh session lows at 156.57 as the risk tone deteriorated in the European morning. Japanese nationwide CPI printed in-line with expectations, with PMIs also constructive; the internal PMI report suggested that “inflation remains a key concern”. Figures which play in favour of a hike in December. On fiscal developments, Japan’s cabinet approved a JPY 21.3tln economic stimulus package (vs expectations of JPY 20–21.3tln), with JPY 17.7tln in fresh spending via the extra budget and an overall impact of JPY 42.58tln, according to Bloomberg.

- Antipodeans are mixed, with the Kiwi marginally firmer whilst the Aussie remains pressured. Overnight activity currencies were buoyed by an improving risk tone – and were unreactive to the region’s own data figures. This morning has seen a scaling back of initial upside, as the risk tone dips.

Fixed Income

- Fixed firmer this morning and climbing as the risk tone deteriorates.

- USTs at a 113-10+ peak with gains of 14 ticks at most. Specifics for the US light, strength in USTs derived from the increasingly risk-off tone seen across markets with NVIDIA once again a primary driver. If the move continues, we look to resistance at 113-18+ from the last week of October before 113-29, the figure and then 114-02. Today’s docket features Real Weekly earnings for September, Flash November PMIs and several Fed speakers. Text expected from Williams, Barr, Jefferson & Logan in addition to TV appearances from Collins and Miran.

- Bunds bid given the tone, in-fitting with USTs. In addition, the complex benefits from a poor set of Flash PMIs which speak to tepid economic performance and ongoing political concerns. For the ECB, the data is unlikely to change much as the inflation-related components were subject to two-way movements and we await the December forecasts. Bunds as high as 129.09, firmer by 47 ticks at most. If the move continues, we look to 129.40 from November 13th.

- Gilts opened with gains of 11 ticks after weak Retail Sales data, despite the offsetting influence of PSNB. Additionally, and as outlined above, the risk tone is playing a role. As such, the benchmark is firmer by just over 50 ticks at best, notching a 92.43 peak, eyeing the WTD high of 92.60.

- The Retail Sales data is itself unlikely to move the dial for the BoE, as Governor Bailey is focused on inflation and caveats apply to the series re. Black Friday and the Budget. However, the subsequent PMI release highlighted increased growth concerns and a “real chance that this pause may turn into a downturn”, points that factor in-favour of further BoE easing, and moves some of the focus away from inflation in assessing the BoE’s near-term outlook; BoE pricing unreactive, remains around an 83% chance of a cut.

Commodities

- WTI and Brent Jan’26 trends lower from USD 58.80/bbl to 57.50/bbl and USD 63.02/bbl to USD 61.98/bbl, respectively, as the global risk tone weakens and further reporting on the 28-point peace plan. Reported by Axios, Kyiv would have to give up additional territory in the east, cap the size of its military, and agree that it will never join NATO. On Ukrainian security, Kyiv would be given a guarantee modelled on NATO’s Article 5, which would commit the US and European allies to treat an attack on Ukraine as an attack on the “transatlantic community“.

- Spot XAU has grinded lower from a peak of USD 4089/oz to a trough of USD 4023/oz before paring back earlier losses to USD 4063/oz as the market continues to consolidate above USD 4k/oz. Despite the recent choppiness in XAU, investors still see further upside in the yellow metal driven by further Fed rate cuts, persistent geopolitical uncertainties and rising fiscal concerns.

- 3M LME Copper is ultimately trading lower as it follows the global risk tone. The red metal initially followed on from Thursday’s selloff, forming a low at USD 10.66k/t before bouncing to a peak of USD 10.72k/t. As the session continues, 3M LME Copper has fallen back to new session lows and remains near lows at USD 10.64k/t.

- Global crude steel output fell 5.9% Y/Y in October and China’s crude steel output fell 12.1% Y/Y, according to World Steel.

Geopolitics

- US President Trump’s 28-point plan for peace in Ukraine would force Kyiv to give up additional territory in the east, cap the size of its military, and agree never to join NATO, according to a draft obtained by Axios.

- US President Trump’s peace plan for Ukraine includes a security guarantee modelled on NATO’s Article 5, which would commit the US & European allies to treat an attack on Ukraine as an attack on the “transatlantic community”, via Axios.

- US officials reportedly intend to brief EU ambassadors in Kyiv on the draft peace proposal, via Reuters citing sources.

- European officials are reportedly still analysing the US-Russia peace proposal re. Ukraine, via FT; a diplomat cited says it “basically means capitulation [to Moscow]”, another said the focus is to “…work for a more reasonable outcome”.

- UK PM Starmer, German Chancellor Merz, French President Macron and Ukrainian President Zelensky is to hold a call today at 11:00GMT, via Bloomberg.

Event Calendar

- 9:45 am: Nov P S&P Global U.S. Manufacturing PMI, est. 52, prior 52.5

- 9:45 am: Nov P S&P Global U.S. Services PMI, est. 54.55, prior 54.8

- 9:45 am: Nov P S&P Global U.S. Composite PMI, est. 54.5, prior 54.6

- 10:00 am: Nov F U. of Mich. Sentiment, est. 50.6, prior 50.3

- 10:00 am: Aug F Wholesale Inventories MoM, prior -0.2%

Central Bank Speakers

- 7:30 am: Fed’s Williams Delivers Keynote Speech

- 8:00 am: Fed’s Collins on CNBC

- 8:30 am: Fed’s Barr Gives Welcoming Remarks at the College Fed Challeng

- 8:30 am: Fed’s Miran Appears on Bloomberg TV

- 8:45 am: Fed’s Jefferson Speaks on Financial Stability

- 9:00 am: Fed’s Logan Speaks at Conference in Switzerland

DB’s Jim Reid concludes the overnight wrap

I’m writing this on a bitterly cold, frosty morning, trying to keep an eye on equally frosty markets while resisting the stress of watching the first day of the Ashes live from Perth. England are chasing their first Test win in Australia since 2011, but so far, it’s gone about as well as the markets have over the past day.

Indeed it’s been a truly remarkable 24 hours, with a sequence of moves that were almost impossible to predict. Any time between 9:30pm GMT on Wednesday night and around 3pm yesterday, if I’d been able to quietly delete Wednesday’s chart of the day (link here) – the one pointing out that Nvidia doesn’t tend to do well on the day and week after earnings – I would have done so without hesitation. After the world’s largest company reported spectacular results, the stock was up around +5% by 3pm London time. It closed down -3.15%. The broader market followed a similar pattern: the S&P 500 initially climbed +1.93%, only to fade and close down -1.56% as doubts about AI valuations crept back in. That marked the biggest intra-day swing for the S&P since the six days of extreme market turmoil that followed the Liberation Day tariffs in early April. Adding to the negative backdrop for crypto were lingering questions over the crypto market structure bill that’s being worked on in Congress.

There were plenty of signs of financial stress underneath the surface. The VIX jumped +2.76pts to finish at 26.42, its highest level since late April. Crypto weakness also resumed in earnest, with Bitcoin down -3.65% yesterday to a 7-month low and another -1.44% lower at around $86,000 this morning. With the cryptocurrency now more than -30% below its peak, that reawakened concerns about a further wave of forced selling, amid worries that retail investors might need to liquidate other assets to meet margin calls.

In Asia the KOSPI (-3.73%) stands out as the largest underperformer overnight, dragged down by major index tech heavyweights Samsung Electronics and SK Hynix. The Nikkei (-2.42%), Hang Seng (-2.08%), ASX (-1.59%), and Shanghai Composite (-1.49%) are also all sharply lower. S&P 500 (+0.25%) futures are edging higher with Nasdaq futures (+0.07%) only just edging back into positive territory.

It’s hard to pin the blame for the global sell-off on the delayed September payrolls report—unless everyone was late back from an early Christmas lunch—since risk assets initially took the data well. That said, the release did offer enough moving parts that you could construct completely different narratives depending on which line you chose to focus on.

On the bright side, nonfarm payrolls were up +119k (vs. +51k expected), which took the 3-month average back up to +62k. Plus the broader U6 measure of underemployment fell back to 8.0%. However, there was more negative news in -33k of revisions, and the unemployment rate, which ticked up to 4.4% (vs. 4.3% expected), and it nearly rounded up further given it was at 4.44% to two decimal places. To be fair, that could partly be explained by a higher participation rate, which unexpectedly moved up to 62.4% (vs. 62.3% expected), but it was still the highest unemployment rate in nearly four years. See our economists’ interpretation of this Rorschach test of a payrolls report here. Following the print, they are just about sticking to their baseline of a December rate cut, but will be reassessing this with upcoming data, most notably jobless claims, ADP and JOLTS.

We did get some good news from the Department of Labor, who released the backlog of weekly initial jobless claims over recent weeks. That came in lower than expected at 220k in the week ending November 15 (vs. 227k expected). So while the jobs report only went up to September, the initial claims data reassured investors that the labour market had broadly held up through the shutdown too. However, an uptick in continuing claims (1,974k vs 1,950k expected) diluted this more positive take a bit.

Net net, investors dialled up the likelihood of a December rate cut from the Fed, with futures moving that up to a 35% chance (from 29% the day before). That was driven by the higher unemployment rate and concern that labour demand was weakening. This initially led to a steepening reaction in Treasuries, which then turned into a broader rally as the risk-off tone took hold. By the close, the 2yr yield (-5.9bps) fell to 3.53%, with the 10yr yield (-5.3bps) down to 4.08% and the 30yr yield (-3.3bps) posting a smaller decline to 4.72%. Remember as well that this is the last payrolls report the Fed will have before their decision on December 10, as the October and November reports are coming out together on December 16.

Digging deeper into the equity sell-off, the S&P 500 -1.56% decline means the index is now down -5.11% from its peak, which is the furthest its been away from its record since May. Tech stocks led those declines, with the NASDAQ (-2.15%) seeing its worst day in two months, whilst Nvidia itself fell -3.15%. Few segments were spared from the sell-off, with the small cap Russell 2000 (-1.82%) and the equal-weighted S&P 500 (-1.17%) also seeing sharp declines. Consumer staples (+1.11%) were the only top-level S&P sector to advance, which came thanks to a strong earnings report from Walmart (+6.46%). By contrast momentum tech stocks got a hammering, with Robinhood (-10.11%) and Micron (-10.87%) two of the three worst performers in the S&P on the day. And CoreWeave saw a remarkable intra-day swing, from +11.44% just after the open to -7.97% by the close.

It might feel like ancient history now, but before the US selloff, European equities had risen on the back of Wednesday night’s Nvidia announcement. Multiple indices were higher, with the STOXX 600 (+0.40%) rising, along with others including the CAC 40 (+0.34%), the DAX (+0.50%) and the FTSE MIB (+0.62%). European futures are down -1 to -1.5% this morning in Asia. In fixed income, the earlier risk-on tone meant yields were generally higher with those on yields on 10yr bunds (+0.5bps) and OATs (+2.9bps) both rising.

Overnight in Japan, core inflation in October increased by +3.0% year-on-year, marking its highest rate since July but aligning with market expectations. Moreover, the headline inflation rate also rose to +3.0%, remaining above the BOJ’s 2% target for 43 consecutive months, but again in line with consensus.

Also overnight, Japanese Prime Minister Sanae Takaichi’s cabinet have sanctioned a 21.3 trillion yen ($135.5 billion) economic stimulus package, representing the first significant policy action under the new leadership, which has committed to implementing expansionary fiscal policies. This package encompasses general account expenditures of 17.7 trillion yen, significantly surpassing the previous year’s 13.9 trillion yen and marking the largest stimulus since the COVID pandemic. It will also feature 2.7 trillion yen in tax reductions. However, this stimulus initiative has raised concerns about exacerbating Japan’s already substantial debt burden, resulting in government bond yields reaching unprecedented levels earlier this week and the yen depreciating against the dollar. The global risk-off may have actually helped the package land today with bonds rallying across the board so 10yr JGBs are -3.0bps lower trading at 1.79% as we go to print.

In geopolitical news, Ukraine’s President Zelenskiy said he agreed to work on a peace plan that was drafted by the US after contacts with Russia, and that he would expect to speak with Trump in the coming days. The reported details of the proposals would require major concessions by Ukraine on territorial and military issues, and there was little in Zelenskiy’s comments to suggest these were acceptable to Kyiv. Still, with the news of talks coming just as US sanctions on Russia’s two oil largest companies are due to take effect today, oil markets saw some relief on risks to Russian oil supply. WTI crude is trading -1.20% lower this morning at $58.30/bbl, following at -0.50% decline yesterday.

To the day ahead now, we’ll get the global flash November PMIs, US November Kansas City Fed services activity, UK November GfK consumer confidence, October retail sales, public finances, France November manufacturing confidence, October retail sales, and Canada retail sales. Central bank speakers include the Fed’s Williams and Logan, the ECB’s Lagarde, de Guindos, Kocher, Muller and Nagel, and the BoE’s Pill.

Tyler Durden

Fri, 11/21/2025 – 07:28ZeroHedge NewsRead More

R1

R1

T1

T1